Benchmarking: examples of the best companies to develop their business. Benchmarking a company: examples from foreign and Russian practice What is compared in the benchmarking process

In simple words, benchmarking(eng. Benchmarking) is a comparison with the best. When collective farmers in Soviet films demonstrated their achievements at agricultural exhibitions and visited each other to exchange best practices, it was not called benchmarking, but in essence that is what it was. When Nikita Khrushchev visited American farms and admired the corn harvest and milk yield, he, too, was engaged in benchmarking.

Benchmarking helps improve business processes relatively quickly and at the lowest cost. It allows you to understand how leading companies operate and achieve the same or better results. The value of benchmarking is not only that it eliminates the need to reinvent the wheel. By carefully studying the achievements and mistakes of other companies, you can develop your own most effective business model.

Benchmarking is not just about copying the systems used by successful companies. This approach may not produce the desired results due to differences in business structures. The main thing is to adapt these principles for internal use. It is thanks to this that the benchmarking system can be effective not only with direct competitors in the market, but also with companies whose target audiences are completely different. You can even analyze the work of enterprises from a completely different field of activity.

Competent benchmarking of a company can radically improve its functioning, but only if there is an understanding of its own processes. When comparing two business models, you need to have a good understanding of both, otherwise you won't get a clear picture of the big picture. Therefore, you first need to analyze the production processes in your company, and only then start benchmarking.

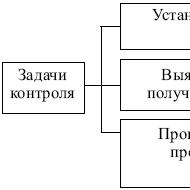

Goals and objectives of benchmarking

Sharing experiences, as well as studying other people's work, has always been beneficial. But we cannot say that this happens in 100% of cases. Some organizations are so far apart in various respects that benchmarking may not be useful. In this regard, the need for this step must first be justified, that is, the company’s strategic goals must coincide with the need to conduct such a study. Benchmarking is a full-fledged business management tool, since its goal is to improve the system and increase the competitiveness of the company in the long term. This goal is achieved through solving specific issues.

In the process of comparing business schemes of different companies, two main tasks are solved:

- Calculation of indicators of your own enterprise and comparison of them with the selected standard.

- Analysis of other people's experience and its implementation in your company.

How to make a company a market leader: the experience of X-fit

Irina Tumanova, executive director of X-Fit, told the General Director magazine how X-fit managed to become a market leader from a small company.

The functions of benchmarking are as follows

- To give management an idea of the current state of affairs in the company, to overcome stagnation in the management sector.

- Strive for improvement.

- Find out in time that the organization is lagging behind in a certain area.

- Identify the company's resources and identify weaknesses that need to be overcome.

- Set difficult but realistic goals for the company.

- Find out priorities in optimizing work.

- Determine the level of the company in comparison with the best in the world.

- Calculate the degree of lag of the company.

- Identify the best management systems and put them into practice.

- Prepare an action plan to correct activities.

- Connect the long-term development plan with the company's self-improvement efforts.

- Find previously unused technologies or management methods.

- Focus on those factors that bring undoubted benefit to the enterprise.

- Achieve large-scale improvements in the organization’s performance, a “breakthrough.”

- With the help of other people's experience, free the company from the “need” to learn from its own mistakes.

- Create a principle of continuous improvement in the organization.

- Reduce financial costs to improve the company's performance.

- Reduce risks when introducing new methods.

- Raise key financial indicators.

Benchmarking objects

Products and services. This position is the first one targeted for benchmarking. The activities of a competing company are analyzed, and the points due to which its business is more successful than yours are highlighted. After this, it becomes clear what needs to be done to increase the productivity of the native company. There is one point here. In the case of manufactured material products, it is somewhat easier to use benchmarking than in the situation with services. The fact is that it is much more difficult to obtain the information necessary for research on the last parameter. You need to at least analyze the production field and conduct several interviews with competing companies.

Financial indicators. Benchmarking financial indicators is not so difficult, of course, if you know where and what to look for. Typically, such information is publicly available. By organizing a study on financial efficiency, you can determine possible achievements and goals that should be set for yourself. Material investments for carrying out such an analysis require very little, and can be completed in a short time.

Business processes. Business process research is the most effective part of benchmarking. To maintain competitiveness in the market, a company must develop the business as a whole, constantly invest various kinds of resources into it and control all operations. The capabilities of a particular organization can be “calculated” by its business processes. This type of analysis is especially important in a situation where two enterprises directly compete with each other, offering the same products to the consumer. The organization that manages to increase competitiveness as efficiently as possible at the lowest cost will be the winner.

This study on the benchmarking system is primary. It is with the help of such an analysis that specialists subsequently outline all the further steps that need to be taken to increase the profitability of the company. But to do this, it is necessary to carefully study the entire chain of work of a competing company, starting from its suppliers and ending with the labor organization system. By the way, it is not at all necessary to limit yourself to studying the activities of just one organization. It is useful to take note of related enterprises working with the same products and benchmark their business processes.

Strategies. No business can function properly without a strategy. You can improve the performance of your own company by carefully analyzing the strategy and organization of work of a competing company. True, obtaining comprehensive information in this case is not so easy. Often such data is a closely guarded company secret. When benchmarking a strategy, you must first use logic, and only then the research will bear fruit.

Staff. Thanks to personnel benchmarking, you can compare the activities of your own HR services with those of the world's leading companies on several indicators. Having received the results of the analysis, the company's management will be able to manage personnel more efficiently. Before starting the comparison, you should determine the main performance indicators of the HR service. Some managers consider this department almost a burden for the company, steadily and unjustifiably absorbing financial resources. But this is far from true. The fact is that the work of the HR service in one way or another affects the quality of activity of many departments. Sometimes this happens in such an indirect way that the benefits of this department are difficult not only to evaluate, but even to notice. Therefore, carefully conducted benchmarking is needed, with the help of which you can obtain specific indicators of the performance of the HR service, as well as identify problems that require immediate intervention.

Functions, groups and organizations. Using benchmarking, specialists collect information not only about the products produced by a competitive company, but also exactly how this is done. Each enterprise has a certain internal structure and labor organization. It is precisely the clarification of all such details that is part of the task of benchmarking on this topic. Moreover, attention is often paid to the most insignificant, at first glance, nuances. For example, the professional qualities of employees of a competing company. The analysis carefully examines the total number of personnel in the company being studied, the groups created, their functions, etc.

To facilitate the benchmarking process in this case, various kinds of websites are often created, with the help of which contacts between specialists are established. Thanks to this, research costs are significantly reduced, because in order to obtain information there is no need to pay for the travel of employees of the analytical department, and the quality of the incoming data does not suffer.

Types of benchmarking

Internal benchmarking. Based on the name, it is clear that this type of research is carried out exclusively within the company. For comparison, processes, goods or services that are closest in parameters are taken. The advantage of the method is that the analysis can be carried out without much difficulty, since there are no difficulties in collecting data. The downside is that research opportunities are very limited, which may result in biased results.

Competitive benchmarking. The analysis is carried out on the basis of comparing the products and services of your company with the products and services of a direct competitor company, and the latter can operate both in the local, regional or international market. This type of benchmarking will be more useful if you choose an international organization for comparison.

Functional benchmarking. In such a study, the processes of one's own company are compared with similar processes of another. The difference from other types of benchmarking is that the company chosen as the standard operates in a completely different area. The advantages of this method are that it requires less effort to obtain objective data, using absolutely ethical and legal methods.

Generalized benchmarking. Companies that have the best indicators of processes and approaches in a certain field of activity are selected for analysis. Moreover, information about the work of these organizations is publicly available. For example, there are many publications about the production system in Toyota or Motorola. An analysis is carried out of the processes and approaches most suitable for one’s own company, which, after appropriate adaptation, are introduced into work.

- Lean Manufacturing: Small Steps for Big Goals

Benchmarking examples

Internal benchmarking at Hewlett-Packard

Direct competitors from Japan were ahead of Hewlett-Packard Corporation in many respects. In particular, products were produced of no less quality, but at a faster pace. The question arose about maintaining the competitiveness of the company. Hewlett-Packard decided to analyze its research and development efforts to find effective methods to speed up production.

The company compared the activities of its divisions using the payback period of the project as a criterion. In order for the products to meet the real requirements of consumers, the technology of deploying quality functions was used.

The result of the benchmarking was the company's decision to introduce a methodology called Six Sigma. Production optimization consisted of complete documentation of the process, measuring characteristics and reducing the variability of their values. There was also a constant search for ways to improve the algorithms. If you look closely, Hewlett-Packard Corporation operated almost according to the DMAIC principle (Define, Measure, Analize, Improve, Control).

Competitive benchmarking at Ford

The Ford Corporation could not compete with its rivals in many design parameters. In addition, according to consumers, its products were not functional. It got to the point where the company's profits fell catastrophically. She was able to return the market only after a completely new family of Taurus passenger cars was created. This car had to at least not be inferior to competitors' models. To achieve this effect, a benchmarking analysis was carried out. The company's specialists organized a survey among the population to find out which properties of the machines are the most popular. After that, we selected the cars on the world market that best meet the specific requirements of potential customers. The task of Taurus was not only to reach their level in various characteristics, but also to surpass it.

Benchmarking studies were carried out taking into account a huge number of car brands, and it did not matter whether they were direct competitors of the company or not. For example, cars such as the BMW and Opel Senator never competed with the Ford Taurus, but had some features that were attractive to buyers. About 400 parameters of more than 50 car models were analyzed. New products at Ford were developed and implemented based on the principles of DMADV (Define, Match, Analyze, Design, Verify - definition, measurement, analysis, development, verification). The result was not long in coming. Soon the Ford Taurus became the car of the year and came out on top in sales.

Unfortunately, the success did not last too long. There were certain shortcomings in the Taurus transmission that undermined the car's reputation. Due to the constant improvements that followed, the company began to deviate more and more from the original concept. As a result, by the end of the 90s of the last century, Taurus sales decreased by almost seven times. They tried to correct the situation, but in 2006 the production of this family of cars ceased. However, we learn from mistakes, and Ford is no exception. The main lesson this time was the understanding that benchmarking of competing enterprises is not a one-time event. Such studies should be carried out regularly in order to update results and adjust activities. In general, the Six Sigma methodology says almost the same thing: searching for sources of variation not only provides certain knowledge about the level of competitiveness of the company, but also shows a schedule of its changes. As a result, company management has the opportunity to take into account not only the short-term effects of implementing certain improvement programs, but also the future consequences of the decisions made.

Functional benchmarking at General Motors

General Motors Company in 1982-1984 conducted a benchmarking analysis, with the help of which it tried to find a way to improve the quality and reliability of products through alternative management options. At that time, as part of the “competition” with Japan, most companies began to pay increased attention to the quality of the product, believing that this parameter was the main one in the struggle for competitiveness. General Motors carried out research based on data from well-known companies: Hewlett-Packard, 3M, John Deer. Before starting the analysis, experts from General Motors outlined 10 hypotheses about the factors that most strongly influence product quality. These hypotheses had to be confirmed using information from partner companies also conducting benchmarking work.

An objective comprehensive assessment of the quality management systems adopted in the companies participating in the research was formed. As a result, a connection was discovered between the quality of goods and the efficiency of enterprises. Moreover, largely thanks to this research, a little later the Malcolm Baldrige National Quality Award appeared, and then a series of ISO 9000 standards, which established general requirements for quality management systems. General Motors was 14 years ahead of research on the criteria of the Baldrige model, as well as the requirements of ISO 9000 standards. This gave the company and its partners an undeniable advantage over competitors. The fact is that customers considered their products to be of significantly higher quality than the products of other companies operating in the same field.

But, as is typical for many benchmarking analyses, this study also suffered from a lack of regular study of the company's working conditions and production processes. Instead of constantly improving itself, General Motors was satisfied with the advantage it had achieved. And then she completely switched to following the requirements of the industry standard QS 9000 (the latter is a modified version of ISO 9000, taking into account the characteristics of the automotive industry). General Motors also regularly competes for the Malcolm Baldrige Award and masters the Six Sigma methodology. But now all automobile enterprises are doing this, and the quality management system must constantly develop.

General benchmarking at Xerox

There are plenty of examples where benchmarking helped a particular company in a difficult situation. However, one of the most famous is Xerox's comparison of its logistics system with those of more successful enterprises. Xerox unwittingly confirmed the correctness of the American scientist William Daming, who argued that a crisis experienced by an organization often provokes an increase in quality. It forces managers to take certain measures to get the company out of trouble. In the late 70s of the last century, Xerox began to succumb to pressure from competitors from Japan. Over the 10 years from 1974 to 1984, the firm's return on assets dropped from 22% to 4%. Xerox decided to try to get out of the crisis and find more suitable management methods using benchmarking.

Fuji Xerox, a Japanese subsidiary of Xerox, played a significant role in the research. The company analyzed three main parameters: its own processes and costs, the costs and processes of its branch, as well as similar components of competitors. Thanks to this research and public information on market prices for copiers, Xerox specialists were able to determine the cost of operations of competitors, and after this, calculate the areas in which they showed better financial performance. As a result, the company was able to assess the size of the gap between itself and its rivals, but it was not immediately possible to eliminate it. Only after turning to the experience of the world's leading companies was Xerox able to catch up with competing firms in those areas where it had previously lagged significantly behind. But benchmarking in that situation did not play the role of the genie in the lamp, capable of getting rid of all the troubles.

The 90s came, and digital technologies replaced analogue technologies. At the same time, Xerox switched from a cumbersome functional structure to a simplified design. Much less attention has been paid to improving production processes than before. Gaining leadership in the copier market by improving the quality of products and conducting research has not only been forgotten, but has been temporarily excluded from priority tasks. From Xerox's experience, benchmarking is a tool that can help a company improve, but nothing more. This is not a panacea, and certainly not a magic wand that, by waving it, can solve all problems. In some situations, simply copying the experience of more advanced enterprises may not help.

Are benchmarking tools suitable for small companies?

If a mid-market company decides to undertake such an analysis, it may have questions:

Don't give up on benchmarking just because there's a lot of work ahead. If you properly use all the opportunities provided by benchmarking, you can take your company to a completely different level.

Stages of benchmarking: from choosing an object to implementing changes

Benchmarking is not an equation that can be solved in a strictly defined way. There is no single system; each company uses its own developments. But all activities can be divided into several stages:

1. At the first stage, you need to select a benchmarking object, analyze it and detail it. It could be some kind of process, service or product produced by the enterprise. Here it is important to decide on the following points: what resources the company can afford to allocate to this research; Is a one-time event planned or will this practice become regular.

2. At the second stage, the characteristics that need to be analyzed are determined. The object of analysis can be certain process parameters, consumer properties of a product or service.

3. The third stage is the appointment of specialists who will conduct benchmarking. It is advisable to hire people from different departments. This will give you the opportunity to take a broader look at the research object both in your own company and in the benchmarking partner company.

4. The fourth stage is the actual selection of partners. These can be serious enterprises whose success in implementing the characteristics that interest you is undeniable (you determined the characteristics themselves at the second stage). You can take one or several companies as partners. During internal benchmarking of an organization, partners will be related divisions of the company; processes within the enterprise or manufactured products will be analyzed.

5. At the fifth stage, the collection and analysis of data necessary for further comparison begins. Often the information received needs to be processed. The fact is that different companies may describe the same technical characteristics of a product in different ways. Everything will need to be brought to a common denominator.

6. The sixth stage of benchmarking is to assess the company’s ability to catch up with the leading organization in terms of the required characteristics. Assessment methods may be different, for example, using GAP analysis.

7. At the seventh stage, specialists determine what changes are needed in the operation of the enterprise to achieve a specific result. The overall picture should be based on the results of adapting the acquired knowledge to the conditions of one’s own company.

8. The eighth stage is devoted to developing strategic goals and drawing up plans to achieve them. Much depends on the scale of the proposed changes. Plans may relate to the organization of production, management system and other aspects of the company's activities.

9. At the ninth stage, previously approved plans are implemented. Moreover, this process requires constant monitoring. If necessary, plans are adjusted as they progress.

10. The last stage is to decide on repeated benchmarking to solve new problems, if, of course, the previous ones were successfully implemented.

2 approaches to benchmarking

Benchmarking wheel

Stage 1. Planning.

- Creation of a team of professionals.

- Selecting parameters for research.

- Determination of the process (product, service) that needs comparison.

Stage 2. Search. Selecting benchmarking partners or other data sources.

Stage 3. Data collection. Selecting a method for obtaining information according to certain parameters.

Stage 4. Analysis. Comparing indicators and finding out the extent to which your company lags behind the one selected for benchmarking. Development and communication of recommendations for improving performance.

Stage 5. Adaptation of the result. Making necessary changes to an organization's product, service, process, or strategy.

Xerox approach

Xerox has proposed its own approach to benchmarking, consisting of five phases and 12 steps.

Phase 1: Planning.

- Find out what exactly needs to be compared.

- Find a benchmarking partner.

- Outline a way to obtain data and start collecting it.

Phase 2: Analysis

- Determine how large the gap is between companies in terms of performance indicators.

- Develop and provide future levels of these indicators.

Phase 3. Agreement

- Connect the results obtained and the acceptable gap in terms of indicators.

- Define functional goals.

Phase 4. Action

- Development of a further action plan.

- Implementation of individual activities in the company with tracking of the company's progress.

- Adjustment of comparison of indicators.

Phase 5: Completion

- Taking the lead.

- Incorporating the experience gained into the company's activities.

Typical mistakes in using benchmarking

1. Some people perceive benchmarking as a kind of inspection of the organization. But this is far from true.

With the help of benchmarking research, you can get certain useful numbers, but the system itself is aimed at finding out what these numbers mean, that is, you can find out where the enterprise ranks in certain positions.

2. Many are confident that certain basic parameters have long been developed and do not require any improvements.

It is not possible to apply such a system in a company simply because any market is not monolithic. There are differences in customer preferences, availability of resources, production conditions, etc. You need to find partners who will share their experience in achieving goals, and also tell you whether your company is capable of reaching such heights.

3. Another common mistake is a lack of attention to the client’s needs.

Some companies, after conducting benchmarking, are so carried away by the need to reduce costs while simultaneously increasing the quality of goods that they completely stop paying attention to what the direct consumer needs from the product. To avoid such a mistake, it would be a good idea to use a specially developed comprehensive system of business indicators - a “balanced scorecard”.

4. The desire to do everything at once will most likely not give positive results.

Managers who decide to benchmark absolutely all of the company's systems at the same time are making a big mistake. First of all, it's expensive. Secondly, it takes too much time. Everything needs to be done gradually, analyzing one system after another.

5. Inconsistency also leads to failure.

There are several points to note here. The use of benchmarking must be consistent with the company's strategy and not conflict with other initiatives. The process of implementing benchmarking must be directed and controlled by management.

6. It would be a mistake to set yourself non-specific, too “vague” tasks.

Sometimes benchmarking is tasked with analyzing communications between company employees. But the question is how can this be measured and in what units? Therefore, it is better to choose more specific goals for research, for example, to evaluate the system of distribution of powers in the company.

7. Conducting benchmarking without a pre-prepared platform makes no sense.

A similar situation may arise when the study of some processes in competing companies or the search for benchmarking partners begins before data on the same processes in one’s own organization is obtained.

8. An insufficiently comprehensive analysis of the research partner can be a fatal mistake.

If both your own and your partner’s time is wasted, then this will not lead to anything good. The existing code of such research states that if you are able to obtain the necessary data or solve the issue yourself, then there is no need to bother your partner about this.

Iwao Kobayashi “20 Keys – Methods for Creating a Quality Work Environment.”

This paper describes a system of 20 keys that organizations can use to improve their performance. This technique is convenient to use for benchmarking. The sequence of actions derived by the author is extremely simple, transparent and useful. With its help, the fundamental problems of producing goods and providing services are solved. Admittedly, the method proposed by Kobayashi, unlike many others, guarantees the achievement of the necessary results with less time and effort. The book not only combines world achievements in increasing productivity into a single whole, but also interconnects individual systems with each other.

Rob Rader, Benchmarking Strategy to Improve Profitability.

After reading this book, you can easily understand the basic principles, methods and rules of internal and external benchmarking. It is easy to learn how to select samples and guidelines for planned research, based on studying the company’s activities and analyzing the needs of all stakeholders. The book discusses methods by which you need to collect benchmarking data and implement the experience of other firms in your own organization. The author talks about the code of conduct for participants in the process and the rules for reporting the results of the analysis.

Rob Rader advises how to properly use benchmarking as a tool for organizational development, as well as to develop a strategy for using the newfound advantages. By following the recommendations of the book, an ordinary well-performing company can be turned into a world-class company.

Harrington H.J., Harrington J.S. “Benchmarking at its best! 20 steps to success."

This publication is practically a benchmarking of benchmarking itself. By studying all the recommendations proposed in the book, you can improve both the work of any division of the company and its entire activity as a whole.

The authors review successful research methods, from purchasing products from a competing company to analyzing the production process. This guide will help you choose the best way to conduct benchmarking.

The work used huge amounts of data from Ernst&Young. The language of the book is completely uncomplicated and free of jargon, which in many cases is very important. After reading this publication about benchmarking, you can find out how some companies using this technique achieved a 2000% increase in production in just eight months. Maybe you can do something similar?

The market places new demands on companies for their logistics activities, the quality of service and their policies in the field of logistics. Companies, in order to remain competitive and offer quality services, need to look for ways to improve. Benchmarking is one such way.

Benchmarking is a way to improve a company through evaluating and comparing indicators that characterize its work with the performance indicators of other companies. Benchmarking appeared in the United States at the end of the twentieth century and is still used as a tool for improving the efficiency of various activities. There are several types of benchmarking. But regardless of the type, its main goal remains to improve the company’s performance.

Benchmarking studies are carried out periodically. Conducting a one-time study cannot fully reflect all the benefits that benchmarking brings. One of the objectives of benchmarking is to determine the current position of a company in the market, followed by making changes. After the changes are made, it is necessary to conduct research again and understand how effective the decisions made are and how the company’s position in the market has changed.

By participating in benchmarking of key logistics KPIs, you will be able to:

- compare performance with other companies,

- make decisions to improve the company,

- track the dynamics of indicators you are interested in,

- get acquainted with the best practices in the industry.

As part of modern business, the idea is gradually emerging that it is not the firms themselves that compete, but their supply chains, which explains the increased interest in logistics.

The strongest competitive advantage in the fight for customers should be efficient logistics. Logistics of industrial enterprises consists in the preparation and implementation of the principles and methods of logistics in its activities.

It becomes obvious that it is necessary to take into account the experience of successful enterprises inside and outside the industry in which the logistics facility operates - not only foreign, but also domestic, closer to real Russian conditions.

This is a relatively new area of marketing research that appeared in the United States in the 70s. The twentieth century is usually called the term “benchmarking”. Foreign scientists define benchmarking as “a systematic activity aimed at finding, evaluating and learning from the best examples, regardless of their size, business area and geographical location.”

There is a slightly different definition: “Benchmarking is a process of systematic and continuous measurement: assessing the internal processes of an enterprise and comparing them with the processes of world leading enterprises in order to obtain information that will be useful for improving one’s own characteristics.”

Many new business methods in logistics, marketing, and quality management, developed by large companies and having success, gradually began to be used by enterprises in other industries. These include 6-sigma (Motorola), just-in-time (Toyota), Poke-yoka (Matsushita Co), and benchmarking itself (Xerox).

Currently, benchmarking is a promising direction for the development of consulting. At the same time, the role of the consultant is to adapt the experience of leading companies, including those from other industries, to the real business conditions of the client company.

The benchmarking approach leads to a significant change in the decision-making procedure in the field of logistics management. Traditionally, such management decisions were made based on the results of marketing and logistics research, and management intuition in the field of organizing supply and distribution chains.

The benchmarking approach in the field of logistics of industrial enterprises involves the discovery, study and use of the useful experience of other companies in solving problems of the development of logistics systems and chains, familiarity with the best practices used, which contributes to a more informed, balanced adoption

management decisions in the field of development of intra-company logistics, thereby increasing the competitiveness of the company.

The subjects of studying benchmarking in logistics include:

1) organization of sales channels

2) warehousing (including technical equipment of warehouses)

3) logistics management

4) transportation and relations with logistics operators

5) logistics systems for managing and monitoring resources at all stages of the production and sales cycle

6) information management during the movement of goods (including the availability of electronic document management, barcoding)

7) process of formation of logistics costs

8) interaction with suppliers and business partners.

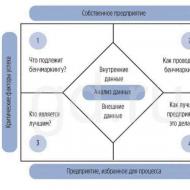

The benchmarking process in logistics can be represented as the following diagram:

1. Determination of the range of problems in the functional areas of logistics to be considered from the standpoint of benchmarking.

2. Determination of a set of factors and variables to analyze the state of logistics at the enterprise.

3. Selection of a set of enterprises for comparison and use of experience, both in the industry to which the logistics object belongs, and from other industries. In parallel with this, external secondary information related to the use of logistics by other enterprises and the formation of supply and distribution chains by them should be analyzed.

4. Collection and analysis of indicators of enterprises selected for comparison according to selected evaluation criteria. In this case, the information received is classified, systematized, an analysis method is selected, and the degree of achievement of the goal and the set of factors that determine the result are assessed.

5. Comparison of the results obtained with our own indicators in order to determine possible areas for improvement.

6. Development of an action plan to improve the state of logistics based on the information received.

7. Implementation and subsequent monitoring.

It is obvious that such a benchmarking scheme should be periodically carried out again, since practice shows that the process of improvement is limitless, since science and management are dynamically developing, and this causes corresponding changes in the application of logistics approaches and methods at the best enterprises.

Of great importance when carrying out benchmarking in logistics is the compilation of a “collective”, essentially “ideal” image of a reference company for orientation, the state of supply chains to which one should strive.

The most important principle of benchmarking is the similarity of the logistics business processes of the logistics object with the companies being compared, which determines the possibility of using their experience.

The problem that needs to be solved during benchmarking is the need to adapt the research results to the characteristics of the company.

In the future, considerable importance should be given to the mutual exchange of information between interested enterprises, including from different industries, through conferences on various applied issues of logistics and marketing. Sources of information for benchmarking in the field of logistics are information posted on the Internet, visits to thematic exhibitions, personal contacts with suppliers, consumers, competitors, representatives of leading companies in other industries, economic periodicals, data from professional associations, and industry consultants.

According to a number of researchers, for example, Y.K.Shetty, the buyer remains the main source of information about the market and competitors. Indeed, by conducting appropriate marketing research, it is possible to find out what consumers think about the state of supply chains and the necessary changes in the nature of interactions.

Direct communication between logistics managers of different enterprises provides valuable ideas and knowledge for business, which can lead to the introduction of new forms of product distribution management, inventory management, modern software products, and the use of new logistics methods.

The main benefit of benchmarking is that the implementation of logistics and related marketing and production functions becomes more efficient as the best methods and technologies of other enterprises or industries are researched and implemented. This will have a positive effect on reducing costs (especially logistics), will lead to better satisfaction of customer needs, which will create the preconditions for increasing business profitability and creating useful competition in the market.

If there are no necessary resources to conduct benchmarking on your own, it is advisable to involve third-party organizations - consulting firms in the field of management and, in particular, logistics consulting. There are not enough of them yet, but it is obvious that this unfilled niche in the market for intellectual services for business will soon begin to be filled.

About what prevents the purchasing department from becoming a full-fledged tool for increasing company profits.

Each of the factors mentioned in the last article reduces the effectiveness of the purchasing department. If you find similarities in several positions regarding your company at once, the situation can be considered critical.

A question arises →

What should the head of the company and the CFO do in such a situation?

Practice shows that it is possible to overcome the crisis only through thoughtful step-by-step transformations.

So, let's begin.

Step one. Evaluating the effectiveness of the purchasing department

Conduct an audit and draw up an objective picture of what is happening in Procurement:

- study the current document flow;

- highlight the TOP 20 categories and the amount of costs for them;

- designate the persons responsible for the procurement of these categories;

- specify the number and functionality of employees involved in the procurement process;

- Assess the level of procurement expertise by category.

Step two. Procurement focus on strategic issues

Free Procurement from non-core work by focusing employees on strategic issues:

1. Sourcing:

- market analysis;

- preparation of technical specifications;

- conducting tenders/negotiations;

- preparation and implementation of the contract.

2. Managing interactions with suppliers:

- assessing the performance of suppliers through surveys of internal customers and market analysis;

- establishing feedback;

- recommendations to suppliers on how to make their service more efficient;

- implementation of innovations.

- procurement and consumption process;

- commercial terms;

- specifications.

2) Creation of a long-term category strategy and new purchasing schemes. For example, switching to operating leasing or car rental instead of purchasing vehicle ownership.

Ensure full coverage of strategic cost categories by Procurement

Strategic categories- categories that critically affect your business. Such categories (packaging, raw materials, transportation, goods and services for marketing) typically make up the majority of budget expenditures.

Spot(one-time purchases with a small cost - buying 10 laptops, searching for an office for rent, buying office furniture, etc.) and operational procurement(processing requests for office goods, supplies for stores, placing and tracking orders from suppliers) separate into a separate operational function. To do this, create a service center in a region with low labor costs or outsource operational functions.

If these processes are left to the initiators, there is a high probability that the savings achieved during sourcing will be nullified.

Reasons for such losses:

Move the table

| Procurement is a non-core activity for initiators | Conflict of interest | The principle of separation of responsibilities does not work |

|

|

|

Step three. Strong expertise

Focus procurement expertise on strategic cost categories.

Important:

- hire specialized specialists for each specific categories;

- fire the “tired” – those who cannot be motivated;

- train employees (trainings, reference visits, etc.);

- accumulate knowledge gained from suppliers and companies from the same industry.

Step four. Clear goals

Set a clear goal for Procurement: to optimize costs for specific purchasing categories. Entrust the achievement of economic indicators to Finance. And in order to effectively spend the funds saved thanks to sourcing activities, adjust the budget quarterly.

Important:

Finance takes into account not the calculated, but the actual savings received

Step five. Sourcing event plan

Agree with the purchasing department on a plan for sourcing activities, designed for a year, or better yet, for the next two years. This will allow you to assess the scale of savings and use the necessary labor resources.

Step six. Signing and tracking SLAs (service level agreements)

Be sure to develop and sign an SLA between Purchasing and other departments of the company.

Measure the performance of the purchasing department once a quarter.

Feedback can be obtained through surveys that help find out →

- Are the initiators satisfied with the service of the suppliers?

- How satisfied are department heads with the service provided by the purchasing department?

- What are the pros and cons of working in a procurement function?

In our work we use the resource surveymonkey.com.

Regularly discuss emerging problems between the initiators and Procurement, monitor the implementation of planned activities. This will reduce the time required to approve tender decisions and conduct procurement, and will also help achieve savings according to the sourcing plan.

Step seven. Taking procurement out of your comfort zone

Take your purchasing out of your comfort zone!

Try to find new opportunities to reduce costs.

One such opportunity is the creation of procurement consortia with other companies. Unfortunately, today many companies do not consolidate purchases even within their own organization/group of companies or even one division, which affects their results.

With the support of management, procurement specialists can consolidate all volumes of a group of companies and carry out sourcing events at a higher level

Suppliers will meet halfway: they are interested in signing a contract for a larger volume within one event.

Step eight. Use benchmarking

Conduct benchmarking - comparison of the company's current conditions with the conditions of other market participants. For example, for mobile communications, you need to compare costs per user per month.

Benchmarking helps stimulate Procurement and allows you to evaluate the potential for cost reduction. In addition, it provides guidance when negotiating with suppliers: what price level should you strive for?.

Step nine. Involve Procurement in covering all requests

Require Procurement to cover all procurement categories - direct and indirect.

Participation of Procurement in the process of making strategic decisions increases their efficiency and competitive advantages, and allows initiators to formulate requests more correctly and clearly

The procurement service is involved from the very beginning in company projects where large costs are planned.

Step ten. Control by the finance function

Finance tasks:

- involve Procurement in the budget formation process;

- set aggressive budget savings goals for Procurement;

- monitor the achievement of these goals;

- participate in the audit of procurement activities.

Finance should set the goal of saving for the initiators as well. This forces proponents to collaborate with Procurement in selecting suppliers, even in categories in which Procurement has not previously been involved.

Step eleven. The head of the company is the main stakeholder

You, like no one else, understand that the results of the procurement function directly affect the company's achievements. Therefore, it is in your best interest to become a key stakeholder, sponsor of the procurement function.

The CEO must regularly (once a quarter):

- evaluate the results of Procurement activities together with other functional managers;

- receive a reliable report on achievements/problems in the field of procurement;

- receive a report on the results of Procurements in comparison with similar companies.

Important:

procurement concerns the activities of the entire company and all functional managers, so control and interest on the part of the CEO is necessary. For this reason, in international companies, the head of the Supply function often reports directly to the CEO

Let's sum it up

If you want to get the most out of your purchasing department, create a competitive environment in which Purchasing competes within its own team, with other functions within the company, and with purchasing functions in other organizations. Otherwise, Procurement activities will remain chaotic and will not bring tangible results.

In international companies, CEOs and CFOs are involved in strategic procurement management issues. This is explained by the fact that purchases increase company profits along with sales.

In Russia, procurement has long remained on the sidelines, as the last 15 years have seen an increase in consumption and sales. Inefficiencies in procurement were not taken into account by management in pursuit of excess profits and due to the lack of competition.

Procurement becomes competitive if the company’s management is interested in this, sets strategic goals for Procurement and monitors their implementation

It's time to change focus. You will certainly be able to make a lot of useful changes in the purchasing function in your company! If you need practical advice, .

Hello, dear purchasing enthusiasts!

In this publication, we continue to review various purchasing tools from the wonderful book “Purchasing chessboard” from consultants A.T. Kearney. Today we will look at one of these tools , How Benchmarking of product composition.

Increasing differentiation, shorter product life cycles and increasing product diversity make sourcing increasingly complex. As a result, it is becoming more and more difficult to implement volume consolidation techniques or achieve economies of scale. Therefore, the first step in this case will be the use of appropriate tools to bring order to the resulting chaos. Using analysis and benchmarking, it is possible to identify potential improvements that can be realized through joint efforts between R&D and manufacturing departments.

A sample of competing products is sent to several suppliers for component analysis. Suppliers provide proposals both for the product as a whole and for its components. By combining the best proposals, the best concept is selected, while the buyer gains an understanding of the suppliers' production costs.

Product composition benchmarking includes seven steps:

1) coordinating the approach with suppliers: it is necessary to identify new potential suppliers (except existing ones) based on their portfolio, competencies and abilities;

2) identification of relevant competitive products;

3) preparation of appropriate costing templates;

4) receiving adjusted templates from suppliers;

5) evaluation of proposals;

6) determination of potential savings:

Determining the supplier with the lowest price for each product within the existing cost estimate;

Product reconfiguration using the lowest cost components;

Determining the lowest production costs

7) determination of target costs

The result product composition benchmarking is a reliable analysis of comparable competitive products.

good example of product composition benchmarking is an example benchmarking of rear view mirrors from an automaker

A car manufacturer decided to benchmark its rear view mirror product formulation after obtaining agreement from four suppliers (2 existing, 2 new) to participate in the process. The team, composed of engineering and purchasing personnel, decided to include two products from direct competitors and two products from competitors in low-cost countries in the process.

The following components were used for the costing templates: body, hinge mechanism, adjusting head, suspension, frame and mirror glass. Parts and materials were specified for each individual element. Suppliers were asked to determine the costs of major product elements and development services, including overhead costs. To better understand the benchmarking procedure, a joint meeting was held with suppliers.

A few weeks later, the results were available with corresponding potential savings, optimal functionality and efficient production processes. Minor functional differences between competing products were identified and financially assessed. Negotiations and subsequent feedback were provided to each of the suppliers.

Potential savings of 27% were identified for the entire product, with the breakdown as follows: 5 to 10% for body, 15 to 25% for hinge mechanism, 5 to 15% for frame, 25 to 30% for mirror glass, from 30 to 35% - for additional indirect costs.

Thus, as the example above shows, product composition benchmarking is a fairly effective purchasing tool that allows you to get up to 30% savings.