Directory of budget classification codes. How to find out the budget classification code? Single tax with simplification

From November 30, 2016, “another person” (i.e., anyone) will be able to pay taxes for the organization. But at the same time, this person cannot demand a refund of the amounts paid.

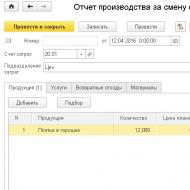

Special modes

simplified tax system

For payments: Tax simplified tax system (simplified): KBK simplified tax system income - 182 1 05 01011 01 1000 110, KBK simplified tax system income-expenses - 182 1 05 01021 01 1000 110 (182 1 05 01050 01 1000 110 - simplified tax system minimum tax for 2012-2015, and for 2016-2018 you must list one simplified tax system “income-expenses”).

By the way, you can absolutely free generate and send to the Federal Tax Service, a zero declaration of the simplified tax system.

In simplified taxation payments, the period should be indicated as follows:

for the 1st quarter - KV.01.2018

for the 2nd quarter - PL.01.2018

for the 3rd quarter - KV.03.2018

for the 4th quarter - GD.00.2018

UTII

For payments: UTII tax (imputation): KBK - 182 1 05 02010 02 1000 110

In UTII payment slips, indicate the period as follows:

for the 1st quarter - KV.01.2018

for the 2nd quarter - KV.02.2018

for the 3rd quarter - KV.03.2018

for the 4th quarter - KV.04.2018

Patent

Since 2013, new BCCs for the patent system (PSN) have appeared.

182 105 04010 02 1000 110 Tax levied in connection with the use of the patent taxation system, credited to the budgets of urban districts (since 2013)

182 105 04020 02 1000 110 Tax levied in connection with the use of the patent taxation system, credited to the budgets of municipal districts (since 2013)

182 1 05 04030 02 1000 110 Tax levied in connection with the use of the patent taxation system, credited to the budgets of the federal cities of Moscow and St. Petersburg (from July 2013)

IP payment

Individual entrepreneur's payment for himself

On February 22, 2018, a new BCC was introduced for payments over 1% of insurance premiums - 182 1 02 02140 06 1210 160 (order dated December 27, 2017 No. 255n). However, then it was canceled (order dated February 28, 2018 No. 35n). For the additional percentage, the BCC does not change.

There is no error in the table. BCC in 2017 in the Pension Fund are the same for fix. parts and for incomes over 300 tr.

| Payment type | Until 2017 (for any year before 2016, 2015, etc.) | After 2017 (for any year - 2017, 2018, etc.) |

|---|---|---|

| Insurance contributions for pension insurance of individual entrepreneurs for themselves in the Pension Fund of the Russian Federation in a fixed amount (based on the minimum wage) | 182 1 02 02140 06 1100 160 | 182 1 02 02140 06 1110 160 |

| Insurance contributions for pension insurance of individual entrepreneurs for themselves in the Pension Fund of the Russian Federation with income exceeding 300,000 rubles. | 182 1 02 02140 06 1200 160 | 182 1 02 02140 06 1110 160 |

| Insurance premiums for medical insurance for individual entrepreneurs for themselves in the Federal Compulsory Compulsory Medical Insurance Fund in a fixed amount (based on the minimum wage) | 182 1 02 02103 08 1011 160 | 182 1 02 02103 08 1013 160 |

The period to be indicated in the Pension Fund is GD.00.2018

Penalties and fines

We change the 7th digit on the right (using the example of KBK USN income):

KBK for tax transfer - 182 1 05 01011 01 1 000 110 (original)

BCC for transferring tax penalties - 182 1 05 01011 01 2 000 110 (this was the case until 2015). From 2015, 182 1 05 01011 01 21 00 110 – for payment of penalties, 182 1 05 01011 01 22 00 110 – for interest.

KBK for transfer of tax fine - 182 1 05 01011 01 3 000 110

Incorrect KBK?

Did you make a mistake in the KBK and indicate it incorrectly? We are writing for the Federal Tax Service or Pension Fund: Application for transfer of KBK.doc.

With help, you can generate payments and receipts for the payment of any taxes under the simplified tax system, UTII and for employees 2017, submit any reports via the Internet, etc. (from 150 rubles/month). 30 days free. With your first payment() three months free.

Budget Classification Code (BCC) – quite a well-known abbreviation for accountants, bank tellers, as well as employees of budgetary institutions.

According to the Budget Code of the Russian Federation, namely No. 145-FZ, the BCC represents groups of expenses, income, as well as sources of formation of budget deficits and operations of public legal entities.

Budget classification codes are twenty-digit combinations special digital code. They are used to group items of the state budget, their preparation and execution, as well as the generation of reporting on their implementation.

Budget classification codes are twenty-digit combinations special digital code. They are used to group items of the state budget, their preparation and execution, as well as the generation of reporting on their implementation.

Code structure in the case of budget revenues:

- Administrator (digits 1 to 3 represent the chief administrator of budget revenues).

- Types of income (4th figure - group, 5 and 6 - subgroup, 7 and 8 - article, 9 to 11 - subarticle, 12 and 13 - element).

- Program/subprogram (digits 14 to 17 – subtype of income).

- EKD (economic classification of income, from digits 18 to 20, classifies operations of the public administration sector).

The first group of the KBK structure consists of three characters. The “Group” component of the types of income of KBK is represented by one sign, the subgroup – by two.

The signs in the subgroup can be the following:

- 1 – taxes;

- 2 – receipts on a gratuitous basis;

- 3 – income from business activities.

An article is represented by two signs, a sub-item by three, an element by two, which determine the type of budget.

Structure of the element code and its meaning:

- 01 – federal budget;

- 02 – budget of a constituent entity of the Russian Federation;

- 03 – local;

- 04 – urban district;

- 05 – municipal district;

- 06 – Pension Fund;

- 07 – FSS of the Russian Federation;

- 08 – Federal Compulsory Medical Insurance Fund of the Russian Federation;

- 09 – territorial Compulsory Medical Insurance Fund;

- 10 – settlement.

Subtype of income (program) is presented next:

- 1000 – payment of the main payment;

- 2100 – penalties;

- 3000 – fines;

- 2200 – interest deduction.

EKD specifies the income code and can be represented by three values.

KBK expenses represented by the following structure with five elements:

- Chief manager of budget funds (1st to 3rd digits, administrator).

- Section and subsection (digits 4 to 7, two characters each).

- Target expense item (digits 8 to 14, digits 11 and 12 – program, digits 13 and 14 – subprogram).

- Type of expenses (15 to 17 digits, three digits).

- ECR, which classifies public sector operations related to budget expenditures).

Section and subsection are specified:

- 01 00 – 15 subsections – issues of a national nature;

- 02 00 – 8 – national defense;

- 03 00 – 13 – law enforcement and national security;

- 04 00 – 11 – national economy;

- 05 00 – 4 – housing and communal services;

- 06 00 – 4 – environmental protection;

- 07 00 – 9 – education;

- 08 00 – 6 – culture, cinematography, media;

- 09 00 – 4 – sports and healthcare;

- 10 00 – 6 – social policy;

- 11 00 – 4 – interbudgetary transfers.

With the help of KBK they determine payment information(their goal, addressee). Using a correctly specified KBK you can:

- Perform payment transactions without errors.

- Be aware of the history of cash movements.

- Make the work of employees in the public service easier.

- Competent budget planning and financial flow management.

- Fixation of loan debt.

- Guarantee the receipt of funds in the current account and the absence of penalties from the sender.

BCC is reflected in a special field of payment orders, which are intended for making tax payments, insurance premiums, penalties and fines.

BCC is reflected in a special field of payment orders, which are intended for making tax payments, insurance premiums, penalties and fines.

Among the KBK we can distinguish following: taxes (personal income tax, VAT, property, etc.), state duties, fines and damages, simplified tax system 6% and 15%, UTII, oil, gas, water, minerals, subsoil use, insurance premiums.

As an example, consider LLC “Vozmezdie”, which makes deductions in the event of accidents and professional accidents. illnesses among employees.

BCC in this case for 2018 will be following:

- 393 1 02 02050 07 1000 160 – timely transfer of funds;

- 393 1 02 02050 07 2100 160 – payment of penalties;

- 393 1 02 02050 07 3000 160 – fines for mandatory payment.

Why was it introduced?

Budget classification codes have been used for a long time, but only after the introduction of Order No. 72n of the Ministry of Finance of the Russian Federation and the Instructions on the application of the budget classification of the Russian Federation, 20-digit codes began to be used.

The created classification system allows you to quickly transfer and send funds to the recipient from the state nomenclature. KBK are used not only by individual entrepreneurs and small businesses, but also by large enterprises.

Sometimes the BCC may change; in most documents, the BCC is mandatory requisite.

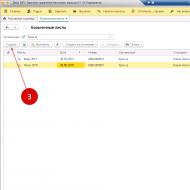

Filling in payment documents

The payment document represents settlement documentation on the basis of which the banking institution makes money transfers. To pay taxes and contributions, use form No. 0401060.

The payment document represents settlement documentation on the basis of which the banking institution makes money transfers. To pay taxes and contributions, use form No. 0401060.

In 2018, the Federal Tax Service is in charge of transferring taxes and insurance premiums; payers will have to submit a single report (No. 243-FZ).

Budget classification code indicator in line No. 104 is filled in in the following way:

- Line 16– recipient – the territorial body of the Federal Tax Service is indicated.

- Line 22– unique accrual identifier (UIN) – 0 for current payments.

- Line 106– basis for payment – the code is established in accordance with the Appendices of the Order of the Ministry of Finance No. 107n.

- Lines 107, 108, 109(tax period, document number for making payment, date of deduction) – filling in is similar to a payment order for taxes.

If the BCC is indicated incorrectly, then the “payments” are either returned to the taxpayer or they are assigned the status “unclarified.”

As a result, the accounting department is obliged to find the document and return the payment amount to the current account. In this case, the tax payment deadlines will be violated, and the payer will be charged penalties for late payment.

Also held repayment of tax. There are situations when an enterprise transferred tax, but made a mistake in indicating the KBK.

As a result, the payment amount was used to pay another tax - for one tax there will be an overpayment, for the other - an arrear. The situation is resolved by drawing up a letter and sending it to the tax authorities in order to transfer funds from one tax to another. Before this, a reconciliation is carried out. In this case, penalties will still be charged, since the payment deadlines are overdue.

According to Order of the Ministry of Finance of the Russian Federation No. 230n, in 2018, some budget classification codes were excluded, and some were added minor adjustments.

KBK insurance premiums in 2018 for organizations and individual entrepreneurs have administrator code 182. The codes differ depending on the period for which the company pays.

All BCCs of insurance premiums have been updated - for companies and entrepreneurs, for basic and additional tariffs. In addition, officials divided them according to additional tariffs for employees in hazardous production. For companies that have conducted a special assessment, the codes are not the same as for others.

The budget classification code is used to indicate budget income and expenses when filling out payment orders. We have figured it out and are ready to talk about what the KBK consists of, how important it is to indicate it correctly in the payment order, and what to do with errors made in the payment order.

What is KBK in a payment order?

The budget classification code in the payment slip is a special digital code that should indicate budget income and expenses. An organization's accounting department encounters these codes when it makes a payment to the budget system, but most often does not understand what this sequence of numbers is and what it means in the payment order. You can see which BCCs and payment cards from January 1, 2019 - the classifier contains up-to-date information. But to understand the structure of the code, let's take a closer look at it. Let's look at what the KBK consists of, how important it is to indicate it correctly on the payment slip, and what to do with errors.

The decoding is given in Order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n. In accordance with it, the BCC indicated in payment orders consists of 20 digits combined into groups. Each group has its own meaning.

What does the budget classification code consist of?

Each digit of the code indicated on the payment slip is also called a digit. The digits are combined into blocks as follows:

The first group is administrative. It consists of three digits and reflects the code of the chief revenue administrator. For example, the Federal Tax Service code in the payment order is 182; FSS code in the payment slip is 393.

The second block is profitable. It includes several information messages at once. The first of them (bit 4) is expressed in one digit and indicates the type of payment received. For example, the number 1 means that it came in the form of a tax, 2 - that it came in the form of gratuitous income, 3 - from business, etc.

Next comes a subgroup. These are two signs that indicate for what purpose the cash receipts from the payment order are intended. So, 01 - profit tax and income tax; 02 - tax or fee for social needs, 08 - state duty.

The table will help when filling out a payment order. It contains a detailed decoding of the KBK, the categories are indicated in a separate column.

|

KBK structure |

Category No. |

|

|

Income group |

|

|

|

Income subgroup |

For tax and non-tax income:

|

The third block also includes a group and a subgroup (two and three numbers in a row, respectively).

The next element in the payment order defines the budget code and consists of two digits, designated as follows:

- 01 - federal;

- 02 - subject of the Federation;

- 03 - local, etc.

|

KBK structure |

Category No. |

What to indicate in a payment order |

|

Income item |

Codes by which administrators classify incoming payments. The codes are indicated in Appendix 1.1 to the Directives approved by Order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n. |

|

|

Sub-item of income |

||

|

Income element |

Codes for distribution of payments - budgets:

|

- payment of the tax itself (fee, contribution);

- payment of penalties on it;

- payment of a fine thereunder.

So, for example, at the time of writing, when filling out payment orders, the following designations are generally accepted: payment - 1000, 2100 - penalties, 3000 - fine. For example:

- 182 1 01 02010 01 1000 110 - when paying personal income tax to the budget;

- 182 1 01 02010 01 2100 110 - upon payment of penalties for personal income tax;

- 182 1 01 02010 01 3000 110 - payment of a fine.

And finally, the last three digits of any code are a classifier of the type of income (tax, non-tax, from property, etc.). For example, 010 is tax income; 130—receipts from the provision of paid services, work and compensation of costs; 150 - gratuitous receipts from budgets.

|

KBK structure |

Category No. |

What to indicate in a payment order |

|

Analytical group of budget income subtype |

The values of the codes are approved by the Ministry of Finance of Russia, the financial body of the subject of the Russian Federation, municipal formation. If not approved, please indicate:

Items of disposal of non-financial assets:

|

KBK field in a payment order

Each field in the payment order is assigned its own number.

The payment order has a separate field for KBK (this is the 104th field), and it must be filled out correctly (you can see the rules for filling out a payment order in the “Regulations on the rules for transferring funds” (approved by the Bank of Russia on June 19, 2012 No. 383-P If the BCC is indicated incorrectly on the payment slip, then the corresponding amount may be classified as unexplained payments. The Federal Treasury may classify it as “unclarified.” At the same time, an error in indicating the BCC on the payment slip can lead to arrears in taxes and insurance premiums.

Here is an example of a completed payment slip with entered data about the recipient:

- field 104 of the payment order indicates the KBK for transferring personal income tax;

- 105 - OKTMO;

- 106 - basis - current payment (abbreviated as TP);

- 107 - period (MS - abbreviated month);

- 108 - this field contains “0” (when paying on demand, the number of the document with the demand is entered in this field of the payment order);

- 109 - “0” (the payment field is intended to indicate the date of submission of the declaration or settlement. If the payment is made regardless of the submission of reports, “0” is always placed in this payment field);

- 110 - the field always remains empty in the payment order;

- 24 - brief purpose of payment: type of tax and payment period.

In 2019, insurance premiums must be paid not to the funds, but to the tax inspectorates; accordingly, other account details are indicated in the payment slips. Payment of contributions for “injuries” is also transferred to the Social Insurance Fund.

If the KBK is incorrectly indicated on the payment, what to do?

The payer may receive a payment with an incorrect BCC. For example, KBK 392 1 16 20010 06 6000 140 is indicated, how to fill out a payment order (2018) using this code? There is only one answer: there is no need to fill out such a payment form, since this code is no longer used. Previously, fines were paid to the Pension Fund of the Russian Federation using this code for late submission of reports on insurance premiums. Now tax accounting in the Pension Fund of Russia is administered by the Federal Tax Service, so the old KBK has lost its relevance. But if a mistake has already been made, you incorrectly indicated the KBK in the payment order and transferred money, then proceed as follows.

Step 1. An application must be sent to the tax office or the territorial branch of an extra-budgetary fund to clarify the details of the payment order. The application is written in any form. Please attach a copy of the payment slip with the bank's stamp to your application.

Step 2. Tax inspectors must make a decision on the issue of clarifying payment within 10 working days. This period begins to count from the date of application, when the inspectors received your application for clarification of payment, or from the date of signing (registration) of the act of joint reconciliation of calculations (if it was carried out).

Step 3. After the deadline has expired, be sure to order a tax certificate of settlements with the budget or a reconciliation report to make sure that the inspectors credited the amount to the correct BCC.

Since the KBK belongs to the group of details that make it possible to determine the identity of the payment, if an erroneously specified KBK is detected in the order for the transfer of tax, the payer has the right to contact the tax authority with an application to clarify the identity of the payment. This position has been repeatedly expressed by the Ministry of Finance (for example, Letter dated January 19, 2017 No. 03-02-07/1/2145).

KBK on transport tax for legal entities and citizens

We have compiled a KBK table for 2017. Budget classification codes have changed; 12 new codes are in effect from January 1. The Ministry of Finance introduced a new code for income tax, insurance premiums, and abolished the code for the minimum tax. Use the transition table to check what to write on your payment slips.

The Ministry of Finance approved a new BCC for income tax

The new budget classification code (KBK) is 18210101090010000110. According to it, companies will pay income tax on income from traded bonds that are denominated in rubles and issued from January 1, 2017 to December 31, 2021.

The Ministry of Finance sent an order dated 06/09/17 No. 87n with a new code for registration with the Ministry of Justice. This BCC will begin to apply on January 1, 2018, but only after the Ministry of Justice registers the order.

Which KBKs changed in 2017

So, what budget classification codes have changed for 2017? Since 2017, use the new KBK for three main payments:

- There will be a new BCC on corporate income tax on income in the form of profits of controlled foreign companies - 182 1 01 01080 01 1000 110.

- There will be no separate code for the minimum tax. Now the minimum tax under the simplified tax system will be transferred according to the same BCC as the single tax - 182 1 05 01021 01 1000 110.

- BCC for insurance premiums has changed.

Table of current budget classification codes (KBK) for 2017

You will be able to figure out on your own which BCC you need to indicate to pay tax (arrears), and which to pay penalties or fines by reading our instructions further. Now let's go directly to the table with KBK codes for 2017.

KBK 2017. VAT

KBK 2017. Corporate income tax

|

Purpose of payment |

|

|---|---|

|

182 1 01 01011 01 1000 110 |

|

|

182 1 01 01012 02 1000 110 |

|

|

182 1 01 01013 01 1000 110 |

|

|

182 1 01 01014 02 1000 110 |

|

|

182 1 01 01020 01 1000 110 |

|

|

182 1 01 01030 01 1000 110 |

|

|

182 1 01 01040 01 1000 110 |

|

|

182 1 01 01050 01 1000 110 |

|

|

182 1 01 01060 01 1000 110 |

|

|

182 1 01 01070 01 1000 110 |

|

|

from income in the form of profits of controlled foreign companies |

182 1 01 01080 01 1000 110 |

Budget classification codes 2017. Personal income tax

KBK 2017. Transport tax

KBK 2017. Organizational property tax

BCC 2017. Insurance contributions to the Pension Fund (applied only for payment of contributions until December 31, 2016)

See also All changes to insurance premiums

|

Purpose of payment |

|

|---|---|

|

for pension insurance in the Pension Fund for employees |

392 1 02 02010 06 1000 160 |

|

392 1 02 02140 06 1100 160 |

|

|

392 1 02 02140 06 1200 160 |

|

|

for the insurance part of the labor pension at an additional rate for employees on list 1 |

392 1 02 02131 06 1000 160 |

|

for the insurance part of the labor pension at an additional rate for employees on list 2 |

392 1 02 02132 06 1000 160 |

BCC 2017. Insurance contributions to the Pension Fund (applicable from January 1, 2017)

|

Purpose of payment |

For periods before 2017 (for example, for December 2016 in January; old debt) |

For periods from 2017 (contributions for January onwards) |

|

for pension insurance for employees |

182 1 02 02010 06 1000 160 |

182 1 02 02010 06 1010 160 |

|

for pension insurance of an individual entrepreneur for himself based on the minimum wage |

182 1 02 02140 06 1100 160 |

182 1 02 02140 06 1110 160 |

|

for pension insurance of an individual entrepreneur for himself with income exceeding 300,000 rubles. |

182 1 02 02140 06 1200 160 |

182 1 02 02140 06 1110 160 |

KBK 2017. Insurance contributions to the Social Insurance Fund from 2017 and old periods

|

Purpose of payment |

|

|---|---|

|

182 1 02 02090 07 1000 160 |

|

|

in case of temporary disability and in connection with maternity |

182 1 02 02090 07 1010 160 |

|

in case of temporary disability and in connection with maternity (applied only for payment of contributions for 2016 until December 31, 2016) |

393 1 02 02090 07 1000 160 |

|

for insurance against industrial accidents and occupational diseases Attention! The year code has not changed, since contributions for injuries remained in the Social Insurance Fund. |

393 1 02 02050 07 1000 160 |

BCC 2017. Insurance premiums for compulsory medical insurance (applied only for payment of contributions for 2016 until December 31, 2016)

KBK 2017. Insurance premiums for compulsory medical insurance from 2017

|

Purpose of payment |

|

|---|---|

|

to the FFOMS budget for employees (for periods before 2017. For example, for December 2016 in January; old debt) |

182 1 02 02101 08 1011 160 |

|

to the FFOMS budget for employees (for periods from 2017 - contributions for January and beyond) |

182 1 02 02101 08 1013 160 |

|

182 1 02 02103 08 1011 160 |

|

|

for medical insurance of an individual entrepreneur for himself based on the minimum wage (IP contributions for 2017) |

182 1 02 02103 08 1013 160 |

KBK 2017. Land tax for companies

|

Purpose of payment |

|

|---|---|

|

182 1 06 06031 03 1000 110 |

|

|

within the boundaries of urban districts |

182 1 06 06032 04 1000 110 |

|

182 1 06 06032 11 1000 110 |

|

|

182 1 06 06032 12 1000 110 |

|

|

182 1 06 06033 05 1000 110 |

|

|

within the boundaries of rural settlements |

182 1 06 06033 10 1000 110 |

|

182 1 06 06033 13 1000 110 |

KBK 2017. UTII

KBK 2017. USN

KBK 2017. Unified Agricultural Sciences

KBK for a patent in 2017

Budget classification codes 2017. Property tax for individuals

|

Purpose of payment |

|

|---|---|

|

182 1 06 01010 03 1000 110 |

|

|

within the boundaries of urban districts |

182 1 06 01020 04 1000 110 |

|

within the boundaries of urban districts with intracity division |

182 1 06 01020 11 1000 110 |

|

within the boundaries of intracity districts |

182 1 06 01020 12 1000 110 |

|

within the boundaries of inter-settlement territories |

182 1 06 01030 05 1000 110 |

|

within the boundaries of rural settlements |

182 1 06 01030 10 1000 110 |

|

within the boundaries of urban settlements |

182 1 06 01030 13 1000 110 |

KBK 2017. Land tax for individuals

|

Purpose of payment |

|

|---|---|

|

within the borders of Moscow, St. Petersburg and Sevastopol |

182 1 06 06041 03 1000 110 |

|

within the boundaries of urban districts |

182 1 06 06042 04 1000 110 |

|

within the boundaries of urban districts with intracity division |

182 1 06 06042 11 1000 110 |

|

within the boundaries of intracity districts |

182 1 06 06042 12 1000 110 |

|

within the boundaries of inter-settlement territories |

182 1 06 06043 05 1000 110 |

|

within the boundaries of rural settlements |

182 1 06 06043 10 1000 110 |

|

within the boundaries of urban settlements |

182 1 06 06043 13 1000 110 |

KBK 2017. Water tax

KBK for state duty for 2017

|

Purpose of payment |

|

|---|---|

|

on proceedings in arbitration courts |

182 1 08 01000 01 1000 110 |

|

on proceedings in the Constitutional Court of the Russian Federation |

182 1 08 02010 01 1000 110 |

|

on proceedings in constitutional (statutory) courts of constituent entities of the Russian Federation |

182 1 08 02020 01 1000 110 |

|

in proceedings in courts of general jurisdiction, magistrates. In addition to the Supreme Court of the Russian Federation |

182 1 08 03010 01 1000 110 |

|

on proceedings in the Supreme Court of the Russian Federation |

182 1 08 03020 01 1000 110 |

|

for state registration: |

182 1 08 07010 01 1000 110 (if documents for state registration of an organization or entrepreneur are submitted not to the tax office, but to a multifunctional center, then the BCC must be indicated with the income subtype code "8000", that is, 182 1 08 07010 01 8000 110 (letter of the Federal Tax Service of Russia dated January 15, 2015 No. ZN -4-1/193)) |

|

for state registration of rights, restrictions on rights to real estate and transactions with it - sale, lease and others |

321 1 08 07020 01 1000 110 |

|

for the right to use the names “Russia”, “Russian Federation” and words and phrases formed on their basis in the names of organizations |

182 1 08 07030 01 1000 110 |

|

for carrying out actions related to licensing, with certification provided for by the legislation of the Russian Federation, credited to the federal budget |

000 1 08 07081 01 1000 110 |

|

for registration of vehicles and other legally significant actions related to changes and issuance of documents for vehicles, registration plates, driver's licenses |

188 1 08 07141 01 1000 110 |

|

for carrying out state technical inspection, registration of tractors, self-propelled and other machines and for issuing tractor driver’s licenses |

000 1 08 07142 01 1000 110 (in categories 1–3, the code is indicated depending on the competence of which chief administrator is in charge of administering a specific budget income (Appendix 7 to the instructions approved by order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n). Indicate the administrator code in categories 1–3 KBK "000" is not allowed.) |

|

for consideration of applications for concluding or amending a pricing agreement |

182 1 08 07320 01 1000 110 |

KBC for fees for services and compensation of state costs in 2017

KBC on fines in 2017

|

Purpose of payment |

|

|---|---|

|

for violation of the legislation on taxes and fees provided for in Articles 116, 118, 119.1, paragraphs 1 and 2 of Article 120, Articles 125, 126, 128, 129, 129.1, 132, 133, 134, 135, 135.1, as well as the previously in force Article 117 Tax Code of the Russian Federation |

182 1 16 03010 01 6000 140 |

|

for violations of the legislation on taxes and fees provided for in Articles 129.3 and 129.4 of the Tax Code of the Russian Federation |

182 1 16 90010 01 6000 140 |

|

for violation of the procedure for registering gambling business objects, provided for in Article 129.2 of the Tax Code of the Russian Federation |

182 1 16 03020 02 6000 140 |

|

for administrative offenses in the field of taxes and fees provided for by the Code of the Russian Federation on Administrative Offenses |

182 1 16 03030 01 6000 140 |

|

for violation of the procedure for using CCP. For example, for violating the rules of technical maintenance of cash registers |

182 1 16 06000 01 6000 140 |

|

for violation of the legislation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation (regarding the budget of the Pension Fund of the Russian Federation) |

392 1 16 20010 06 6000 140 |

|

issued by the Pension Fund of the Russian Federation in accordance with Articles 48−51 of the Law of July 24, 2009 No. 212-FZ |

392 1 16 20050 01 6000 140 |

|

for violation of the legislation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation (regarding the budget of the Social Insurance Fund of Russia) |

393 1 16 20020 07 6000 140 |

|

for violation of the legislation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation (regarding the budget of the Federal Compulsory Medical Insurance Fund of Russia) |

394 1 16 20030 08 6000 140 |

|

for administrative offenses in the field of state regulation of the production and turnover of ethyl alcohol, alcohol, alcohol-containing and tobacco products |

141 1 16 08000 01 6000 140 (if the payment administrator is Rospotrebnadzor) 160 1 16 08010 01 6000 140 (if the payment administrator is Rosalkogolregulirovanie) 188 1 16 08000 01 6000 140 (if the payment administrator is the Ministry of Internal Affairs of Russia) (Chief administrators can delegate their powers to administer certain budget revenues to federal government agencies. In such situations, when transferring payments in categories 14–17 BCC, you must indicate the revenue subtype code “7000”) |

|

for violation of the procedure for handling cash, conducting cash transactions and failure to fulfill obligations to monitor compliance with the rules for conducting cash transactions |

182 1 16 31000 01 6000 140 |

|

for violation of the legislation on state registration of legal entities and individual entrepreneurs, provided for in Article 14.25 of the Code of Administrative Offenses of the Russian Federation |

182 1 16 36000 01 6000 140 |

|

for evasion of administrative punishment provided for in Article 20.25 of the Code of Administrative Offenses of the Russian Federation |

182 1 16 43000 01 6000 140 |

KBK transition table for taxes.

KBK transition table for insurance premiums.

|

Type of payment (insurance premiums) |

Old code |

New code |

|

|---|---|---|---|

|

for periods up to 2017 |

for periods since 2017 |

||

|

Insurance premiums for OPS |

392 1 02 02010 06 1000 160 |

182 1 02 02010 06 1000 160 |

182 1 02 02010 06 1010 160 |

|

Insurance premiums for compulsory medical insurance |

392 1 02 02101 08 1011 160 |

182 1 02 02101 08 1011 160 |

182 1 02 02101 08 1013 160 |

|

Social insurance premiums |

393 1 02 02090 07 1000 160 |

182 1 02 02090 07 1000 160 |

182 1 02 02090 07 1010 160 |

|

Additional pension contributions at tariff 1 |

392 1 02 02131 06 1000 160 |

182 1 02 02131 06 1010 160 – if the tariff does not depend on the special assessment; 182 1 02 02131 06 1020 160 – if the tariff depends on a special assessment |

|

|

Additional pension contributions at tariff 2 |

392 1 02 02132 06 1000 160 |

182 1 02 02132 06 1010 160 – if the tariff does not depend on the special assessment; 182 1 02 02132 06 1020 160 – if the tariff depends on a special assessment |

|

Why is KBK needed?

To pay a tax, penalty or fine, you fill out a payment order. And in field 104 indicate the code that is valid in 2017. We have collected current budget classification codes. If you make a mistake, the tax authorities will not count the tax. Test yourself with

Which CBCs are subject to penalties and fines in 2017? BCCs for paying penalties and fines differ from the codes by which the company pays current payments. Therefore, we made separate tables for penalties and fines.

BCC for VAT for 2017. Penalties and fines.

KBK for income tax in 2017. Penalties and fines

|

Purpose of payment |

KBK on penalties |

KBK for a fine |

|---|---|---|

|

to the federal budget (except for consolidated groups of taxpayers) |

182 1 01 01011 01 2100 110 |

182 1 01 01011 01 3000 110 |

|

to the budgets of the constituent entities of the Russian Federation (except for consolidated groups of taxpayers) |

182 1 01 01012 02 2100 110 |

182 1 01 01012 02 3000 110 |

|

to the federal budget (for consolidated groups of taxpayers) |

182 1 01 01013 01 2100 110 |

182 1 01 01013 01 3000 110 |

|

to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) |

182 1 01 01014 02 2100 110 |

182 1 01 01014 02 3000 110 |

|

when implementing production sharing agreements concluded before October 21, 2011 (before the Law of December 30, 1995 No. 225-FZ came into force) |

182 1 01 01020 01 2100 110 |

182 1 01 01020 01 3000 110 |

|

from the income of foreign organizations not related to activities in Russia through a permanent representative office |

182 1 01 01030 01 2100 110 |

182 1 01 01030 01 3000 110 |

|

from the income of Russian organizations in the form of dividends from Russian organizations |

182 1 01 01040 01 2100 110 |

182 1 01 01040 01 3000 110 |

|

from the income of foreign organizations in the form of dividends from Russian organizations |

182 1 01 01050 01 2100 110 |

182 1 01 01050 01 3000 110 |

|

from dividends from foreign organizations |

182 1 01 01060 01 2100 110 |

182 1 01 01060 01 3000 110 |

|

from interest on state and municipal securities |

182 1 01 01070 01 2100 110 |

182 1 01 01070 01 3000 110 |

|

The corporate income tax on income in the form of profits of controlled foreign companies will have its own code. |

182 1 01 01080 01 2100 110 |

182 1 01 01080 01 3000 110 |

KBK for personal income tax for 2017. Penalties and fines

|

Purpose of payment |

KBK on penalties |

KBK for a fine |

|---|---|---|

|

paid by tax agent |

182 1 01 02010 01 2100 110 |

182 1 01 02010 01 3000 110 |

|

paid by entrepreneurs and persons engaged in private practice, including notaries and lawyers (Article 227 of the Tax Code of the Russian Federation) |

182 1 01 02020 01 2100 110 |

182 1 01 02020 01 3000 110 |

|

paid by the resident independently, including from income from the sale of personal property |

182 1 01 02030 01 2100 110 |

182 1 01 02030 01 3000 110 |

|

in the form of fixed advance payments from the income of foreigners working on the basis of a patent (Article 227.1 of the Tax Code of the Russian Federation) |

182 1 01 02040 01 2100 110 |

182 1 01 02040 01 3000 110 |

KBK for transport tax for 2017. Penalties and fines

BCC for corporate property tax for 2017. Penalties and fines

|

Purpose of payment |

KBK on penalties |

KBK for a fine |

|---|---|---|

|

for property not included in the Unified Gas Supply System |

182 1 06 02010 02 2100 110 |

182 1 06 02010 02 3000 110 |

|

for property included in the Unified Gas Supply System |

182 1 06 02020 02 2100 110 |

182 1 06 02020 02 3000 110 |

KBC for insurance premiums in 2017*. Penalties and fines

|

Payment type |

KBK in 2016 |

KBK in 2017 for payment of contributions |

|

|---|---|---|---|

|

for December 2016 |

for January and the following months |

||

|

Insurance contributions for pension insurance (basic tariff) |

|||

|

392 1 02 02010 06 1000 160 |

182 1 02 02010 06 1000 160 |

182 1 02 02010 06 1010 160 |

|

|

392 1 02 02010 06 2100 160 |

182 1 02 02010 06 2100 160 |

182 1 02 02010 06 2110 160 |

|

|

392 1 02 02010 06 3000 160 |

182 1 02 02010 06 3000 160 |

182 1 02 02010 06 3010 160 |

|

|

Health insurance premiums |

|||

|

392 1 02 02101 08 1011 160 |

182 1 02 02101 08 1011 160 |

182 1 02 02101 08 1013 160 |

|

|

392 1 02 02101 08 2011 160 |

182 1 02 02101 08 2011 160 |

182 1 02 02101 08 2013 160 |

|

|

392 1 02 02101 08 3011 160 |

182 1 02 02101 08 3011 160 |

182 1 02 02101 08 3013 160 |

|

|

Insurance contributions for social insurance in case of temporary disability and in connection with maternity |

|||

|

393 1 02 02090 07 1000 160 |

182 1 02 02090 07 1000 160 |

182 1 02 02090 07 1010 160 |

|

|

393 1 02 02090 07 2100 160 |

182 1 02 02090 07 2100 160 |

182 1 02 02090 07 2110 160 |

|

|

393 1 02 02090 07 3000 160 |

182 1 02 02090 07 3000 160 |

182 1 02 02090 07 3010 160 |

|

|

Insurance premiums for injuries |

|||

|

393 1 02 02050 07 1000 160 |

393 1 02 02050 07 1000 160 |

393 1 02 02050 07 1000 160 |

|

|

393 1 02 02050 07 2100 160 |

393 1 02 02050 07 2100 160 |

393 1 02 02050 07 2100 160 |

|

|

393 1 02 02050 07 3000 160 |

393 1 02 02050 07 3000 160 |

393 1 02 02050 07 3000 160 |

|

BCC for land tax for 2017 for companies. Penalties and fines

|

Purpose of payment |

KBK on penalties |

KBK for a fine |

|---|---|---|

|

within the borders of Moscow, St. Petersburg and Sevastopol |

182 1 06 06031 03 2100 110 |

182 1 06 06031 03 3000 110 |

|

within the boundaries of urban districts |

182 1 06 06032 04 2100 110 |

182 1 06 06032 04 3000 110 |

|

within the boundaries of urban districts with intracity division |

182 1 06 06032 11 2100 110 |

182 1 06 06032 11 3000 110 |

|

within the boundaries of intracity districts |

182 1 06 06032 12 2100 110 |

182 1 06 06032 12 3000 110 |

|

within the boundaries of inter-settlement territories |

182 1 06 06033 05 2100 110 |

182 1 06 06033 05 3000 110 |

|

within the boundaries of rural settlements |

182 1 06 06033 10 2100 110 |

182 1 06 06033 10 3000 110 |

|

within the boundaries of urban settlements |

182 1 06 06033 13 2100 110 |

182 1 06 06033 13 3000 110 |

KBK on UTII in 2017. Penalties and fines

KBC under the simplified tax system in 2017. Penalties and fines

BCC for Unified Agricultural Tax for 2017. Penalties and fines

KBK for a patent in 2017. Penalties and fines

|

Purpose of payment |

KBK on penalties |

KBK for a fine |

|---|---|---|

|

tax to the budgets of city districts |

182 1 05 04010 02 2100 110 |

182 1 05 04010 02 3000 110 |

|

tax to the budgets of municipal districts |

182 1 05 04020 02 2100 110 |

182 1 05 04020 02 3000 110 |

|

tax to the budgets of Moscow, St. Petersburg and Sevastopol |

182 1 05 04030 02 2100 110 |

182 1 05 04030 02 3000 110 |

|

tax to the budgets of urban districts with intracity division |

182 1 05 04040 02 2100 110 |

182 1 05 04040 02 3000 110 |

|

to the budgets of intracity districts |

182 1 05 04050 02 2100 110 |

182 1 05 04050 02 3000 110 |

BCC for personal property tax for 2017. Penalties and fines

|

Purpose of payment |

KBK on penalties |

KBK for a fine |

|---|---|---|

|

In Moscow, St. Petersburg and Sevastopol |

182 1 06 01010 03 2100 110 |

182 1 06 01010 03 3000 110 |

|

within the boundaries of urban districts |

182 1 06 01020 04 2100 110 |

182 1 06 01020 04 3000 110 |

|

within the boundaries of urban districts with intracity division |

182 1 06 01020 11 2100 110 |

182 1 06 01020 11 3000 110 |

|

within the boundaries of intracity districts |

182 1 06 01020 12 2100 110 |

182 1 06 01020 12 3000 110 |

|

within the boundaries of inter-settlement territories |

182 1 06 01030 05 2100 110 |

182 1 06 01030 05 3000 110 |

|

within the boundaries of rural settlements |

182 1 06 01030 10 2100 110 |

182 1 06 01030 10 3000 110 |

|

within the boundaries of urban settlements |

182 1 06 01030 13 2100 110 |

182 1 06 01030 13 3000 110 |

KBC for land tax for 2017 for individuals. Penalties and fines

|

Purpose of payment |

KBK on penalties |

KBK for a fine |

|---|---|---|

|

within the borders of Moscow, St. Petersburg and Sevastopol |

182 1 06 06041 03 2100 110 |

182 1 06 06041 03 3000 110 |

|

within the boundaries of urban districts |

182 1 06 06042 04 2100 110 |

182 1 06 06042 04 3000 110 |

|

within the boundaries of urban districts with intracity division |

182 1 06 06042 11 2100 110 |

182 1 06 06042 11 3000 110 |

|

within the boundaries of intracity districts |

182 1 06 06042 12 2100 110 |

182 1 06 06042 12 3000 110 |

|

within the boundaries of inter-settlement territories |

182 1 06 06043 05 2100 110 |

182 1 06 06043 05 3000 110 |

|

within the boundaries of rural settlements |

182 1 06 06043 10 2100 110 |

182 1 06 06043 10 3000 110 |

|

within the boundaries of urban settlements |

182 1 06 06043 13 2100 110 |

182 1 06 06043 13 3000 110 |

An article for those who do not yet know what KBK means in the details and where to get it, and how to decipher this abbreviation. It will help you learn a lot of new and useful things in the field of taxes and finance.

What does KBC mean?

KBK in the details (this article will tell you where to get it) are budget classification codes, needed when paying funds for the state. More precisely, to determine whether any payment belongs to the budget for its correct distribution. The payer must indicate these codes when filling out a receipt for transferring: insurance premiums, funds for taxes, as well as when paying a fine, a tuition fee, for example, at Moscow State University. Lomonosov, MADI, MGUPS (MIIT) or another university, making any other payment.

These codes are established by the Russian Ministry of Finance; when they are changed, the official website of the ministry publishes a corresponding order. The current codes are contained in the "Special Directory of the CDC".

Main directions of KBK:

- Taxes (transport, goods, property, VAT, personal income tax, income tax, other payments to the Federal Tax Service from people, LLCs, OJSCs, other organizations);

- Simplified taxation system for individual entrepreneurs and various organizations;

- A single tax on imputed income;

- State fees, here it is necessary to transfer funds to replace the passport, for a copy of the charter, pay the fee according to the decision of the arbitration court, and any other state fee is also paid here;

- Insurance premiums, in this direction there is a transfer of insurance premiums for any employee in

- Pension Fund, as well as various payments to the Compulsory Medical Insurance Fund, Social Insurance Fund;

- Fines, compensation for damages - payment of fines from the traffic police, other services of the Ministry of Internal Affairs and other departments, including those sanctions imposed by bailiffs;

- Minerals, every organization that produces gas, oil and even water pays here, including Gazprom,

- Transgaz;

- The use of subsoil is the purpose of the direction; it is the payment of funds for the lease of subsoil on the territory of Russia.

But this list does not exhaust the possibilities of using the KBK in the details; if you wish, you can pay for the services of a kindergarten, for a telephone in Rostelecom, to Rosreestr for an urgent extract from the Unified State Register, for the services of institutions of the Ministry of Health, pay to the department of Rosprirodnadzor, an art school, customs will receive transfers , where the child is studying and you can even donate funds to charity.

How to decipher KBK in bank details?

Any KBK in the details, where everyone asks themselves where to get it, consists of 20 numbers, they are divided into information blocks:

- administrative - consists of 3 digits, they determine the recipient who will receive the money for management;

- income - consists of several subgroups, determines the type of income, the group where the payment will be placed;

- programmatic - 4 characters of this block detail the transfer, for example, taxes have the code “1000”;

- classifying - a value of 3 digits classifies the scope of activity, for example, “110” is taxes, 160 is various social revenues.

When filling out a receipt, you need to remember this subtlety - if a person simply transfers funds using the service of Sberbank, another bank of the Russian Federation, then the value of the BCC of the recipient organization is indicated, if the payment is intended for Sberbank itself, then you need to indicate its budget classifier.

If the receipt for payment is filled out incorrectly, the money will not reach the recipient; this will also happen if the lines of the document intended for this code are left blank. In the best case, the cash register operator will return the bills with instructions to correct the defect. In other cases, money may be credited to the wrong organization for receipt or be credited to the recipient in the “unidentified” section. They can be returned, for example, if it is a tax, then the tax office will correct the error after the application, but if the deadline for paying the tax passes, then this trouble will not exempt you from paying a fine, and a penalty will also be charged.

Trade fee details for payment of KBK in the details

To pay the trade tax on the territory of federal cities, enter the code: 182 1 05 05010 02 1000 110

The city is identified by OKTMO (former OKATO), which must also be indicated in the payment order.

KBK in the regions

Russia has a unified KBK system in the details (where to get it, this article will tell you) throughout the country, so it will not be difficult to use the codes in all regions: in St. Petersburg, in Vladimir, in Leningrad, in Chelyabinsk, in Rostov, in Nizhny Novgorod, in Novosibirsk, Ryazan, Belgorod, Sverdlovsk, Yaroslavl, Lipetsk, Moscow, Samara, Tyumen regions, as well as Krasnoyarsk, Krasnodar Territory and even Leninsky district, Golyanovo (Moscow).