How to issue a sick leave certificate in 1c zup. Additional initial data for calculating benefits

Sick leaves in the 1C 8.3 ZUP program are registered for the calculation of disability benefits. The data from the sick leave is entered into the program, and the sick leave is automatically calculated taking into account the employee’s length of service and his income for previous periods. Read more about calculating sick leave in 1C ZUP 8.3 in this article.

Read in the article:

A sick leave certificate is issued to an employee at a medical institution. This document confirms the legality of release from work and is necessary for the calculation of various benefits. The reasons for release can be different - illness or injury, maternity leave, caring for a sick child, etc. Based on sick leave, the accountant calculates various benefits.

Read how to process sick leave in 1C 8.3 ZUP in 4 steps.

Step 1. Open the “Sick Leave” window

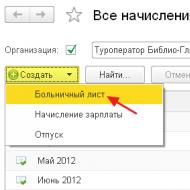

Go to the “Salary” section (1) and click the “Sick leave” link (2). A new window will open.

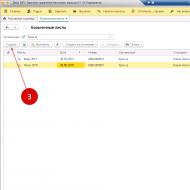

In the window that opens, you will see a list of sick leaves. To register a new sick leave in ZUP 1C 8.3, click the “Create” button (3).

An additional window “Sick leave (creation)” will open to enter the data that is necessary when calculating sick leave benefits. It looks like this:

Step 2. Fill in the basic details

In the upper section of the “Sick leave (creation)” window, fill in the “Organization” field (4), indicate the month in which the benefit will be accrued (5), and select the employee for whom the sick leave is to be filled out (6). Also enter in the “LN number” (7) field the number of the sick leave certificate issued by the medical institution.

Step 3. Fill in the data to calculate sick leave

In the “Main” tab (8), select the reason for disability (9) and indicate the period of release from work (10). Below, in the “Payment” window (11), indicate when you will issue disability benefits: with an advance, a salary, or in between. Now, in the “Accrued” and “Deducted” fields, you see the amount of accrual and deduction for sick leave.

In the “Payment” tab of the sick leave in 1C 8.3 ZUP (12), you can see what percentage of the salary is taken into account when calculating sick leave (13). Here you can see the length of service (14), from which this percentage is calculated. If the length of service data is entered into 1C 8.3 ZUP correctly, the program automatically determines the percentage of payment. We remind you that if the employee’s experience is 8 years or more, then when calculating sick leave, 100% of the average earnings is taken into account, if the experience is from 5 to 8 years - 80%, up to 5 years - 60%.

In the “Accrued (detailed)” tab (15) in sick leave in 1C ZUP 8.3, you can see separately the accruals at the expense of the employer (16) and at the expense of the Social Insurance Fund (17). Here you will see the number of days paid at the expense of the employer (18) and at the expense of the Social Insurance Fund (19). As you remember, the first three days of sick leave issued due to illness or injury are paid by the employer, and from the 4th day such sick leave is paid by the Social Insurance Fund.

Photo by Evgeny Smirnov, news agency “Clerk.Ru”

Temporary disability benefits can be paid both at the expense of the employer and at the expense of the Federal Social Insurance Fund of the Russian Federation. The amount of the calculated benefit depends on the employee’s length of service, the amount of his salary, and the start date of sick leave. In addition, do not forget about the increase in the minimum wage from July 1. In the article, 1C experts give examples of calculating temporary disability benefits and their reflection in the 1C: Salaries and Personnel Management 8 program, edition 3, for the most common cases in practice.

A sick leave certificate is an important document. It confirms the legality of the employee’s absence from work and serves as the basis for calculating and paying benefits.

In addition to earnings for the previous two years, the calculation of benefits is affected by the length of service and the date of onset of illness.

Calculation of benefits...

...depending on insurance experience

In accordance with Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity” (hereinafter referred to as Law No. 255-FZ), in most cases the amount of disability benefits depends on the length of service:- from 8 years and more - a benefit is paid in the amount of 100% of average earnings;

- from 5 to 8 years - 80% of average earnings;

- up to 5 years - 60% of average earnings.

- own illness (other than occupational illness); injury (except for injury associated with an industrial accident); quarantine; prosthetics for medical reasons; follow-up treatment in sanatorium-resort institutions immediately after hospitalization (Part 1, Article 7 of Law No. 255-FZ);

- caring for a sick child on an outpatient basis and in a hospital (clauses 1, 2, part 3, article 7 of Law No. 255-FZ);

- outpatient care for an adult family member (Part 4, Article 7 of Law No. 255-FZ).

- maternity benefit (Article 11 of Law No. 255-FZ);

- occupational disease or accident at work (Article 9 of the Federal Law of July 24, 1998 No. 125-FZ).

Rules for calculating and confirming experience to determine the amount of benefits for temporary disability, pregnancy and childbirth, approved by order of the Ministry of Health and Social Development of Russia dated 02/06/2007 No. 91 (as amended by order of the Ministry of Health and Social Development of Russia dated 09/11/2009 No. 740n) (hereinafter referred to as the Rules).

Paragraph 21 of the Rules states that periods of work (service, activity) are calculated on a calendar basis based on full months (30 days) and a full year (12 months). In this case, every 30 days of these periods are converted into full months, and every 12 months of these periods are converted into full years. This does not mean that the entire period must be converted into days, and then divided by 30 and 12. It is necessary to select complete calendar periods: years, months, and convert the remainder into months at the rate of 30 days per month.

Example 1. Calculation of length of service for a period

Let's calculate the length of service for the period 09/14/2015-03/16/2016.If you simply divide the number of days for the entire period of 185 by 30, you get 6 months and 5 days of experience.

But according to the Rules, you must first take into account full calendar periods: 5 full months - from October 2015 to February 2016. Next, the 17 days of September 2015 are summed up with the 16 days of March 2016. According to the rules, 33 days are 1 month (30 days) and 3 days. Thus, the total length of service is 6 months and 3 days. This is exactly how the length of service in the program is calculated.

Sometimes the documents confirming the experience do not indicate exact dates. Paragraph 27 of the Rules establishes that if only years are indicated without indicating exact dates, the date is taken to be July 1 of the corresponding year, and if the day of the month is not indicated, then the 15th day of the corresponding month is taken as such. This means that these are the dates that need to be indicated in the program. In the 1C: Salaries and Personnel Management 8 program, the length of service is indicated on the card Employee link Labor activity.

Insurance experience for calculating sick leave consists of periods during which a person was insured against temporary disability and non-insurance periods.

Insurance periods include periods of work of the insured person under an employment contract, state civil or municipal service and periods of other activities during which the citizen was subject to compulsory social insurance in case of temporary disability and in connection with maternity (Part 1 of Article 16 of Law No. 255- Federal Law).

Non-insurance periods are periods of military service, as well as other service provided for by the Law of the Russian Federation of February 12, 1993 No. 4468-I “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, turnover control bodies narcotic drugs and psychotropic substances, institutions and bodies of the penal system, and their families,” which the employee underwent from 01/01/2007.

Let us recall that the allocation of non-insurance periods is associated with differences in the procedure for financing the payment of temporary disability benefits. The presence of non-insurance periods may affect the percentage of average earnings used to calculate benefits.

For example, without non-insurance periods, the length of service is 7 years. The benefit is calculated at 80% of average earnings. But if you add 2 more non-insurance years, then 100% of average earnings are already taken into account when calculating benefits.

In general, sick leave expenses (with the exception of the first three days in case of illness or injury to an employee) are reimbursed from the funds of the Federal Social Insurance Fund of the Russian Federation. The difference in the amount of benefits arising in connection with non-insurance periods is additionally financed from the federal budget (through interbudgetary transfers from the federal budget provided to the budget of the Social Insurance Fund of the Russian Federation for these purposes).

When filling out data on length of service in the program and on the certificate of incapacity for work, the following must be taken into account. The “Insurance length” field of the certificate of incapacity for work (section “To be filled in by the employer”) is the full length of service, which is taken into account when calculating sick leave. This field corresponds to the Length of Experience program field for sick leave payments, taking into account non-insurance periods. In the field “including non-insurance periods” of the certificate of incapacity, you need to highlight only the length of non-insurance periods.

At the same time, in the Insurance length of service field for payment of sick leave in the program, you must indicate the length of service without non-insurance periods.

Example 2. Filling out data on length of service on a sick leave form and in the 1C: Salary and Personnel Management 8 program

| The length of service for paying sick leave, taking into account non-insurance periods (“Insurance period” - in the certificate of incapacity for work) 01/01/2006 - 05/31/2016 is 10 years 5 months. Moreover, the employee was in service from 01/01/2006 to 12/31/2014. The non-insurance period begins from 01/01/2007 and lasts until 12/31/2014, i.e. it is 8 years. On the form, in the “Insurance period” field, 10 years 5 months are indicated and the non-insurance period is highlighted, including 8 years (Fig. 1).

Rice. 1 Fragment of a certificate of incapacity for work In the program, in the Employee’s card, in the field Length of service for payment of sick leave, taking into account non-insurance periods, 10 years 5 months are indicated, and in the field Insurance length of service for payment of sick leave, you must indicate length of service without non-insurance periods, i.e. 2 years and 5 months (Fig. 2).

Rice. 2. Information about work experience |

For an employee, it makes no difference whether there are non-insurance periods in his work experience, but for the Social Insurance Fund this is important.

Example 3. Calculation of disability benefits in the presence of non-insurance periods

| Disability benefits were provided from 06/01/2016 to 06/18/2016. The employee has a length of service for paying sick leave, taking into account non-insurance periods of 10 years 5 months, including a non-insurance period of 8 years. When filling out the Sick Leave document, on the Payment tab, select the Apply benefits flag and select Payments in connection with the inclusion of non-insurance periods in the insurance period. The Payment percentage field was automatically set to 100%, because the total experience is more than 8 years. But in the field Percentage of payment without benefits is 60%, because without benefits the length of service is only 2 years and 5 months, which is less than 5 years. The difference between total length of service and length of service without benefits is paid from the federal budget minus the first three days paid by the employer. On the Accrued tab (Fig. 3), the sick leave accrual is calculated for a total amount of 13,767.15 rubles, including at the expense of the federal budget - 5,506.80 rubles. In the 4-FSS report, expenses from the federal budget are allocated automatically. |

Rice. 3. Accruals for sick leave, taking into account non-insurance periods

...depending on the date of onset of the disease

Throughout 2016, the maximum average daily earnings for all cases except maternity leave is 1,772.6 rubles. When calculating the average daily earnings in 2016, you need to take into account all earnings for 2014, from which insurance premiums were transferred, but not more than 624,000 rubles, and all earnings for 2015, from which insurance premiums were transferred, but not more than 670,000 rubles. Average daily earnings are obtained by dividing the sum of these limited earnings for 2 years by 730. In some cases, the amount of benefits is affected by the minimum wage, and it changed during 2016.From 01/01/2016 the minimum wage is equal to 6,204 rubles per month (Article 1 of the Federal Law dated 12/14/2015 No. 376-FZ), and from 07/01/2016 the Federal Law of 06/02/2016 No. 164-FZ is set at 7,500 rubles per month . It is necessary to take into account changes in the minimum wage

from 07/01/2016, if the employee…

… average earnings for the previous two years are below the minimum wage

If the average employee’s earnings calculated for 2014 and 2015 (calculated for a full calendar month) are below the minimum wage, then the benefit is calculated based on the minimum wage. If the date of onset of the disease falls on the period from 01/01/2016 to 06/30/2016, then the minimum average daily earnings calculated from the minimum wage is 203 rubles. 97 kopecks (RUB 6,204 x 24) / 730 = RUB 203.97). For illnesses occurring starting from 07/01/2016, the minimum average daily earnings is 246 rubles. 58 kopecks (RUB 7,500 x 24) / 730 = RUB 246.58).Example 4. Calculation of benefits from the minimum wage due to low earnings

Employee N.I. Rostova presented to the accounting department a sick leave certificate for caring for a child under 7 years old on an outpatient basis for 1 day on 07/15/2016. The employee's length of service on the day of illness was 2 years (less than 5 years, but more than six months). N.I. Rostova has been working part-time since November 2015. Her earnings for 2015 amounted to 50,000 rubles. Certificates from previous places of employment were not provided.The actual average daily earnings were:

RUB 50,000.00 / 730 = 68.49 rub.

The minimum average daily earnings from the minimum wage, taking into account part-time work, was: 246.58 rubles. x 0.5 = 123.29 rubles, which is more than actual. The benefit is calculated from the minimum wage of 123.29 rubles. taking into account experience. The experience is less than five years, so 60% is taken into account to calculate the benefit: 123.29 rubles. x 60% = 73.97 rub.

Please note that the start date of the disability is important in this case. The disease occurred in July, so the minimum wage was 7,500 rubles. If the onset date of the illness was before July 1, 2016, and the illness continued in July, then a minimum wage of 6,204 rubles would be used.

... less than six months of experience

If the employee’s length of service is less than six months, then the disability and maternity benefits cannot exceed the minimum wage for each calendar month.Example 5. Limitation of benefits to the minimum wage due to short work experience

Employee D.V. Borovoy began working on 04/01/2016 full-time at an enterprise in an area without a regional coefficient (RK). A certificate of earnings from a previous employer in 2015 confirms the amount of 500,000 rubles.Sick leave was provided for 2 days: 06/30/2016-07/01/2017.

On the day of the onset of illness, the length of service is less than six months and the amount of benefit is limited not by the maximum value of the base for calculating insurance premiums, but by the maximum amount of daily benefit calculated from the minimum wage.

The actual average daily earnings were: RUB 500,000. / 730 = 684.93 rub. The experience is less than five years, so the average daily earnings are limited to 60% and equal to 684.93 rubles. x 60% = 410.96 rub. But since the length of service is less than six months, it is limited to the maximum daily benefit in June: 6,204 rubles. / 30 = 206.80 rubles, and in July 7,500 rubles. / 31 = 241.94 rub.

Thus, for 2 days, a benefit of 206.80 rubles was accrued. + 241.94 rub. = 448.74 rub. (Fig. 4).

Rice. 4. Sick leave accruals from the minimum wage

note, maternity benefits are accrued in advance and if the employee went on maternity leave before July 1 and before the new minimum wage was approved. Moreover, if the vacation continues after July 1, then the amount of the benefit must be recalculated taking into account the new minimum wage and the difference must be paid.

The need for recalculation arises if maternity benefits are limited to the maximum amount of daily benefits similar to Example 5 due to the fact that the employee’s length of service was less than six months. To perform recalculation in the program, you need to open a previously created and paid document Sick leave. By button To correct create a new document. In it on the bookmark Recalculation of the previous period previously accrued amounts are reversed, and on the tab Accrued (details) new charges are displayed. As a result, the new document shows the difference, in this case the amount of additional payment.

... violation of the regime

If an employee violates the regime prescribed by the attending physician without good reason or if the incapacity for work occurs due to alcohol or drug intoxication, then the calculation is made in the same way as in the second case.This case differs from the previous one in that in case of violation of the regime, benefits based on the minimum wage are accrued starting from the day of the noted violation, and before that - according to the general rules, taking into account the actual average earnings.

Sick leave is calculated from the certificate of incapacity for work provided by the employee. The amount of the benefit depends on the nature of the disability, as well as the length of insurance coverage. Let's look at how the insurance period is reflected in the calculation of benefits:

- Less than 5 years -60% of average earnings calculation;

- From 5 to 8 years – 80% of the calculated average earnings;

- Over 8 years – 100% of average earnings.

Sick leave is calculated based on the average earnings of the insured employee for the previous two years. At the same time, the calendar years for which sick leave is calculated for the employee can be replaced. These are situations where the employee used maternity leave or maternity leave in one or two of these calendar years. According to the employee's application, one or both years are replaced if the replacement entails an increase in the amount of the benefit.

How to issue a sick leave certificate in 1C 8.3 ZUP

Let's look at step by step how to process sick leave in 1C ZUP.

How to register a no-show on sick leave

If at the time of calculating the advance or salary the employee is absent, then in 1C 8.3 ZUP it is necessary to register a failure to appear for an unknown reason, so that the salary is not accrued for the period of absence.

To be able to register an employee’s absence, you need to check the settings of the 1C program. Menu item Settings - select Payroll - next Setting up the composition of accruals and deductions - next Absence accounting - check Absenteeism and no-shows:

Failure to appear is registered using the document Absenteeism, failure to appear. The document can be entered both in the personnel menu and in the Salary section:

From our example, the employee fell ill in April from 11 to 22:

For each month of no-show/absenteeism, if the no-show continues into the next month, it is necessary to enter a new document in 1C, that is, separately for May, for June, etc.

How to reflect sick leave in 1C

After the employee has provided sick leave, we enter the Sick Leave document to calculate benefits. The document is a personnel and payroll document. It can be entered from the Personnel section:

or using the Payroll section:

Let's create a new document. If the work experience has not been completed previously, the program will pay attention to this fact:

If you go to this field, you can indicate the length of service directly in the document:

We indicate the nature of the disability from the sick leave certificate and the date of our sick leave. The accrual month in our case is May, that is, this is the month that will be displayed on the employee’s payslip. Checking the payment:

Checking sick leave accrual:

Absence from work for an unknown reason is reversed on the Recalculation of the previous period tab:

The date of payment for sick leave is important for personal income tax accounting. Non-salary income is recorded based on the date of payment. You can choose the payment method - in advance, with salary, or by interpayment. We take sick leave:

Calculation of payment for sick leave in 1C 8.3 ZUP

Payment of sick leave for child care

The peculiarity of these sick leaves is that payment for outpatient treatment is carried out in the first 10 calendar days in accordance with the length of service, and then in the amount of 50% of average earnings. If treatment takes place in a hospital, then taking into account the insurance period.

There are also calculation features in 1C ZUP that depend on the age of the child. Selecting an option for calculating sick leave for care in the Sick Leave document on the Child Care tab:

The 1C 8.3 ZUP program also tracks from what day payment will be made in the amount of 50%:

Payment of sick leave for pregnancy and childbirth, for injury at work or occupational disease

If we pay for maternity leave, benefits for work injuries or occupational diseases, then this is 100% sick pay and does not take into account length of service:

Also, if a dismissed employee provided a certificate of incapacity for work within 30 calendar days from the date of dismissal, and has not yet found a new job, then this payment is in the amount of 60% of the calculated average earnings.

Calculation of average earnings

In 1C ZUP, when calculating the average earnings of an employee, taking into account the earnings of previous policyholders, it is necessary that the checkbox “Take into account the earnings of previous policyholders” is checked in the document:

Where in 1C ZUP 8.3 can I enter earnings from previous policyholders? You need to go to the Main tab and click on the Change calculation of average earnings button to fill in the data:

Or from the Salary section - See also - Certificates for calculating benefits:

Average earnings are determined automatically by the 1C ZUP 3.1 program based on data on how much was included in the final base for calculating contributions in previous years. Average earnings are determined for each calendar year in an amount not exceeding the maximum base for calculating insurance contributions to the Social Insurance Fund established for that year.

The average daily income for calculating benefits is calculated by dividing accrued earnings by 730. For maternity benefits, earnings are divided by the sum of calendar days of the two previous years minus excluded periods (sick leave, maternity leave, maternity leave, periods of release from work with full or partial retention of wages, if insurance premiums were not paid for wages at that time).

You can view a printed calculation form. Printed forms Calculation of average earnings and Detailed calculation are used by the accountant to check the calculation and data, and the form Calculation of benefits for a certificate of incapacity for work is an “official” calculation, we apply it to sick leave:

Payment of sick leave at the expense of the Social Insurance Fund

Funding for sick leave benefits depends on the nature of the disability. If this is an illness or injury (other than work-related), then the first three days are paid by the policyholder. Subsequent days are paid at the expense of the Social Insurance Fund. In other cases, payment is made at the expense of the Social Insurance Fund from the first day. In the 1C ZUP program, this division is visible in two types of calculation: Sick leave and Payment for sick leave at the expense of the employer:

Program 1C ZUP accrual of sick leave can be done through “Sick leave”. The “Sick Leave” document logs are available in the “Personnel” and “Salary” functional areas, using the “Sick Leave” link.

Before accruing sick leave in 1C, you need to check the correctness of the input, and, if necessary, establish the employee’s insurance record for paying sick leave. You can set it directly in the employee’s card by clicking on “Labor activity” (if this is not done, the “Sick leave certificate” will contain the message “The length of service is not filled out, benefits may be calculated incorrectly”).

Fig.1

Average earnings, for calculating the amount of benefits, are calculated based on the salary for two years before. If an employee who worked for less than two years before falling ill went on sick leave, information about his earnings in previous places must be entered into the ZUP.

This information is inserted into the “Help for calculating benefits (incoming)” in the “Salary” functional area using the “Create” button.

Fig.2

The incoming certificate for calculating benefits indicates:

- Organization (if the information base maintains records for several organizations);

- The person for whom the certificate is issued;

- The period of work for which the certificate was issued;

- Name of the policyholder who issued the certificate;

- Amount of earnings, broken down by year, and number of sick/child care days, etc., broken down by year.

After filling out the certificate, click “File and close”.

After clicking on “Create” in the document log “Sick Leaves”, a new document form appears, in the fields of which you must enter the sick leave data:

- Organization (available if IB calculates salaries for several companies);

- The month in which the accrual is made;

- Sheet number (can be entered manually from the keyboard, downloaded from the Social Insurance Fund or from a file);

- If the sheet is an extension of the previous one, then you need to check the appropriate box and select the previous sheet;

- Select the cause of disability;

- Indicate the time for which the work exemption is valid;

- When a person received income for two years preceding illness and sick leave, then you need to enable the “Take into account the earnings of previous employers” checkbox;

- If the period of incapacity for work begins after the beginning of the month when the accrual occurs, then the payment - “in the inter-calculation period”, “with an advance” or the period of absence from work begins in the month following the month of accrual, then the “Accrue salary for...” checkbox becomes available. . When the checkbox is enabled, in addition to benefits, wages will be accrued for the days worked before the start of sick leave;

- If the option of additional payment for sick days up to the full average earnings is enabled in the accrual settings, then the “Pay up to” checkbox appears;

- Other fields (payment, payment date).

Fig.3

After filling out all the fields, the calculation results will be reflected in the “Accrued”, “Withheld” and “Average Earnings” sections. In the latter, you can click on the button with a pencil and when you open the “Entering data for calculation” form, change the calculation, for example, add the missing data from your previous place of work.

Fig.4

On “Payment” enter:

- Check the “Benefit accrual period” checkbox, otherwise the sick leave cannot be paid;

- The value of the start date of working ability is set automatically by the first date of the period of release from work of this sheet or the one of which it is a continuation;

- Payment percentage. The value of the percentage of payment is set automatically in accordance with the length of service for paying sick leave and can be changed;

- Benefit limitation. The benefit limit value is set automatically in accordance with legal requirements, but can be changed manually;

- We fill in other fields as necessary.

Fig.5

In “Accrued (detailed)” you will see accruals, their results, how many days were paid for each accrual, period and basis. After filling out the sick leave and checking the correctness of the calculations, click on “Record and post”.

“Sick leave” has the following printed forms:

- Calculation of benefits for the certificate of incapacity for work;

- Calculation of average earnings;

- Detailed calculation of charges.

The printable form “Calculation of benefits for a certificate of incapacity for work” will display the following information:

- Calculation of average and minimum average earnings from the minimum wage;

- The amount of benefits due both at the expense of the Social Insurance Fund and at the expense of the employer.

The printed average calculation form shows the following information:

- Earnings by year by policyholder;

- The calculation itself;

- Calculation of the minimum average earnings from the minimum wage.

The printed form “Detailed calculation of accruals” will display the following information:

- Earnings by year by policyholder;

- Calculation of average earnings to pay benefits;

- List of types of charges and the result of their calculation.

To get a printed form, you need to click on “Print” and select the one you need from the list provided.

Let’s imagine that the employee was on a business trip and his average salary was retained. If, upon returning from a business trip, he provided a certificate of incapacity for work, then when entering the sheet into the ZUP, the period of sick leave will be recalculated according to the settings of the accrual types.

Fig.6

Let’s say that an employee was sick in March, but provided a certificate of incapacity for work only in April. Then, for the period of absence in March, you need to enter the document “Absence (illness, absenteeism, no-show)” for the employee. When the certificate of incapacity for work is available, it will need to be entered into the ZUP and set the period of release from work when the employee was absent.

Then, in March, the employee was accrued benefits without taking into account earnings from previous employers, because when he was hired, he did not provide a certificate confirming this. He did this in April and needs to recalculate his benefits. To do this, you need to open the “Sick Leave” entered for March and click on the “Correct” link. A new sheet will appear in which you will need to enable the “Take into account the earnings of previous policyholders” checkbox, click on the edit button for average earnings, enter data from your previous place of work and post the document. After posting a new one, the previous document will not be available for editing. In the document form, the text “The document has been corrected and editing is prohibited” will be displayed in red.

Temporary disability benefits can be paid both at the expense of the employer and at the expense of the Federal Social Insurance Fund of the Russian Federation. The amount of the calculated benefit depends on the employee’s length of service, the amount of his salary, and the start date of sick leave. In addition, do not forget about the increase in the minimum wage from July 1. In the article, 1C experts give examples of calculating temporary disability benefits and their reflection in the 1C: Salaries and Personnel Management 8 program, edition 3, for the most common cases in practice.

A sick leave certificate is an important document. It confirms the legality of the employee’s absence from work and serves as the basis for calculating and paying benefits.

In addition to earnings for the previous two years, the calculation of benefits is affected by the length of service and the date of onset of illness.

Cheat sheet on the article from the editors of BUKH.1S for those who do not have time

1. The sick leave confirms the legality of the employee’s absence from work and serves as the basis for the calculation and payment of benefits.

2. The calculation of benefits is influenced by length of service, the date of onset of illness and the amount of earnings for the previous two years.

3. A resigned employee can receive benefits if he falls ill within 30 calendar days from the date of dismissal.

4. Sick leave expenses (except for the first three days in case of illness or injury to an employee) are reimbursed from the funds of the Federal Social Insurance Fund of the Russian Federation.

Calculation of benefits...

...depending on insurance experience

In accordance with Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity” (hereinafter referred to as Law No. 255-FZ), in most cases the amount of disability benefits depends on the length of service:

- from 8 years and more - a benefit is paid in the amount of 100% of average earnings;

- from 5 to 8 years – 80% of average earnings;

- up to 5 years – 60% of average earnings.

The percentage of average earnings for calculating benefits is taken into account in the following situations

- own illness (other than occupational illness); injury (except for injury associated with an industrial accident); quarantine; prosthetics for medical reasons; follow-up treatment in sanatorium-resort institutions immediately after hospitalization (Part 1, Article 7 of Law No. 255-FZ);

- caring for a sick child on an outpatient basis and in a hospital (clauses 1, 2, part 3, article 7 of Law No. 255-FZ);

- outpatient care for an adult family member (Part 4, Article 7 of Law No. 255-FZ).

In some cases, benefits are paid in the amount of 100% of average earnings, regardless of length of service. This:

- maternity benefit (Article 11 of Law No. 255-FZ);

- occupational disease or accident at work (Article 9 of the Federal Law of July 24, 1998 No. 125-FZ).

If an employee who resigned from the organization developed a personal illness or injury within 30 calendar days from the date of dismissal, then, on the basis of Part 2 of Article 7 of Law No. 125-FZ, a benefit is paid in the amount of 60% of average earnings, regardless of length of service.

Rules for calculating and confirming experience to determine the amount of benefits for temporary disability, pregnancy and childbirth, approved by order of the Ministry of Health and Social Development of Russia dated 02/06/2007 No. 91 (as amended by order of the Ministry of Health and Social Development of Russia dated 09/11/2009 No. 740n) (hereinafter referred to as the Rules).

Paragraph 21 of the Rules states that periods of work (service, activity) are calculated on a calendar basis based on full months (30 days) and a full year (12 months). In this case, every 30 days of these periods are converted into full months, and every 12 months of these periods are converted into full years. This does not mean that the entire period must be converted into days, and then divided by 30 and 12. It is necessary to select complete calendar periods: years, months, and convert the remainder into months at the rate of 30 days per month.

Example 1. Calculation of length of service for a period

Let's calculate the length of service for the period 09/14/2015–03/16/2016.

| No. | Month | Days in a month |

|---|---|---|

| 1 | September 2015 | 17 |

| 2 | October 2015 | 31 |

| 3 | November 2015 | 30 |

| 4 | December 2015 | 31 |

| 5 | January 2016 | 31 |

| 6 | February 2016 | 29 |

| 7 | March 2016 | 16 |

If you simply divide the number of days for the entire period of 185 by 30, you get 6 months and 5 days of experience.

But according to the Rules, you must first take into account full calendar periods: 5 full months - from October 2015 to February 2016. Next, the 17 days of September 2015 are summed up with the 16 days of March 2016. According to the rules, 33 days are 1 month (30 days) and 3 days. Thus, the total length of service is 6 months and 3 days. This is exactly how the length of service in the program is calculated.

Sometimes the documents confirming the experience do not indicate exact dates. Paragraph 27 of the Rules establishes that if only years are indicated without indicating exact dates, the date is taken to be July 1 of the corresponding year, and if the day of the month is not indicated, then the 15th day of the corresponding month is taken as such. This means that these are the dates that need to be indicated in the program. In the 1C: Salaries and Personnel Management 8 program, the length of service is indicated on the card Employee link Labor activity.

Insurance experience for calculating sick leave consists of periods during which a person was insured against temporary disability and non-insurance periods.

Insurance periods include periods of work of the insured person under an employment contract, state civil or municipal service and periods of other activities during which the citizen was subject to compulsory social insurance in case of temporary disability and in connection with maternity (Part 1 of Article 16 of Law No. 255- Federal Law).

Non-insurance periods are periods of military service, as well as other service provided for by the Law of the Russian Federation of February 12, 1993 No. 4468-I “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, turnover control bodies narcotic drugs and psychotropic substances, institutions and bodies of the penal system, and their families,” which the employee underwent from 01/01/2007.

Let us recall that the allocation of non-insurance periods is associated with differences in the procedure for financing the payment of temporary disability benefits. The presence of non-insurance periods may affect the percentage of average earnings used to calculate benefits.

For example, without non-insurance periods, the length of service is 7 years. The benefit is calculated at 80% of average earnings. But if you add 2 more non-insurance years, then 100% of average earnings are already taken into account when calculating benefits.

In general, sick leave expenses (with the exception of the first three days in case of illness or injury to an employee) are reimbursed from the funds of the Federal Social Insurance Fund of the Russian Federation. The difference in the amount of benefits arising in connection with non-insurance periods is additionally financed from the federal budget (through interbudgetary transfers from the federal budget provided to the budget of the Social Insurance Fund of the Russian Federation for these purposes).

When filling out data on length of service in the program and on the certificate of incapacity for work, the following must be taken into account. The “Insurance length” field of the certificate of incapacity for work (section “To be filled in by the employer”) is the full length of service, which is taken into account when calculating sick leave. This field corresponds to the Length of Experience program field for sick leave payments, taking into account non-insurance periods. In the field “including non-insurance periods” of the certificate of incapacity, you need to highlight only the length of non-insurance periods.

At the same time, in the Insurance length of service field for payment of sick leave in the program, you must indicate the length of service without non-insurance periods.

Example 2. Filling out data on length of service on a sick leave form and in the 1C: Salary and Personnel Management 8 program

|

The length of service for paying sick leave, taking into account non-insurance periods (“Insurance period” - in the certificate of incapacity for work) 01/01/2006 – 05/31/2016 is 10 years 5 months. Moreover, the employee was in service from 01/01/2006 to 12/31/2014. The non-insurance period begins from 01/01/2007 and lasts until 12/31/2014, i.e. it is 8 years. On the form, in the field “Insurance period”, 10 years 5 months are indicated and the non-insurance period is highlighted, including 8 years (Fig. 1).

Rice. 1 Fragment of a certificate of incapacity for work In the program, in the Employee’s card, in the field Length of service for payment of sick leave, taking into account non-insurance periods, 10 years 5 months are indicated, and in the field Insurance length of service for payment of sick leave, you must indicate length of service without non-insurance periods, i.e. 2 years and 5 months (Fig. 2).

Rice. 2. Information about work experience |

For an employee, it makes no difference whether there are non-insurance periods in his work experience, but for the Social Insurance Fund this is important.

Example 3. Calculation of disability benefits in the presence of non-insurance periods

|

Disability benefits were provided from 06/01/2016 to 06/18/2016. The employee has a length of service for paying sick leave, taking into account non-insurance periods of 10 years 5 months, including a non-insurance period of 8 years. When filling out the Sick Leave document, on the Payment tab, select the Apply benefits flag and select Payments in connection with the inclusion of non-insurance periods in the insurance period. The Payment percentage field was automatically set to 100%, because the total experience is more than 8 years. But in the field Percentage of payment without benefits is 60%, because without benefits the length of service is only 2 years and 5 months, which is less than 5 years. The difference between total length of service and length of service without benefits is paid from the federal budget minus the first three days paid by the employer. On the Accrued tab (Fig. 3), the sick leave accrual is calculated for a total amount of 13,767.15 rubles, including at the expense of the federal budget - 5,506.80 rubles. In the 4-FSS report, expenses from the federal budget are allocated automatically. |

Rice. 3. Accruals for sick leave, taking into account non-insurance periods

...depending on the date of onset of the disease

Throughout 2016, the maximum average daily earnings for all cases except maternity leave is 1,772.6 rubles. When calculating the average daily earnings in 2016, you need to take into account all earnings for 2014, from which insurance premiums were transferred, but not more than 624,000 rubles, and all earnings for 2015, from which insurance premiums were transferred, but not more than 670,000 rubles. Average daily earnings are obtained by dividing the sum of these limited earnings for 2 years by 730. In some cases, the amount of benefits is affected by the minimum wage, and it changed during 2016.

From 01/01/2016 the minimum wage is equal to 6,204 rubles per month (Article 1 of the Federal Law dated 12/14/2015 No. 376-FZ), and from 07/01/2016 the Federal Law of 06/02/2016 No. 164-FZ is set at 7,500 rubles per month . It is necessary to take into account changes in the minimum wage

from 07/01/2016, if the employee…

… average earnings for the previous two years are below the minimum wage

If the average employee’s earnings calculated for 2014 and 2015 (calculated for a full calendar month) are below the minimum wage, then the benefit is calculated based on the minimum wage. If the date of onset of the disease falls on the period from 01/01/2016 to 06/30/2016, then the minimum average daily earnings calculated from the minimum wage is 203 rubles. 97 kopecks (RUB 6,204 x 24) / 730 = RUB 203.97). For illnesses occurring starting from 07/01/2016, the minimum average daily earnings is 246 rubles. 58 kopecks (RUB 7,500 x 24) / 730 = RUB 246.58).

Example 4. Calculation of benefits from the minimum wage due to low earnings

Please note that the start date of the disability is important in this case. The disease occurred in July, so the minimum wage was 7,500 rubles. If the onset date of the illness was before July 1, 2016, and the illness continued in July, then a minimum wage of 6,204 rubles would be used.

... less than six months of experience

If the employee’s length of service is less than six months, then the disability and maternity benefits cannot exceed the minimum wage for each calendar month.

Example 5. Limitation of benefits to the minimum wage due to short work experience

|

Employee D.V. Borovoy began working on 04/01/2016 full-time at an enterprise in an area without a regional coefficient (RK). A certificate of earnings from a previous employer in 2015 confirms the amount of 500,000 rubles. Sick leave was provided for 2 days: 06/30/2016–07/01/2017. On the day of the onset of illness, the length of service is less than six months and the amount of benefit is limited not by the maximum value of the base for calculating insurance premiums, but by the maximum amount of daily benefit calculated from the minimum wage. The actual average daily earnings were: RUB 500,000. / 730 = 684.93 rub. The experience is less than five years, so the average daily earnings are limited to 60% and equal to 684.93 rubles. x 60% = 410.96 rub. But since the length of service is less than six months, it is limited to the maximum daily benefit in June: 6,204 rubles. / 30 = 206.80 rubles, and in July 7,500 rubles. / 31 = 241.94 rub. Thus, for 2 days, a benefit of 206.80 rubles was accrued. + 241.94 rub. = 448.74 rub. (Fig. 4). |

Rice. 4. Sick leave accruals from the minimum wage

note, maternity benefits are accrued in advance and if the employee went on maternity leave before July 1 and before the new minimum wage was approved. Moreover, if the vacation continues after July 1, then the amount of the benefit must be recalculated taking into account the new minimum wage and the difference must be paid.

The need for recalculation arises if maternity benefits are limited to the maximum amount of daily benefits similar to Example 5 due to the fact that the employee’s length of service was less than six months. To perform recalculation in the program, you need to open a previously created and paid document Sick leave. By button To correct create a new document. In it on the bookmark Recalculation of the previous period previously accrued amounts are reversed, and on the tab Accrued (details) new charges are displayed. As a result, the new document shows the difference, in this case, the amount of additional payment.

... violation of the regime

If an employee violates the regime prescribed by the attending physician without good reason or if the incapacity for work occurs due to alcohol or drug intoxication, then the calculation is made in the same way as in the second case.

This case differs from the previous one in that in case of violation of the regime, benefits based on the minimum wage are accrued starting from the day of the noted violation, and before that - according to the general rules, taking into account the actual average earnings.