Zup 8.3 sick leave at the expense of profit. Necessary settings for registering absence for unknown reasons

Registration of sick leave in 1C Accounting 8.3 (edition 3.0)

2016-12-07T18:15:57+00:00Finally, the troika has grown to the point where I confidently recommend that all accountants do accrual of temporary disability benefits (sick leave) not the old fashioned way (a separate type of accrual), but specially created for these purposes document "Sick leave".

This allows you to automate the calculation of average earnings for further vacations and sick leave, and also in some way brings 1C: Accounting 8.3 closer to 1C salary and personnel. But first things first.

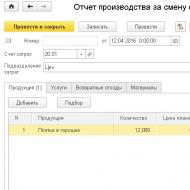

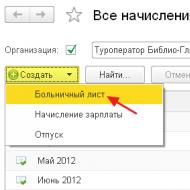

Here, for now, there are only payroll accruals for past periods. Let's create a document "Sick leave":

Let's fill out the document in accordance with the figure below:

We filled in the month (sick leave is accrued in January), selected an employee, indicated the cause of incapacity (illness), indicated the period of illness and the percentage of payment based on the employee’s length of service.

The program completely correctly calculated our average earnings and the amount of sick leave, and also divided this amount at the expense of the employer and at the expense of the Social Insurance Fund. Great!

Let's go into the calculation of average earnings (the "Change" button next to the calculated average earnings). A data entry window for calculating average earnings will open:

It shows the employee’s income for the previous 2 years and the calculated average earnings.

Let's click on the question mark next to the amount of average earnings to see the calculation itself in more detail. As you can see, the program even compares average earnings with the minimum wage:

Let's close the data entry window for calculating average earnings using the "OK" button and return to the open "Sick Leave" document. Find and click the “Calculate average earnings” button:

We will see a certificate calculating the average salary of an employee:

Finally, let’s run the “Sick leave” document using the “Post and close” button and see that it accrued sick leave, but did not accrue personal income tax.

Everything is correct. Personal income tax will be calculated in the final payroll document, which we will make last and which will include the sick leave accrued by us.

Create a payroll document for January and click the “Fill” button:

We see that the sick leave period is taken into account when calculating days and hours worked. The amount of sick leave was included in this month’s accruals. Personal income tax is assessed on this amount (as well as on the total salary). Amazing!

The payslip will look like this.

At the top of the document, you need to fill in the month of accrual, select an employee and enter the number of the certificate of incapacity for work.

Then, on the “Main” tab, we carefully indicate the reason for incapacity and the period. If this sick leave is a continuation, then check the appropriate box and select the previous sick leave.

We will also indicate below when we will pay temporary disability benefits. This date is necessary for correctly filling out the 6-NDFL declaration. The program provides three options for the payment date: with an advance payment, with a salary and during the interpayment period. If you actually paid the employee benefits on some other day, then return to this document and correct the payment date.

Now let's take a closer look at calculating average earnings. It is calculated automatically in the program based on the available data. If you need to adjust accruals from previous periods, you can do this here by clicking on the green pencil:

In the window that opens, we can manually change the payroll period, as well as add a salary certificate from the employee’s previous place of work.

Now let's go to the "Payment" tab

There is a very important link “Insurance Experience”. The fact is that the employee has been working in the organization since February 2014 and the program takes two years of experience by default and, as a result, 60% for sick leave. Here we have the opportunity to correct the employee’s work experience.

On the last tab you can see in more detail the accruals due to the Social Insurance Fund and the employer.

You can immediately create a payment document directly from this document. I draw your attention to the fact that this is only possible if the “Sick Leave” document indicates the payment during the interpayment period. In this case, a payment slip will be automatically generated.

And lastly, these are printed forms. From the “Sick Leave” document, using the “Print” button, you can generate three of them:

Calculation of disability benefits

Sick leave is calculated from the certificate of incapacity for work provided by the employee. The amount of the benefit depends on the nature of the disability, as well as the length of insurance coverage. Let's look at how the insurance period is reflected in the calculation of benefits:

- Less than 5 years -60% of average earnings calculation;

- From 5 to 8 years – 80% of the calculated average earnings;

- Over 8 years – 100% of average earnings.

Sick leave is calculated based on the average earnings of the insured employee for the previous two years. At the same time, the calendar years for which sick leave is calculated for the employee can be replaced. These are situations where the employee used maternity leave or maternity leave in one or two of these calendar years. According to the employee's application, one or both years are replaced if the replacement entails an increase in the amount of the benefit.

How to issue a sick leave certificate in 1C 8.3 ZUP

Let's look at step by step how to process sick leave in 1C ZUP.

How to register a no-show on sick leave

If at the time of calculating the advance or salary the employee is absent, then in 1C 8.3 ZUP it is necessary to register a failure to appear for an unknown reason, so that the salary is not accrued for the period of absence.

To be able to register an employee’s absence, you need to check the settings of the 1C program. Menu item Settings - select Payroll - next Setting up the composition of accruals and deductions - next Absence accounting - check Absenteeism and no-shows:

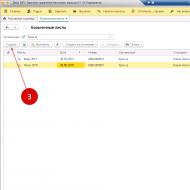

Failure to appear is registered using the document Absenteeism, failure to appear. The document can be entered both in the personnel menu and in the Salary section:

From our example, the employee fell ill in April from 11 to 22:

For each month of no-show/absenteeism, if the no-show continues into the next month, it is necessary to enter a new document in 1C, that is, separately for May, for June, etc.

How to reflect sick leave in 1C

After the employee has provided sick leave, we enter the Sick Leave document to calculate benefits. The document is a personnel and payroll document. It can be entered from the Personnel section:

or using the Payroll section:

Let's create a new document. If the work experience has not been completed previously, the program will pay attention to this fact:

If you go to this field, you can indicate the length of service directly in the document:

We indicate the nature of the disability from the sick leave certificate and the date of our sick leave. The accrual month in our case is May, that is, this is the month that will be displayed on the employee’s payslip. Checking the payment:

Checking sick leave accrual:

Absence from work for an unknown reason is reversed on the Recalculation of the previous period tab:

The date of payment for sick leave is important for personal income tax accounting. Non-salary income is recorded based on the date of payment. You can choose the payment method - in advance, with salary, or by interpayment. We take sick leave:

Calculation of payment for sick leave in 1C 8.3 ZUP

Payment of sick leave for child care

The peculiarity of these sick leaves is that payment for outpatient treatment is carried out in the first 10 calendar days in accordance with the length of service, and then in the amount of 50% of average earnings. If treatment takes place in a hospital, then taking into account the insurance period.

There are also calculation features in 1C ZUP that depend on the age of the child. Selecting an option for calculating sick leave for care in the Sick Leave document on the Child Care tab:

The 1C 8.3 ZUP program also tracks from what day payment will be made in the amount of 50%:

Payment of sick leave for pregnancy and childbirth, for injury at work or occupational disease

If we pay for maternity leave, benefits for work injuries or occupational diseases, then this is 100% sick pay and does not take into account length of service:

Also, if a dismissed employee provided a certificate of incapacity for work within 30 calendar days from the date of dismissal, and has not yet found a new job, then this payment is in the amount of 60% of the calculated average earnings.

Calculation of average earnings

In 1C ZUP, when calculating the average earnings of an employee, taking into account the earnings of previous policyholders, it is necessary that the checkbox “Take into account the earnings of previous policyholders” is checked in the document:

Where in 1C ZUP 8.3 can I enter earnings from previous policyholders? You need to go to the Main tab and click on the Change calculation of average earnings button to fill in the data:

Or from the Salary section - See also - Certificates for calculating benefits:

Average earnings are determined automatically by the 1C ZUP 3.1 program based on data on how much was included in the final base for calculating contributions in previous years. Average earnings are determined for each calendar year in an amount not exceeding the maximum base for calculating insurance contributions to the Social Insurance Fund established for that year.

The average daily income for calculating benefits is calculated by dividing accrued earnings by 730. For maternity benefits, earnings are divided by the sum of calendar days of the two previous years minus excluded periods (sick leave, maternity leave, maternity leave, periods of release from work with full or partial retention of wages, if insurance premiums were not paid for wages at that time).

You can view a printed calculation form. Printed forms Calculation of average earnings and Detailed calculation are used by the accountant to check the calculation and data, and the form Calculation of benefits for a certificate of incapacity for work is an “official” calculation, we apply it to sick leave:

Payment of sick leave at the expense of the Social Insurance Fund

Funding for sick leave benefits depends on the nature of the disability. If this is an illness or injury (other than work-related), then the first three days are paid by the policyholder. Subsequent days are paid at the expense of the Social Insurance Fund. In other cases, payment is made at the expense of the Social Insurance Fund from the first day. In the 1C ZUP program, this division is visible in two types of calculation: Sick leave and Payment for sick leave at the expense of the employer:

Instructions for calculating sick leave in the 1C Accounting for Ukraine program.

“Payroll for employees of an organization” is the main document on which all calculations regarding sick leaves of employees of an organization are made. The figure shows the path to this document.

But before you start looking at accruals for sick leave, you need to make sure that the corresponding accrual for sick leave is available in the directory “Plans for types of calculations”. You can find the necessary data using the following scheme:

- Open 1C in mode 1:Enterprise;

- Select the menu item “Operations”;

- Click the button “Plans of types of calculations;

- A window will open;

- Here there is an option “Basic accruals of organizations”, which you have to select.

After you have done everything, a directory will open in front of you. It contains the main types of accrual in the organization. To choose to reflect only hospital accruals, you need to select one of the options:

- The first is sick leave at the expense of the enterprise;

- The second is sick leave paid for by social insurance.

To apply for sick leave at the expense of the company, you need to fill out all the details. This is shown in detail in the figure below. This will be quite enough when it is necessary to issue a standard sick leave for an employee.

Do not forget also that the data required to be filled out is not only in the “General” tab, but also in the “Base for calculations”.

Once all the fields are filled in, check that the entered details and other data are correct, and then you can close the card and write down the directory item.

After this, you need to open the element in the directory called “medicine for the FSS rakhunok”. In this tab you need to fill in all fields. How to do this correctly is shown in the figure below. This information will be enough to issue a standard sick leave in most cases.

Remember that not only the data in the “General” tab requires filling out, but also all fields in the “Calculation Base” must also contain the necessary data.

Now you can once again check the correctness of the entered data. If everything is correct, close the card and write down the directory item.

When all the necessary types of calculations have already been generated, you will need to create a special document - “Payroll for employees of the organization.”

Even before accruals are reflected taking into account sick leave, filling out all documents is carried out according to the usual scheme, which is used with “Payroll for employees of an organization”. To make it clear and visual, let's look at the accrual feature, using one employee as an example.

As soon as you completed everything according to the usual scheme, sick leave was not taken into account by the system; you need to do this manually. To do this you need to enter the following data:

- Sick leave period;

- Type of accrual;

- Base period and other important information.

Also, do not forget to correct the changed base period: you need to adjust the values back up to those values that correspond to the month.

The calculations do not end there, because you still need to recalculate the number of days for calculating the salary and take into account the number of days that fell during the period of sick leave.

Make sure that the “Auto-calculation flag” checkbox is unchecked; if not, remove it. After this, you can click the “Calculate” button or select “Calculate by employee”. The system will give you a warning that there is a need to re-register documents (there may also be re-registration of records, it all depends on the state of the files). You need to agree to the warning and wait for the calculations to complete.

The figure shows what will happen after the final formation of charges.

Don’t forget to also recalculate and refill the employee data in certain tabs:

- Payroll contributions and fees;

- Personal income tax and so on.

The process follows the same pattern as it did in the very first bookmark. That is, you select a tab, then find the desired employee, then the scheme is as follows (if you are working with a payroll):

“Fill” -> “Fill by employee” -> “Calculate” -> “Calculate by employee”.

Don’t forget to double-check the correctness of the entered data, and then create transactions on the tab.

There are a few more steps left and the work will be completed. To do this, click the “Record” button, then agree with “OK”, then post the document. Now the accrual of sick leave, which includes taxes and contributions, has been fully processed. Now all you have to do is make the payment using the “Salaries Payable” document, and do not forget to indicate the appropriate types of payments. That's all.

From July 1, 2017, all medical institutions can issue certificates of incapacity for work both in paper and electronic form. To do this, the following conditions must be met:

- There is written consent from the employee to receive sick leave electronically;

- The medical institution and the organization became participants in information interaction for the exchange of information in order to generate an electronic sick leave.

Interaction with the Social Insurance Fund regarding electronic certificates of incapacity for work is possible directly from 1C programs. The general scheme for exchanging electronic certificates of incapacity for work, or abbreviated ELN, with the Social Insurance Fund is as follows. First, the medical institution, in the process of issuing a certificate of incapacity for work to an employee of the organization, sends it to the Social Insurance Fund. Then, after the employee has provided sick leave to the organization’s accounting department, the accounting department employee, using the sick leave number, receives from the Social Insurance Fund all the necessary information directly from the 1C: ZUP program.

Based on all the information provided to the Social Insurance Fund, the accountant in the program automatically calculates the amount of temporary disability benefits. Then all information on calculated sick leave is sent back to the Social Insurance Fund.

Sick leave

In the process of entering an electronic sick leave, the accounting employee simply needs to fill out the basic information: indicate the name of the organization, the surname, first name and patronymic of the employee, as well as the number of the certificate of incapacity for work.

Then you should click the “Get data from the Social Insurance Fund” button and the entire document will be filled in with the data of the electronic certificate of incapacity for work, which will be automatically filled in with data from the Social Insurance Fund server. The amount of the benefit will be calculated based on the available information about the employee’s earnings and length of service, which are stored in the program database. In order to download information on an electronic certificate of incapacity from a file downloaded from the policyholder’s personal account on the information portal of the Federal Social Insurance Fund of the Russian Federation, you should click the “Load from file” button and select the required file.

All information about the medical institution is automatically downloaded. To view this information, click on the hyperlink.

Creating and sending a register of electronic certificates of incapacity for work to the Social Insurance Fund

Note 1

To compile a register of electronic certificates of incapacity for work, you should follow the path: section “Reporting, certificates - 1C-Reporting”.

The tabular part of the document dialog box that opens can be filled out in several ways. In the first case, you should click the “Fill” button and the table will be filled with all electronic certificates of incapacity for work, information about which has not yet been sent. In the second case, you should use the Add button and select specific electronic certificates of incapacity for work that need to be sent to the Social Insurance Fund.

If there is a need to obtain additional information about the electronic certificate of incapacity for work, which will be sent to the Social Insurance Fund, you need to double-click on the line with this certificate of incapacity for work. As a result, a form will open that will contain all the additional information.

Before the document is sent, it must be completed. In this case, the program checks the required fields. In order to send the register to the FSS, click the Send register to the FSS button.

If the program does not have a connection with the FSS configured, the program user will be prompted to connect to 1C-Reporting. If the user does not use 1C-Reporting, then setting up the FSS certificate for electronic certificates of incapacity for work can be done manually.