Reducing the single tax on insurance premiums. What insurance premiums does an employer pay for an employee, and how are they calculated? What amount of insurance premiums is an individual entrepreneur required to pay?

Individual entrepreneurs using the simplified tax system must pay insurance premiums for themselves and for their employees, if any. In 2017, a new article appeared in the Tax Code, which transfers control over contributions to the Federal Tax Service. Consequently, you now need to pay contributions directly to the tax office under the new BCC. The only exception was the payment for injuries; as before, we pay it to the social insurance fund. Contributions “for yourself” must be paid, even if you did not conduct business or suffered losses; the very fact of registering you as an individual entrepreneur obliges you to pay.

Payment period

The deadlines for paying contributions are strictly regulated. The individual entrepreneur is responsible for non-compliance.

- Individual entrepreneurs without employees pay insurance premiums for themselves in a fixed amount for the year until December 31 of the current year, and for income exceeding 300,000 rubles, 1% - no later than April 1 of the year following the expired billing period (clause 2 of Art. 432 Tax Code of the Russian Federation);

- For individual entrepreneurs with staff - until the 15th day of the month following the month of payment of income to the employee.

If an individual entrepreneur makes advance payments on contributions during the year, then this can be done at least every month, there is no specific date, but as an individual entrepreneur on the simplified tax system with the taxable object “Income”, it is beneficial to pay the amount of contributions before the end of the quarter. We'll talk about this later.

How to pay?

To pay the fees, you will need to generate a receipt for payment to the bank. This can be done through the tax service website.

- You need to go to the official website of the tax service;

- Select the “Pay taxes” section;

- Click on the button to create a payment order for an individual entrepreneur;

- In the form that appears, select “IP”;

- Mark “Payment document”;

- Fill in the KBK, the remaining lines will be filled in by the system automatically, if you do not know the KBK, then first select the tax group and name of the payment, then, if necessary, specify the type of payment;

- Next, fill in your residential address;

- In the payment details, select the payer status as an individual entrepreneur;

- We put “TP”, which means payment for the current period, if you make the main payment;

- Select the period for which you pay MS funds with monthly payments.

- Enter the amount;

- Indicate your first name, middle name and last name;

- Fill in the TIN;

- Place a check next to your place of residence (this means that the address of residence and the location of the taxable object are the same);

- Select the payment method (cash - in this case the system will generate a receipt for you, which you will print and submit to the bank, non-cash - payment will be made from the tax service website through a partner bank).

Important! You can only pay with a card issued in your name, so that the tax office can see who the payment came from; if you indicate someone else’s card, the system will not miss the payment.

Individual entrepreneur on the simplified tax system without employees

An individual entrepreneur who does not have employees pays contributions only for himself in a fixed amount.

The minimum wage in 2017 is 7,500 rubles. The amount of the fixed payment depends on the size of the minimum wage. You need to pay 5.1% of the product of the minimum wage amount and the months worked to the compulsory medical insurance fund, so we calculate using the example of a full year worked: (7,500 × 12) × 5.1% = 4,590 this amount must be paid for the year.

The amount of fixed insurance premiums can be calculated using the formula:

Pension insurance contributions = minimum wage × tariff × number of months.

If the annual income exceeds 300 thousand rubles, then you need to pay another 1% of the excess amount. It turns out that in 2017 the fixed amount of individual entrepreneurs’ pension insurance contributions was 23,400 = 7,500 × 26% × 12 months.

So, for a year of fixed insurance premiums, you need to pay the tax office in the amount of 27,990 rubles plus 1% of the excess amount.

The formula for calculation will be as follows:

Minimum wage × Tariff × number of months + 1% (Actual income – 300,000).

In the Compulsory Medical Insurance Fund, insurance premiums for excess income are 300,000 rubles. 1% is not paid.

There is a maximum limit for insurance premiums established by the state; it is equal to the amount of 187,200 rubles. If, according to your calculations, you should pay more, then you will not have to do this. This level of insurance premiums depends on the minimum wage.

Let's look at an example:

The individual entrepreneur’s income for the year was 500,000 rubles, then 23,400 + 1% (500,000 - 300,000) = 23,400 + 2,000 = 25,400 must be paid. 23,400 must be paid by the end of the year, and 2,000 must be paid before April 1 of the year following the reporting year.

I wrote above that for a year an individual entrepreneur must pay contributions of 23,400 rubles for pension insurance and 4,590 for compulsory medical insurance, so in the examples below we will use these amounts for calculation.

Let's look at another example:

The individual entrepreneur registered on July 25, 2017, we will calculate the amount of insurance premiums. The profit of the individual entrepreneur amounted to 700,000 rubles.

For compulsory health insurance: (4,590 ÷ 12 × 5) + (382.5 ÷ 31 × 7) = 1,912.5 + 86.37 = 1,998.87, where 4,590 is the annual contribution amount, 382.5 is the amount of contributions to month, 5 are for the months from August to December, and 7 are the days of July.

By analogy, we calculate for pension contributions: (23,400 ÷ 12 × 5) + (1,950 ÷ 31 × 7) + 1% (700,000 - 300,000) = 9,750 + 440.32 + 4,000 = 14,190.32.

The total contributions to be paid will be in the amount of 16,189.19 rubles.

Individual entrepreneur on the simplified tax system with employees

An individual entrepreneur who has employees must pay 30% of their income (wages, bonuses) to the Pension Fund for them every month. For employees who work under the GPC, you do not have to deduct 2.9% to the Social Insurance Fund, and then you will deduct 27.1%.

Let's look at an example:

The individual entrepreneur has 3 hired employees, 2 of them work under a GPC contract with a fixed payment of 15,000 and one under an employment contract with a payment of 20,000 rubles. All employees worked for a full year. Profit for the year amounted to 600 thousand rubles.

Contributions of the individual entrepreneur himself are 23,400, because income exceeded 300,000, then 1% (600,000 - 300,000) = 3,000, a total of 26,400 the individual entrepreneur will pay for pension insurance. The fixed contribution to compulsory medical insurance for the year is 4590.

Employee contributions

15,000 × 12 × 27.1% × 2 = 97,560 for employees at GPC.

20,000 × 12 × 30% = 72,000 per employee under an employment contract.

In total, the entrepreneur will pay contributions for the year in the amount of: 23,400 + 3,000 + 4,590 + 97,560 + 72,000 = 200,550 rubles.

Reduction of tax on the amount of insurance premiums

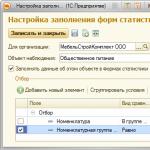

If an entrepreneur has chosen the object of taxation “Income”, then he has the right to reduce the tax by the amount of insurance premiums. When the object of taxation is “Income minus expenses,” insurance premiums reduce the tax base for calculating the payment.

If an individual entrepreneur does not have employees, then the tax amount can be reduced by 100% of contributions, but if there are employees, then only by 50%, but this is exclusively for individual entrepreneurs who work on the simplified tax system at a rate of 6% on income. In order to reduce the tax on the amount of insurance premiums, it is advantageous to pay the premiums quarterly until the last day of the quarter, because the tax can be reduced in the period when the premium is paid.

General provisions

Insurance premiums are a fee that organizations and individual entrepreneurs in Russia are required to pay. They have been introduced since 2010, when they replaced the single social tax (UST).

Until 2017, insurance premiums were not formally part of the Russian tax system, but have always played a vital role in our country’s compulsory social insurance system. Their payment ensures the right to receive financial support during retirement, pregnancy and in the event of the birth of a child, or illness. The right to receive free medical care is also inextricably linked with the payment of insurance premiums.

Now tax authorities monitor compliance by policyholders with legislation on taxes and fees through desk and on-site audits. However, the FSS checks whether contributions for injuries have been calculated and transferred correctly, and whether benefits have been paid correctly, as before. The changes are provided for by Federal Law No. 243-FZ of July 3, 2016.

Insurance premiums include:

- Insurance contributions for compulsory pension insurance (OPI). They have been listed in the Federal Tax Service since 2017.

- Insurance contributions for compulsory social insurance for temporary disability and in connection with maternity. They are transferred, as before, to the Social Insurance Fund of the Russian Federation.

- Insurance premiums for compulsory health insurance (CHI). They have been transferred to the Federal Tax Service since 2017.

There are also so-called injury contributions (insurance contributions for compulsory social insurance against industrial accidents and occupational diseases), however, they are regulated by another federal law and stand somewhat apart. A separate material in ours is devoted to contributions for injuries.

Basis and legal basis

Issues of insurance premiums were previously regulated by a number of federal laws. Fundamental among them was Federal Law No. 212-FZ of July 24, 2009, which became invalid due to amendments to the Tax Code.

Now the norms of the Tax Code of the Russian Federation apply to the calculation and payment of insurance premiums. New section 11 and chapter 34 of the Code are devoted to insurance premiums.

Since 2017, tax authorities:

With regard to insurance premiums for periods expired before 2017, the Pension Fund and the Social Insurance Fund continue to conduct inspections and identify the presence of arrears.

The Tax Code in Article 8 establishes the concept of insurance contributions - these are mandatory payments for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, for compulsory medical insurance, collected from organizations and individuals for the purpose of financial security for the implementation of the rights of insured persons to receive insurance coverage for the corresponding type of compulsory social insurance.

Insurance contributions are also recognized as contributions collected from organizations for the purpose of additional social security for certain categories of individuals.

The Tax Code of the Russian Federation in its latest edition establishes:

- general conditions for establishing insurance premiums (Article 18.2 of the Tax Code of the Russian Federation);

- circle of contribution payers (Article 419 of the Tax Code of the Russian Federation);

- obligations of payers (Article 23 of the Tax Code of the Russian Federation);

- the procedure for calculating insurance premiums (Article 52 of the Tax Code of the Russian Federation);

- taxable object and base (Articles 420 and 421 of the Tax Code of the Russian Federation);

- tariffs of insurance premiums (Articles 425-429 of the Tax Code of the Russian Federation);

- the procedure for paying insurance premiums (Article 431 of the Tax Code of the Russian Federation);

- liability for violation of legislation on insurance premiums and other issues.

Payers of insurance premiums

According to Article 419 of the Tax Code of the Russian Federation, payers of contributions are persons making payments and other remuneration to individuals:

- organizations;

- individual entrepreneurs;

- individuals who are not individual entrepreneurs.

Contributions are also paid by individual entrepreneurs, lawyers, mediators, notaries engaged in private practice, arbitration managers, appraisers, patent attorneys and other persons engaged in private practice in accordance with the legislation of the Russian Federation. These are payers who do not make payments or other remuneration to individuals. A separate material is devoted to them in the tax reference book.

If the payer belongs to several categories simultaneously, he calculates and pays insurance premiums separately for each basis.

Object of taxation of insurance premiums

Tax Code in Art. 420 provides rules for determining the object of taxation of insurance premiums in three cases.

For organizations and individual entrepreneurs making payments in favor of individuals subject to compulsory social insurance in accordance with federal laws on specific types of compulsory social insurance, the object of taxation is payments and other remuneration accrued:

- within the framework of labor relations and civil contracts, the subject of which is the performance of work and the provision of services;

- under copyright contracts in favor of the authors of works;

- under agreements on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements on granting the right to use works of science, literature, art;

For individuals not recognized as individual entrepreneurs, the objects of taxation are:

- payments and other remuneration under employment contracts and civil law contracts, the subject of which is the performance of work, provision of services, paid by payers of insurance premiums in favor of individuals (with the exception of remunerations paid to individual entrepreneurs, lawyers, notaries and other persons engaged in private practice) . The concepts of the object of taxation for these payers have been transferred without significant changes from Federal Law No. 212-FZ, which has lost force.

New in the Tax Code is the allocation of a separate object for individual entrepreneurs, lawyers, notaries and other persons engaged in private practice. This:

- the minimum wage established at the beginning of the corresponding billing period, and if the amount of income of such a payer for the billing period exceeds 300,000 rubles, his income is also considered subject to insurance premiums.

What payments are not subject to insurance premiums:

- Payments and other remuneration within the framework of civil contracts, the subject of which is the transfer of ownership, and contracts related to the transfer of property for use (except for contracts of author's order, contracts for the alienation of the exclusive right to works of science, literature, art, publishing licenses contracts, licensing agreements on granting the right to use works of science, literature, art). These are contracts of purchase and sale, lease, loan, borrowing, etc.

- Payments to a foreign citizen or stateless person on the basis of an employment contract, according to which the person’s place of work is a separate division of a Russian organization outside the Russian Federation, or a civil contract for the performance of work (rendering services), the execution of which also takes place outside the territory of the Russian Federation.

- Payments to reimburse a volunteer’s expenses within the framework of the execution of a civil contract concluded in accordance with Federal Law No. 135-FZ of August 11, 1995 “On Charitable Activities and Charitable Organizations,” with the exception of food expenses in an amount exceeding the daily allowance.

- Payments to foreign citizens and stateless persons under employment contracts or under civil law contracts in connection with the preparation and holding of the 2018 FIFA World Cup and the 2017 FIFA Confederations Cup in the Russian Federation. Payments made to volunteers under civil law contracts that are concluded with FIFA to reimburse the expenses of volunteers in connection with the execution of these contracts in the form of payment for the costs of processing and issuing visas, invitations and similar documents, payment of travel costs, accommodation, food, sports equipment, training, communication services, transportation support, and others .

The list of amounts not subject to insurance premiums, given in Article 422 of the Tax Code of the Russian Federation, is slightly different from the list that was enshrined in Art. 9 of Federal Law N 212-FZ.

Previously, employer contributions paid in accordance with the legislation of the Russian Federation on additional social security for certain categories of employees in the amount of paid contributions were not subject to insurance contributions. In the new list, such employer contributions are not mentioned, which means that contributions will have to be deducted from their payment.

The second change is that previously, when payers paid for travel expenses of employees, per diem allowances were not subject to insurance premiums, regardless of the amount. Now, when payers pay expenses for business trips, daily allowances will not be subject to insurance contributions, only those provided for in paragraph 3 of Art. 217 Tax Code of the Russian Federation.

The third change: among payments not subject to insurance premiums, payments to guardians were previously mentioned, but there was no indication of the conditions for such payments. Now there is a rule that the amount of one-time financial assistance provided to guardians when establishing guardianship over a child, paid during the first year after the establishment of guardianship, but not more than 50 thousand rubles, is not subject to insurance contributions. for each child.

The following are not subject to insurance premiums under Article 422 of the Tax Code of the Russian Federation:

- State benefits, including unemployment benefits, as well as benefits and other types of compulsory insurance coverage for compulsory social insurance.

- All types of compensation payments (within the limits established in accordance with the legislation of the Russian Federation) - the article provides an exhaustive list of them.

- Amounts of one-time financial assistance to employees in connection with a natural disaster (emergency circumstances, terrorist attacks); with the death of a family member; upon the birth (adoption) of a child or the establishment of guardianship, but not more than 50,000 rubles for each child.

- Income of communities of indigenous peoples of the North, Siberia and the Far East from the sale of products obtained as a result of their traditional types of fishing (except for wages of workers).

- Amounts of insurance payments (contributions) for compulsory insurance of employees carried out by the payer in the manner established by the legislation of the Russian Federation, amounts of payments under contracts of voluntary personal insurance of employees concluded for a period of at least one year, amounts of payments under contracts for the provision of medical services to employees concluded for a period of at least one year, the amount of payments under voluntary personal insurance contracts for employees, concluded exclusively in the event of the death of the insured person and (or) harm to the health of the insured person, as well as the amount of pension contributions of the payer under non-state pension agreements.

- Employer contributions to a funded pension in the amount of contributions paid, but not more than 12,000 rubles per year per employee for whose benefit employer contributions were paid.

- The cost of travel for employees to and from the vacation destination and the cost of luggage weighing up to 30 kilograms, paid by the payer of insurance premiums to persons working and living in the Far North.

- Amounts paid to individuals by election commissions, referendum commissions, as well as from the election funds of candidates for the position of President of the Russian Federation, candidates for State Duma deputies, candidates for deputies of the legislative (representative) body of state power of a constituent entity of the Russian Federation, candidates for a position in another state body of a constituent entity of the Russian Federation Federation for the performance by these persons of work directly related to the conduct of election campaigns and referendum campaigns.

- The cost of uniforms and uniforms issued to employees in accordance with the legislation of the Russian Federation, as well as to civil servants of federal government bodies free of charge or with partial payment and remaining for their personal permanent use.

- The cost of travel benefits provided by the legislation of the Russian Federation to certain categories of employees.

- Financial assistance to employees up to 4,000 rubles. per person per calendar year.

- Amounts of tuition fees for employees in basic professional educational programs and additional professional programs.

- Reimbursement of employee expenses for paying interest on a loan for the purchase or construction of housing.

- Amounts of monetary allowance, food and clothing support in connection with the performance of military service duties and service in the specified bodies in accordance with the legislation of the Russian Federation.

- All types of payments and remuneration under civil law contracts, including copyright contracts, in favor of foreign citizens and stateless persons temporarily residing in the territory of the Russian Federation.

- Daily allowances for business trips provided for in paragraph 3 of Article 217 of the Tax Code of the Russian Federation, as well as actually incurred and documented targeted expenses for travel to the destination and back.

- Expenses of members of the board of directors or members of another similar body of the company in connection with their arrival to participate in its meeting.

Base for calculating insurance premiums

How is the base for calculating contributions determined in 2017?

The base for calculating insurance premiums for payers making payments and other remunerations to individuals is determined by Article 421 of the Tax Code of the Russian Federation as the amount of payments and other remunerations provided for in paragraph 1 of Art. 420 of the Tax Code of the Russian Federation, accrued by payers of insurance premiums for the billing period in favor of individuals (except for amounts not subject to insurance premiums specified in Article 422 of the Tax Code of the Russian Federation).

The base for calculating insurance premiums is determined separately for each individual from the beginning of the billing period at the end of each calendar month on an accrual basis.

When calculating the base, remuneration paid both in cash and in kind is taken into account. The base for payments in kind is defined as the cost of goods (work, services) received by an individual.

Limit amount of payments for calculating contributions

In 2017, the size of the maximum base for calculating insurance premiums is provided separately for insurance premiums for compulsory pension insurance and insurance for temporary disability and maternity. There is no maximum base for calculating insurance premiums for compulsory medical insurance.

The maximum value of the base for calculating insurance premiums is established taking into account increasing factors for each year from 2017 to 2021. In 2017, its value is:

- for calculating insurance premiums for temporary disability and in connection with maternity - 876,000 rubles;

- for calculating insurance premiums for compulsory pension insurance - 755,000 rubles.

The size of the maximum base for calculating insurance premiums is rounded to the nearest thousand rubles. In this case, the amount of 500 rubles or more is rounded up to the full thousand rubles, and the amount less than 500 rubles is discarded.

Payments when calculating the base relating to an author's order agreement, an agreement on the alienation of the exclusive right to works of science, literature, art, etc. is defined as the amount of income received under these contracts, reduced by the amount of actually incurred and documented expenses associated with the extraction of such income.

If such expenses cannot be documented, they are accepted for deduction in the following amounts (as a percentage of the amount of accrued income):

- for the creation of literary works, including for theatre, cinema, stage and circus - 20 percent;

- for the creation of artistic and graphic works, photographs for printing, works of architecture and design - 30 percent;

- for the creation of works of sculpture, monumental and decorative painting, decorative and decorative art, easel painting, theatrical and film set art and graphics, made in various techniques - 40 percent;

- for the creation of audiovisual works (video, television and films) - 30 percent;

- for the creation of musical stage works (operas, ballets, musical comedies), symphonic, choral, chamber works, works for brass band, original music for cinema, television, video films and theatrical productions - 40 percent;

- for the creation of other musical works, including works prepared for publication - 25 percent;

- for the performance of works of literature and art - 20 percent;

- for the creation of scientific works and developments - 20 percent;

- for discoveries, inventions and the creation of industrial designs (percentage of the amount of income received in the first two years of use) - 30 percent.

Billing and reporting periods

According to Article 423 of the Tax Code of the Russian Federation, the calculation period is a calendar year. Reporting periods are the first quarter, six months, and nine months of the calendar year.Date of payments and other rewards

For organizations and individual entrepreneurs:

- the day of accrual of payments and other remunerations in favor of the employee (individual in whose favor payments and other remunerations are made).

For individuals not recognized as individual entrepreneurs:

- the day of payments and other remuneration in favor of an individual.

Insurance premium rates in 2017

If an organization does not have the right to apply reduced tariffs, then it charges contributions at the basic tariffs. They are indicated in Art. 426 Tax Code of the Russian Federation.

Tariffs of insurance premiums for payments to employees not exceeding the maximum base:

- For compulsory pension insurance (OPI) - 22%;

- For insurance for temporary disability and in connection with maternity (VNIM) - 2.9%;

- For compulsory health insurance (CHI) - 5.1%.

Tariffs of insurance premiums for payments to an employee in the part exceeding the maximum base:

- For compulsory pension insurance - 10%;

- For compulsory health insurance - 5.1%.

Reduced contribution rates are established, in particular, for the following categories of organizations:

- IT organization (Tariffs: OPS - 8%, VNiM - 2%, compulsory medical insurance - 4%);

- An organization on the simplified tax system that conducts preferential activities according to paragraphs. 5 p. 1 art. 427 of the Tax Code of the Russian Federation (Tariffs: OPS - 20%, VNiM - 0%, compulsory medical insurance - 0%);

- Pharmacy on UTII in relation to payments to employees engaged in pharmaceutical activities (Tariffs: OPS - 20%, VNiM - 0%, compulsory medical insurance - 0%).

Organizations whose annual income does not exceed 79 million rubles have the right to apply a reduced tariff.

Contributions to compulsory health insurance at additional rates are charged to organizations that have employees engaged in work that give the right to early assignment of an insurance pension (listed in clauses 1 - 18, part 1, article 30 of Law N 400-FZ). This is indicated by Art. 428 of the Tax Code of the Russian Federation, Letters of the Ministry of Finance dated November 16, 2016 N 03-04-12/67082, Ministry of Labor dated February 25, 2014 N 17-3/B-76.

Insurance premiums paid by payers who do not make payments or other remuneration to individuals

Individual entrepreneurs, lawyers, notaries engaged in private practice, who do not make payments or other remuneration to individuals, pay contributions for themselves in fixed amounts.

They pay contributions for disability and maternity to the budget of the Social Insurance Fund of the Russian Federation on a voluntary basis.

Payment of fees. Reporting on insurance premiums

Payment of contributions by employers

Payment of insurance premiums from payments to individuals assumes that during the billing period (year) it is necessary to calculate and pay contributions in the form of monthly mandatory payments.

At the end of each reporting period - the first quarter, half a year, 9 months, calendar year - you need to summarize the payment of insurance premiums: fill out and submit calculations for accrued and paid premiums for these periods.

At the same time, it is necessary to keep records of accrued payments and contributions for each employee.

A monthly mandatory payment has been paid since 2017 to the Federal Tax Service for all employees in the total amount (except for the contribution to the Social Insurance Fund). The amounts of monthly mandatory payments must be transferred in rubles and kopecks.

Monthly mandatory payments for insurance premiums must be paid no later than the 15th day of the month following the month for which they were accrued. If the last day for payment falls on a non-business day, the payment deadline will be the next business day.

Reporting on insurance premiums

On January 1, 2017, new rules for reporting insurance premiums came into force.

Starting from the 1st quarter of 2017, you must submit a new unified calculation of insurance premiums to your tax office. It combines data from four reports to the funds at once: RSV-1 PFR, 4 - FSS, RSV-2 PFR and RV-3 PFR. The calculation, format and procedure for filling out are approved by Order of the Federal Tax Service of Russia dated October 10, 2016 N ММВ-7-11/

Important! The deadline for submitting calculations has changed.

Calculation of contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance must be submitted to the tax authority once a quarter no later than the 30th day of the month following the billing (reporting) period (p 7 Article 431 of the Tax Code of the Russian Federation). The innovation is due to the fact that the Tax Code of the Russian Federation has been supplemented with provisions on the collection of insurance premiums (except for contributions for injuries).

The deadline for paying contributions remains the same - the 15th day of the month following the month for which they were accrued.

The changes are provided for by Federal Law No. 243-FZ of July 3, 2016.

Note! For late submission of payment calculations, inspectors are fined under Art. 119 of the Tax Code of the Russian Federation, the minimum fine is 1,000 rubles.

Personalized accounting

Deadlines for submitting reports on personalized accounting - new in 2017

On January 1, 2017, the law on new deadlines for filing personalized reports came into force.

The deadline for submitting monthly personalized reporting (form SZV-M) has been moved from the 10th to the 15th of the month following the reporting month.

In addition, the data that employers, according to the old rules, submitted once a quarter as part of RSV-1, now needs to be sent to the Pension Fund annually (no later than March 1 of the next year). An exception is information about the amount of income subject to contributions to compulsory pension insurance and their size. The frequency of submission of this information remains the same, but it is required to submit it to the tax authority.

The changes are provided for by Federal Law No. 250-FZ of July 3, 2016.

A fine has been introduced for the fact that personalized accounting information is not submitted electronically. If the policyholder is required to provide personalized accounting information in electronic form, then failure to fulfill this obligation will entail a fine of 1,000 rubles.

A statute of limitations has been established for prosecution - the territorial body of the Pension Fund of the Russian Federation will be able to prosecute for an offense in the field of personalized accounting only if less than three years have passed from the date on which it became known.

Reporting forms for personalized accounting

- Form SZV-M for submitting information about insured persons. Approved by Resolution of the Pension Fund Board of February 1, 2016 N 83p.

- Form for calculating insurance premiums. The procedure for filling out and the format for submitting calculations in electronic form are approved by Order of the Federal Tax Service of Russia dated October 10, 2016 N ММВ-7-11/ The form is applied starting from the submission of calculations for insurance premiums for the 1st quarter of 2017 (Article 423 of the Tax Code of the Russian Federation, paragraph 2 of the Order of the Federal Tax Service of Russia dated 10.10.2016 N ММВ-7-11/).

- Data on the length of service of employees. They should be submitted to the Pension Fund of Russia at the place of registration in a form approved by the Pension Fund (clause 2 of Article 8, clauses 1, 2 of Article 11 of the Law on Personalized Pension Accounting). For the first time in this order, information about the length of service is submitted for 2017 no later than March 1, 2018.

- Form SPV-2, required to provide information about the insurance experience of the insured person for the purpose of establishing a labor pension. The form itself and instructions for filling it out were approved by Resolution of the Pension Fund Board of June 1, 2016 N 473p. The information must be submitted to the territorial body of the Pension Fund of the Russian Federation within three calendar days from the day on which such person applied to submit it.

- Form SZV-K. The form and rules for filling it out were approved by Resolution of the Pension Fund Board of June 1, 2016 N 473p. Information about the work experience of the insured person for the period before registration in the compulsory pension insurance system (before 01/01/2002) is submitted to the territorial body of the Pension Fund of the Russian Federation at the request of the Pension Fund of the Russian Federation.

Insurance premiums: what's new in 2017?

From January 1, 2017, the collection of insurance premiums, except for contributions for injuries, is regulated by the Tax Code of the Russian Federation. Now tax authorities monitor compliance by policyholders with legislation on taxes and fees.

New section 11 and chapter 34 of the Tax Code are devoted to insurance premiums.

Since 2017, tax authorities:

- control the completeness and timeliness of payment of insurance premiums accrued according to the new rules;

- accept and check reports starting with the calculation of insurance premiums for the first quarter of 2017;

- collect arrears, penalties and fines on insurance premiums, including for 2016 and previous periods.

Let us list the changes in insurance premiums that resulted from the key change in legislation.

- The maximum base for sick leave and pension contributions has been increased.

The maximum base for contributions to compulsory social insurance in case of illness and in connection with maternity is 755,000 rubles, and for contributions to compulsory pension insurance - 876,000 rubles. For 2016, the limits were set at 718,000 rubles and 796,000 rubles, respectively.

In 2017, contributions in case of temporary disability and in connection with maternity are not accrued for amounts of payments and other remuneration exceeding the maximum base value. But pension contributions after the limit has been exhausted are charged at a lower rate - not 22%, but 10%. The same rules were actually in effect last year. The changes are provided for by Decree of the Government of the Russian Federation dated November 29, 2016 N 1255.

For medical contributions, the maximum base has not been established since 2015. These contributions are subject to payments, regardless of their amount, on an accrual basis from the beginning of the year.

- During a desk audit, the inspectorate has the right to request data on amounts not subject to insurance contributions.

Carrying out a desk audit of the calculation of insurance premiums, the inspectorate can now request from a legal entity information and documents that confirm the validity of reflecting amounts not subject to contributions, as well as information and documents that confirm the validity of the application of reduced contribution rates (clause 8.6 of Article 88 of the Tax Code of the Russian Federation) .

According to the rules in force until 2017, similar powers were vested in the Pension Fund and the Social Insurance Fund. However, from periods beginning no earlier than 2017, according to the general rule, desk audits of contributions are carried out by tax authorities, guided by the requirements of the Tax Code of the Russian Federation, and funds check past periods. Until January 1, 2017, the Tax Code of the Russian Federation allowed the inspection to request documents and information during a desk audit only in certain cases. For example, when a legal entity applied a benefit for the tax being audited. The changes are provided for by Federal Law No. 401-FZ of November 30, 2016.

- Insurance premiums that an organization must pay to the budget can be transferred by anyone.

Since 2017, Article 45 of the Tax Code of the Russian Federation has been supplemented with clause 9, according to which insurance premiums are subject to the provision of the Code that another person can contribute the amount to the budget for the payer. We believe that the same rule applies when paying penalties and fines.

Important! The innovations do not affect contributions for injuries, as well as penalties and fines for them, since the Tax Code of the Russian Federation does not apply to these payments. The now repealed Law on Insurance Contributions did not establish such a payment procedure. Therefore, we believe that the changes apply to the payment of contributions for periods starting before 2017, if the funds are actually transferred in 2017. The changes are provided for by Federal Law No. 401-FZ of November 30, 2016.

- Business trip around Russia: paying daily allowances over 700 rubles has become even less profitable.

A rule has appeared in the Tax Code of the Russian Federation, from which it follows that for daily allowances over 700 rubles per day of travel in Russia and over 2,500 rubles per day of a business trip abroad, insurance premiums must be charged (clause 2 of Article 422 of the Tax Code of the Russian Federation). According to the repealed Law on Insurance Contributions, daily contributions were not subject to daily contributions. The Pension Fund of the Russian Federation and the Social Insurance Fund noted that contributions are not accrued on daily allowances that are paid according to the standards established in the collective agreement or local act. The change does not affect contributions for injuries. The Occupational Accident Insurance Act has not been amended to limit the non-taxable amount of daily allowance. The changes are provided for by Federal Law No. 243-FZ of July 3, 2016.

- New rules for submitting reports on insurance premiums have come into force.

Calculation of contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance must be submitted to the tax authority once a quarter no later than the 30th day of the month following the billing (reporting) period (clause 7 Article 431 of the Tax Code of the Russian Federation).

From the clarification of the FSS it follows that the calculation must be submitted for periods beginning no earlier than January 1, 2017. Reporting on contributions, including updated ones, for earlier periods is submitted according to the old rules. They are as follows: the electronic 4-FSS must be submitted to the territorial body of the FSS no later than the 25th day, the paper one - no later than the 20th day of the month after the reporting period. RSV-1 in electronic form should be sent to the territorial body of the Pension Fund no later than the 20th day, in paper form - no later than the 15th day of the second month following the reporting period.

The deadline for paying contributions remains the same - the 15th day of the month following the month for which they were accrued. The changes are provided for by Federal Law No. 243-FZ of July 3, 2016.

Innovations in 2017 in the field of personalized accounting:

- The deadline for submitting SZV-M has been extended.

The SZV-M form is submitted no later than the 15th day of the next month, and not the 10th, as provided for in the Law on Personalized Accounting.

- A separate report on the length of service of insured persons is provided.

The length of service of insured persons must be reported to the Pension Fund separately, and not as part of the RSV-1 form. The form must be submitted no later than March 1 of the year following the reporting year. If this rule is violated, the fine will be 500 rubles for each insured person.

- A fine has been introduced for the fact that personalized accounting information is not submitted electronically.

If the policyholder is required to provide personalized accounting information in electronic form, then failure to fulfill this obligation will entail a fine of 1,000 rubles.

- A statute of limitations has been established for prosecution.

The territorial body of the Pension Fund of Russia will be able to prosecute for an offense in the field of personalized accounting only if less than three years have passed from the date on which it became known.

Emelyanenko Elena Alexandrovna,

leading expert of the expert and consulting department of the PRAVOVEST company,

Member of the Chamber of Tax Consultants of Russia

2. Insurance premiums must be calculated and paid for the same period.

The amount of tax under the simplified tax system can be reduced only by pension contributions that are calculated from January 1 to December 31, that is, in the period for which the declaration under the simplified tax system is submitted. Contributions must be paid for the same period. However, it is not necessary to pay them in the same period for which the declaration is submitted under the simplified tax system. The main thing is that contributions to compulsory pension insurance are paid before filing a declaration under the simplified tax system.

As noted in the letter of the Federal Tax Service of Russia, it is legal to reduce the tax only by the amounts actually paid (within the amount of accrued (payable) for the tax (reporting) period) insurance premiums for mandatory insurance on the date of payment of advance tax payments for the reporting period or the date of filing the tax return at a single tax for .

Moreover, tax authorities draw attention to the fact that if taxpayers paid insurance premiums for compulsory insurance after submitting a tax return under the simplified tax system, they have the right to clarify their tax obligations for the single tax for the past calendar year and submit an updated declaration to the tax authority.

If insurance premiums are paid within one tax period, then they can be offset when calculating tax (advance tax payments) for the year (the following reporting periods of the current calendar year) and included in the tax return for the tax period.

3. The amount of the single tax can be reduced only by the amount of pension contributions within the limits calculated and reflected in the declarations for mandatory pension insurance, which are submitted to the tax authority, for the same period of time.

This is due to the fact that the obligation to calculate is considered fulfilled after the submission of the corresponding tax return, which reflects the amount of the calculated tax liability.

4. The reduction of the single tax cannot take into account more insurance premiums than calculated.

So, if more contributions to compulsory pension insurance have been paid than calculated, then only the calculated amount is taken into account. It is also impossible to count off those contributions that have been paid in advance but have not yet been calculated.

Example 2

Romashka LLC applies the simplified tax system with the object of taxation “income”. The LLC submitted its declaration under the simplified tax system for 2008 on March 28, 2009. In the first quarter of 2009, income amounted to RUB 1,500,000. Contributions for OPS have been calculated:

– for January 2009 – 10,000 rubles;

– for February 2009 – 12,000 rubles;

– for March 2009 – 11,000 rubles.

Insurance premiums paid:

Temporary disability benefits were not paid for the first quarter of 2009.

Let's calculate the amount of the advance payment based on the results of the first quarter of 2009:

RUB 1,500,000 x 6% = 90,000 rub.

Romashka LLC can reduce this amount by the amount of pension contributions, but not more than 50%: 45,000 rubles. (90,000 rub. x 50%).

Since more was paid for March than accrued, Romashka LLC, following the recommendations of the tax service, could take into account contributions to compulsory pension insurance in the amount of 33,000 rubles in the reduction of the advance payment for the first quarter of 2009. (10,000 rub. + 12,000 rub. + 11,000 rub.).

Contributions transferred in advance in the amount of 1000 rubles. (12,000 rubles - 11,000 rubles) can be offset when calculating the advance payment in the next reporting period.

In the first quarter of 2009, the company paid contributions for December 2008 in the amount of 9,500 rubles. They were paid before filing the declaration under the simplified tax system for 2008, so Romashka LLC could include the specified amount in the declaration.

Considering that the amount of contributions to the Pension Fund does not exceed the established limit, Ro-mashka LLC had to pay an advance payment for the first quarter of 2009 in the amount of 57,000 rubles no later than April 25. (90,000 rub. – 33,000 rub.).

So, we have examined the position of the Federal Tax Service of Russia. However, specialists from the Russian Ministry of Finance have a different opinion.

According to the latest clarifications from the financial department, contributions reduce the amount of single tax in the period in which they are actually paid, regardless of the period for which they are accrued. For example, when calculating the amount of single tax for the first quarter of 2009, pension contributions paid in January 2009 for December 2008 must be taken into account.

In substantiating its position, the Russian Ministry of Finance cites the norm of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation, according to which expenses of the taxpayer are recognized as expenses after their actual payment.

At the same time, according to financiers, the amount of actually paid contributions for a calendar year can be increased by the amount of overpayment of insurance premiums for the previous year and the amount not taken into account when calculating the single tax for the previous year. Moreover, this can be done only if the procedure for offset of this amount is carried out.

Current legislation establishes mandatory insurance payments to various funds - pension, social and health insurance. This is an absolute responsibility for all companies and entrepreneurs. In other words, everyone pays contributions - individual entrepreneurs without hired personnel, LLCs with average incomes, and a huge corporation with a considerable staff. In addition, even for some reason, non-functioning organizations, i.e. those that do not receive income, but have not officially declared the termination of their activities, also make these payments. The calculation of insurance premiums is carried out differently in different enterprises, it all depends on many reasons: the status of the enterprise, organizational features and other conditions. Let's try to understand the intricacies of accruals for different categories of organizations and employees and find out the procedure for calculating insurance premiums for enterprises of different forms of ownership.

What is the difference between the taxes of an employer and its employees?

First, let's look at the differences in the payment of taxes by employees and employers, since they are often confused, although these concepts are polar opposites. Insurance premiums are calculated based on wages. You cannot mix such different concepts as employer and employee payments. The employee pays personal income tax on the amount of the salary accrued to him personally, and the employer pays 30% of the entire staff salary fund to various funds. By the way, acting as a tax agent, a company or individual entrepreneur withholds and transfers to the budget the full amount of personal income tax from its employees. This is the difference between the taxes paid by employees and business managers.

Insurance premiums: what are they?

Contributions paid by the employer to social funds are called insurance or social contributions. All payments are calculated and transferred monthly within the time limits established by law.  The overwhelming majority of the Russian population are hired workers of various enterprises. For companies operating on a traditional taxation system, the basis for calculating insurance premiums is based solely on the amount of the accrued salary and related payments, for example, bonuses or additional payments for work on holidays and weekends, class, territorial coefficient, etc. Payments characterized as social are not included in the calculation base. These include:

The overwhelming majority of the Russian population are hired workers of various enterprises. For companies operating on a traditional taxation system, the basis for calculating insurance premiums is based solely on the amount of the accrued salary and related payments, for example, bonuses or additional payments for work on holidays and weekends, class, territorial coefficient, etc. Payments characterized as social are not included in the calculation base. These include:

- material compensation;

- assistance from the company for restoring health or purchasing medicines on the basis of a collective agreement or industry tariff agreements;

- benefits accrued upon dismissal of employees caused by reduction in production and elimination of jobs;

- business travel expenses that are of a production nature but not related to payroll.

So, all accruals are made on the amount of accrued wages. We will find out to which funds enterprises using OSNO transfer contributions, their amounts and calculation features, as well as for which companies and in what cases reduced tariffs apply.

FSS

One of the most important social funds to which insurance premiums are paid is the Social Insurance Fund. It works in two directions: it monitors and pays for temporary disability benefits and compensates for damages caused by work-related injuries.  In this regard, contributions to the Social Insurance Fund are calculated at the following rates:

In this regard, contributions to the Social Insurance Fund are calculated at the following rates:

▪ 1st – for temporary disability and maternity – 2.9% of employees’ wages. For 2015, the maximum level of wages from which contributions are calculated is set in the amount of 670 thousand rubles. No tariff is charged on income received above this level.

▪ 2nd – insurance against industrial accidents. The contribution amount varies from 0.2% to 8.5% and corresponds to one of 32 occupational risk classes, legally established for companies with varying degrees of occupational injuries. For this type of insurance there is no size of the maximum base; deductions from wages are made regardless of the amount of income according to the risk class established for each enterprise. Only for budgetary enterprises professional risk is limited to first class.

FFOMS

Health insurance contributions amounted to 5.1% of wages in 2015. The maximum salary level, above which contributions are not calculated, is 624 thousand rubles.

Pension Fund

For enterprises operating on a general basis, contributions are 22%. The maximum income for their accrual in the current year is 711 thousand rubles. Unlike other funds, in the Pension Fund for amounts exceeding the standard, deductions are made in the amount of 10%. But they are no longer distributed to the employee’s separate account, but to a general, consolidated account. The presented table indicates the amounts of deductions and the maximum levels of income on which they are accrued for enterprises using OSNO.

1. Example of calculation of insurance premiums

An employee of the enterprise received a salary of 68 thousand rubles for January. It includes payments:

- salary - 40,000 rubles;

- vacation pay - 15,000 rubles;

- paid sick leave - 13,000 rubles.

Total accrued: RUB 68,000.

Payment of sick leave is not included in the calculation base, reducing the amount of income for calculating contributions.

68 – 13 = 55 thousand rubles.

Contributions accrued for January:

to the Pension Fund:

55,000 * 22% = 12,100 rub.

to FSS:

55,000 * 2.9% = 1,595 rubles.

In the FSS (from uncounted words):

55,000 * 0.2% = 110 rub.

in FFOMS:

55,000 * 5.1% = 2805 rub.

Total accrued contributions for the month - 16,610 rubles.

Let's continue the example:

The salary of this employee for 10 months of the year amounted to 856,000 rubles. The amount of contributions accrued during this time:

To the Pension Fund:

711,000 * 22% + (856,000 – 711,000) * 10% = 156,420 + 31,900 = 188,320 rub.

to FSS:

670,000 * 2.9% = 19,430 rubles.

FSS (from nesch/sl.):

856,000 * 0.2% = 1,712 rubles.

FFOMS:

624,000 * 5.1% = 31,824 rubles.

Accrued for 10 months - 241,286 rubles.

Insurance premiums: calculation for individual entrepreneurs

Often entrepreneurs, when organizing their own business, work in the singular, without recruiting staff. The individual entrepreneur does not pay himself a salary; he receives income from entrepreneurial activities. This category also includes the so-called self-employed population - privately practicing lawyers, doctors and other specialists who have organized their own businesses.

For such entrepreneurs, a special procedure for calculating such payments has been established by law - fixed (mandatory) insurance premiums.

Mandatory insurance premiums are calculated based on the minimum wage, which is indexed annually. Therefore, the amount of fixed contributions increases every year, not counting the experiment of legislators in 2013, when not one minimum wage, but two were taken as the basis for calculating deductions.

This amount is clearly defined and is calculated as the product of 12 times the minimum wage and the tariffs established for the Pension Fund at 26% and the Federal Compulsory Medical Insurance Fund at 5.1%:

This year the mandatory contribution amounted to 18,610.80 rubles. and 3650.58 rub. respectively. A total of 22,261.38 rubles must be transferred for the year.

Individual entrepreneurs do not calculate insurance contributions to the Social Insurance Fund, since they are not provided for settlements with the fund either for payment of sick leave or for work-related injuries.

The legal limit for earning income for the possibility of paying deductions in a fixed amount is 300 thousand rubles. Exceeding this level of income will require additional assessment of the amount of contributions: 1% is charged on the amount received in excess of this standard. This rule applies only to the calculation of contributions to the Pension Fund. It does not apply to contributions to the Federal Compulsory Medical Insurance Fund. The size of the contribution to this fund is not affected by the amount of income; it is stable.

The procedure for transferring and calculating insurance contributions to the Pension Fund of the Russian Federation by entrepreneurs

The algorithm for settlements with the pension fund is as follows:

A fixed contribution must be paid before the end of the current year. This is the responsibility of all entrepreneurs. As already mentioned, when paying this contribution, neither the financial result of the activity, nor the taxation regime, nor the amount of income, nor its complete absence plays a role. This fee is paid because it is mandatory.

Until April 1 of the next year, the part of the contributions received by calculation is transferred - 1% of the amount of income exceeding the three hundred thousand limit.

3. Consider an example of calculating insurance premiums for an individual entrepreneur working without staff:

The annual income of a practicing doctor was 278 thousand rubles. Let's calculate insurance premiums:

in the Pension Fund = 5965 * 12 * 26% = 18,610.80 rubles.

in FFOMS = 5965 * 12 * 5.1% = 3650.58 rubles.

Payments are made in equal quarterly installments or in full at once. The main thing is that they are submitted before the end of the year.

4. Consider the following example:

Individual entrepreneur’s income for the year is RUB 2,560,000.

Contribution to the Pension Fund = 18,610.80 + 1% * (2,560,000 – 300,000) = 18,610.80 + 22,600 = 41,210.80 rubles.

In FFOMS - 3650.58 rubles.

Important! Fixed amount RUB 22,261.38. must be transferred before the end of the tax year, the contribution from the difference is 18,949.42 rubles. must be paid by April 1.

The maximum contribution amount for the current year is RUB 148,886.40. It is calculated using the formula: 8 times the minimum wage for the year, multiplied by the established Pension Fund tariff.

Features of calculating individual entrepreneur contributions: how to correctly calculate the amount of income of an individual entrepreneur

The calculation of insurance premiums for individual entrepreneurs has been radically changed. And if previously all calculations were based on the amount of profit, today the basis for their calculation is the amount of income received. And these concepts should be distinguished, since an incorrectly calculated amount of income and, therefore, payment may lead to the imposition of penalties.

When combining several tax regimes, income from activities in each of them must be summed up. If the entrepreneur’s income for the year is no more than 300 thousand rubles or is absent, then the individual entrepreneur is obliged to transfer only a fixed contribution.

Application of reduced tariffs: who can count on benefits?

Russian legislation regulates the possibility of using reduced tariffs for certain categories of employer enterprises. The amounts of these tariffs are different for different companies and depend on the activities in which they are engaged. The tariff rates are listed in Part 1 of Art. 58 Z-na No. 212-FZ. This is a very extensive register that contains a number of payers who have the right to use benefits. The table provides a list of enterprises whose activities allow the use of preferential tariffs when calculating social contributions.

| Companies eligible to apply preferential tariffs | Pension Fund | FSS | FFOM |

| Enterprises working on the Unified Agricultural Tax, agricultural producers, public representations of people with disabilities | 21 | 2,4 | 3,7 |

| Partnerships organized by budgetary, non-profit institutions, IT companies, etc. | 8 | 4 | 2 |

| Companies and individual entrepreneurs working on a patent and the simplified tax system for the types of activities listed in the law, entrepreneurs-pharmacists on UTII, non-profit organizations on the simplified tax system, enterprises working in the field of social security, R&D, healthcare, culture, charitable activities | 20 | 0 | 0 |

| Enterprises participating in the Skolkovo project | 14 | 0 | 0 |

In paragraph 8, part 1 of Art. 58 a list of activities for which preferential tariffs have been established has been published. Organizations and individual entrepreneurs working with any of them are given the right not to count social and health insurance contributions, and for contributions to the Pension Fund a rate of 20% is established. The maximum income for calculating deductions is 711 thousand rubles. For income received in excess of this amount, contributions are not calculated. Legislators have also established certain restrictive barriers that must be applied for enterprises to exercise their right to use preferential tariffs.

Let's look at the calculation of insurance premiums at preferential rates using the following several examples.

1. From the annual income of an employee of an agricultural producer enterprise entitled to a preferential payment in the amount of 264,000 rubles. deductions amounted to:

To the Pension Fund:

264,000 * 21% = 55,440 rub.

to FSS:

264,000 * 2.4% = 6,336 rubles.

In FFOMS:

264,000 * 3.7% = 9,768 rubles.

Total: 71,544 rub.

2. The following contributions must be calculated from the salary of an employee of a social security enterprise conducting activities that are eligible for benefits in the amount of 210,000 rubles:

To the Pension Fund:

210,000 * 20% = 40,500 rub.

Total: 40,500 rub.

3. From the annual income of an IT company employee in the amount of 547,000 rubles. deductions made:

To the Pension Fund:

547,000 * 8% = 43,760 rub.

to FSS:

547,000 * 4% = 21,880 rub.

In FFOMS:

547,000 * 2% = 10,940 rub.

Total: 76,580 rub.

Another innovation since the beginning of this year is that the amounts of contributions when paid are not rounded to the nearest ruble, as was previously accepted, but are calculated and paid in rubles and kopecks, without creating tiny overpayments when settling with funds.

Accounting for calculations of insurance premiums: accrual, postings, features

Insurance premiums are calculated by employers in the same month for which salaries are calculated. Important! The accrual and calculation of insurance premiums for vacation pay is made immediately when calculating vacation pay, and for the entire amount, regardless of the length of the vacation period. It often begins in one month and ends in another. However, the calculation of accrued insurance premiums is made for the entire amount at once.

Accounting for insurance contributions is carried out on account No. 69 “Calculations for social insurance” and its subaccounts for the separate allocation of types of deductions and funds. It corresponds with the production cost accounts, the amount of accrued contributions is reflected in the credit of the 69th account:

D-t 20 (23, 26, 44 ...) K-t 69 - contributions to the Pension Fund, Social Insurance Fund and Federal Compulsory Medical Insurance Fund are accrued to the corresponding sub-accounts approved by the company.

Paid contributions are debited to subaccounts 69 and reflected in the credit of account 51 “Current Account”, confirming the payment made and the settlement of insurance premiums paid.

Peculiarities of applying benefits when paying contributions for “simplified people”

The law establishes the possibility of reducing the tax base of enterprises using special regimes. Insurance premiums paid in full of the calculated amount reduce the base for the accrued tax provided for by the special regime in the following cases:

The individual entrepreneur applies the simplified tax system and/or UTII and operates without hired personnel;

The company operates on a simplified “income minus expenses” regime.

1/2 of the amount of deductions reduces the basis for calculating tax when the following regimes are applied:

simplified tax system “Income * 6%”;

For patent holders, insurance premiums do not reduce their value.

It should be noted that the right to use these benefits is exercisable only in the period for which the tax is calculated, and the base can be reduced only by the amount of contributions paid (not accrued!) in the same reporting period.

Penalties

Insurance premiums, the calculation of which is made, must be paid to the funds within the prescribed period. According to the law, if monthly payments are not made on time, regulatory agencies have the right to present the organization with a penalty for each day of delay.

Penalties not provided for by law cannot be applied as sanctions, but fines can be quite impressive. There are many reasons that may cause displeasure of extra-budgetary funds. They have the right to fine a company for late registration in funds or for being late in reporting contributions, as well as for using forms of an unspecified form. This is not a complete list of violations; the extra-budgetary fund has considerable power and it is better to prepare and submit all the necessary reporting forms in advance in order to be able to change anything and report on time.

The most popular tax regime for small businesses. Another name for this system is “USN 6 percent”, because the standard tax rate here is only 6% of income received. But this calculated amount of tax can be further reduced due to insurance premiums that individual entrepreneurs pay for themselves, and employers for employees. Find out how to reduce tax on insurance premiums using our calculations as an example.

Normative base

First, a little theory, which allows payers of the simplified tax system to reduce the calculated tax by 6 percent down to zero. The opportunity to take into account amounts paid in 2019 for the simplified tax system is provided by Article 346.21 of the Tax Code of the Russian Federation.

Here is the very provision from this article: “Taxpayers who have chosen income as an object of taxation reduce the amount of tax (advance tax payments) calculated for the tax (reporting) period by the amount of insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, compulsory social insurance against accidents at work and occupational diseases paid (within the calculated amounts) in a given tax (reporting) period.”

The tax period for individual entrepreneurs on the simplified tax system of 6% is a calendar year, and the reporting periods, based on the results of which it is necessary to calculate and pay, are the following periods: the first quarter, half a year and 9 months. The deadline for making advance payments is no later than the 25th day of the month following the reporting period (April 25, July, October, respectively).

If the payer of the simplified tax system for income paid insurance premiums for himself or for employees during the reporting period, then the calculated advance payment can be reduced. Moreover, the reduction of the simplified tax system for the amount of insurance premiums in 2019 for individual entrepreneurs without employees is carried out in a special manner - they can reduce the advance payment for all contributions paid. If an entrepreneur has employees, then the tax can be reduced by no more than 50%. This is indicated in the same article 346.21 of the Tax Code.

It is no coincidence that we are considering a reduction in tax payments due to paid insurance premiums only for the simplified system in the “Income” option. The fact is that when choosing, the taxpayer has the right only to take into account the paid contributions in his expenses, but cannot reduce the tax payments themselves.

How to reduce tax on the simplified tax system for individual entrepreneurs without employees

First, let's look at the reduction in the simplified tax system for the amount of insurance premiums in 2019 for individual entrepreneurs without employees. We will show you how to reduce calculated tax payments using a specific example.

Example

An entrepreneur who has chosen the simplified tax system for income independently provides household services to the population. In 2019, he received an income of 937,000 rubles. What taxes and contributions should he pay on such income?

The amount of tax for individual entrepreneurs on the simplified tax system of 6% will be (937,000 * 6%) 56,220 rubles. In addition, the entrepreneur must pay insurance premiums for himself. in 2019 for the simplified tax system it is made as follows: a minimum fixed contribution of 36,238 rubles plus an additional contribution (1% of the amount of income over 300,000 rubles) of 6,370 rubles, a total of 42,608 rubles.

At first glance, it can be assumed that the total amount to be paid to the budget will be equal to 42,608 rubles of contributions plus 56,220 rubles of tax and advance payments. Total, 98,828 rubles. In fact, this is not true.

A simplified 6 percent rate for an entrepreneur without employees allows you to reduce the tax that was assessed. As a result, the individual entrepreneur will pay only 56,220 rubles to the budget along with contributions, but this must be done correctly.

Although there is one deadline for paying contributions for yourself (no later than December 31), in order to immediately reduce the calculated 6 percent for individual entrepreneurs, contributions should be paid in installments every quarter. The table reflects the amounts of income and paid contributions for the reporting periods on an accrual basis, as established by Article 346.21 of the Tax Code of the Russian Federation.

*Note: the additional 1% contribution can be paid later, before July 1, 2020, but the entrepreneur transferred the entire amount in the current year.

Now, using these data as an example, let’s see how advance payments and taxes are calculated and reduced at the end of the year at the expense of paid contributions.

- For the first quarter: 135,000 * 6% = 8,100 minus paid contributions of 8,000, 100 rubles remain to be paid.

- For the six months, the calculated payment will be 418,000 * 6% = 25,080 rubles. We subtract the contributions paid for the half-year and the advance paid for the first quarter: 25,080 - 18,000 - 100 = 6,980 rubles. All that remains is to pay extra into the budget.

- For nine months, the calculated tax will be 614,000 * 6% = 36,840 rubles. We reduce by paid fees and advances: 36,840 - 27,000 - 100 - 6,980 = 2,760 rubles. You must list them before October 25th.

- At the end of the year, we calculate how much the entrepreneur needs to pay extra by April 30: 937,000 * 6% = 56,220 - 42,608 - 100 - 6980 - 2760 = 3,772 rubles.

Let's check the accuracy of the calculations again. Total paid:

- advance payments based on the results of the reporting periods: (100 + 6980 + 2760) 9,840;

- remaining tax at the end of the year 3,772;

- contributions for the whole year 42,608.

We find that indeed all payments to the budget amounted to 56,220 rubles, and not 98,828 rubles, as it might seem at first glance.

What would the calculation be like if advance payments to the simplified tax system at the end of the reporting periods did not decrease, because the entrepreneur paid contributions for himself in one amount at the end of the year - December 30?

In this case, advance payments are made each reporting period in full, i.e. instead of 9,840 rubles, based on the results of nine months, the individual entrepreneur will transfer 36,840 rubles. The remaining tax (56,220 - 36,840) = 19,380 is reduced by the one-time contribution amount of 42,608 rubles, resulting in an overpayment of tax by 23,228 rubles.

For the convenience of paying taxes and insurance premiums, we recommend opening a current account. Moreover, now many banks offer favorable conditions for opening and maintaining a current account.

How to reduce tax payments on the simplified tax system for individual entrepreneurs with employees

If an entrepreneur hires workers, then advance payments and the tax itself can be reduced by the amount of contributions, but not more than 50%. In this case, it is allowed to take into account contributions paid not only for oneself, but also for employees.

In general, the rate of insurance premiums for an employee is 30% of salary and other payments:

- for pension insurance - 22%;

- for health insurance - 5.1%;

- for social insurance - 2.9%.

In addition, you must pay contributions to the Social Insurance Fund, the rate of which, depending on the professional risk class of the individual entrepreneur’s activity, ranges from 0.2% to 8.5%.

Until 2019, many entrepreneurs using the simplified tax system paid a reduced rate of insurance contributions for employees (only 20% for pension insurance). However, starting this year, the benefit was canceled, so simplified workers pay insurance premiums on a general basis.

Example

In 2019, an individual entrepreneur and an employee earned 1,780,450 rubles. We will reflect the receipt of income and payment of contributions for ourselves and for the employee in this table.

The calculated tax taking into account advance payments in this example will be 1,780,450 * 6% = 106,827 rubles, and contributions for individual entrepreneurs and for the employee were paid in the amount of 78,790. Taking into account the 50% limit, the calculated tax can only be reduced to (106,827/ 2) 53413.5 rubles, although the contributions paid are more than this amount. As we can see, the financial burden of an individual entrepreneur on the simplified tax system is higher not only due to contributions for employees, but also due to the limitation of tax benefits.

If you still have questions or would like advice from a professional, we can offer free tax consultation from 1C.