Accounting info. Accounting for fixed assets 1 with accounting for fixed assets

Fixed assets are buildings, structures, transport, equipment. Such property is used for more than 12 months and costs no less than a certain amount. Acceptance of OS for accounting in 1C 8.3 occurs in several stages. Each of them is reflected in a certain order. Let's look at this in more detail.

Read in the article:

Acceptance of fixed assets for accounting in 1C 8.3 occurs in two stages: first, the receipt of fixed assets is reflected, then their commissioning. In this article, read how to accept fixed assets for accounting in 1C Accounting 8.3 in 3 steps.

Step 1. Reflect the receipt of fixed assets in 1C 8.3

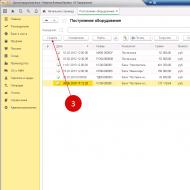

Go to the “OS and intangible assets” section (1) and click on the “Equipment receipt” link (2).

In the window that opens, click the “Create” button (3).

The “Receipt: Equipment (creation)” window will open. In the upper section of the document (4) in the “Organization” field, indicate your organization, in the “Warehouse” field, indicate which warehouse the equipment was received at. In the “Counterparty” and “Agreement” fields, indicate the supplier of fixed assets and the details of the agreement with him. In the “Invoice No.” field, indicate the number of the invoice under which the property was received.

The lower section consists of five tabs (5):

- Equipment;

- Goods;

- Services;

- Returnable packaging;

- Additionally.

In the “Equipment” tab, click the “Add” button (6) and enter data on the received fixed asset. In the “Nomenclature” field, indicate the name of the OS; in the “Quantity” and “Price” fields, indicate the quantity and price of the received equipment. “Accounting account” 1C 8.3 will be determined automatically, depending on the type of equipment received (fixed assets, equipment to be installed). When all the data has been entered, you can save the document; to do this, click the “Post and close” button (7). Now the purchase of fixed assets is reflected in accounting as the debit of account 08 (if you bought fixed assets) or 07 (if you bought equipment that requires installation).

Step 2. Put fixed assets into operation

The second stage is the acceptance of the OS for accounting in 1C 8.3 - commissioning. A fixed asset ready for operation is placed on the balance sheet on the basis of a transfer and acceptance certificate. For this purpose, create a document “Acceptance for accounting of fixed assets”. To do this, go to the section “Fixed assets and intangible assets” (8) and click on the link “Acceptance for accounting of fixed assets” (9).

In the window that opens, click the “Create” button (10). The “Acceptance for accounting of fixed assets” window will open.

In the upper section of the “Acceptance for accounting with OS” window (11), fill in the fields:

- "Organization";

- "Type of operation." In this field, you can select one of three values: “Equipment”, “Construction objects” or “Based on inventory results”;

- "OS Event". In this field, select the appropriate operation from the list, for example, “Acceptance for accounting with commissioning”;

- "MOL." Specify the financially responsible person;

- "Location of OS". Indicate in which department the fixed asset will be operated.

The lower section of the window consists of five tabs (12):

- Non-current asset;

- Fixed assets;

- Accounting;

- Tax accounting;

- Depreciation bonus.

In the “Non-current asset” tab (13), indicate the appropriate “Method of receipt”, for example “Purchase for payment”. In the “Equipment” field, select from the “Nomenclature” directory the equipment that you are putting into operation. Also indicate the “Warehouse” where it is located. In the “Account” field, the accounting account in which the object was reflected upon receipt of goods will be automatically set (Step 1).

In the “Fixed Assets” tab (14), you need to create a new fixed asset object. To do this, click on the “Add” button (15), and then on “+” (16).

A window will open for filling in data on the fixed asset. In this window, fill in the fields:

- "Assets accounting group". In this field, you must select a suitable group from the list, for example, “Machinery and equipment (except office)”;

- "Name";

- "Full name".

In the “Accounting” tab (19) indicate:

- "Accounting procedure". Specify “Depreciation”;

- "Method of calculating depreciation." Here, select the depreciation method for the object, for example linear;

- “Method of reflecting depreciation expenses.” In this reference book, indicate in which accounting account depreciation should be calculated;

- "Useful life (in months)." Here, indicate how many months the fixed asset will be depreciated in accounting.

In the “Tax Accounting” tab (20), fill in:

- “The procedure for including costs in expenses.” Here you can select one of the methods from the list, for example, “depreciation calculation”;

- "Useful life (in months)." In this field, fill in how many months the object will be depreciated in tax accounting.

All data for commissioning the fixed asset has been completed. Now you can save and post the document. To do this, click “Record” (21) and “Pass” (22). Fixed assets in 1C 8.3 Accounting are registered. The fixed asset was put into operation, and entries were made in the accounting records to debit account 01 “Fixed Assets”.

Let's consider the first example, where we will take into account an asset costing less than 100,000 rubles. enterprise on the general taxation system (OSNO).

Let’s say the organization Trading House “Complex” purchased an HP LaserJet Pro 500 color MFP M570dw laser color MFP for 67,956 rubles. We are faced with the task of taking this OS into account in the 1C 8.3 database.

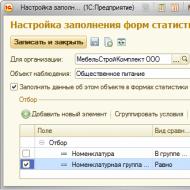

First, let’s create the document Acceptance for accounting of fixed assets: in the menu OS and intangible assets open the section Acceptance of fixed assets for accounting:

Click the Create button:

Fill in the date of acceptance for accounting of the fixed assets; we select a financially responsible party (MOL) and the location of the property.

In the Non-current assets section, we record the method of receipt of fixed assets, select the multifunctional device from the product group, and indicate the storage warehouse:

Go to the bookmark Fixed assets, press the button Add:

Select the desired OS object. If the required OS is not in the nomenclature list, then we create a new one. Fill in the name and asset accounting group by selecting the OKOF code. The depreciation group in 1C 8.3 will be filled in automatically:

Let's go to the Accounting tab: enter an account where the fixed assets and accounting procedure will be taken into account. The fixed asset has a cost of more than 40,000 rubles, so it is necessary to calculate depreciation in accounting. Check the Accrue depreciation box and indicate the accrual account. Let for this enterprise expenses be charged to account 20.01 - main production in a linear manner for 5 years:

For tax accounting, property worth 100,000 rubles. and less purchased after 01/01/2016 are taken into account as part of fixed assets and are not considered depreciable. The costs of purchasing such property are taken into account immediately as part of material costs.

On the bookmark Tax accounting in the line The procedure for including costs in expenses choose Inclusion in expenses when accounting for:

Dt/Kt. In our case, the enterprise does not apply PBU 18/02 “Accounting for calculations of corporate income tax.” Therefore, the wiring will look like this:

- In accounting, acceptance of fixed assets for accounting – Dt 01.01/Kt 08.04;

- In tax accounting, it is also included in expenses - Dt 20.01/Kt 01.01:

If an organization applies PBU 18/02, then permanent differences in the value of an object accepted for accounting will be reflected in tax accounting entries with a minus. Thus, entries Dt 20.01/Kt 01.01 reflect the cost of fixed assets not recognized as depreciable, removed from tax accounting:

How to set depreciation parameters for accounting and tax accounting in 1C 8.2 (8.3) under OSNO, when depreciation for tax accounting is calculated according to the provisions of Chapter 25 of the Tax Code of the Russian Federation, see our video lesson:

How to capitalize fixed assets worth more than 100,000 rubles.

Let's look at the second example.

Let’s say that the organization Trading House “Complex” under OSNO accepts for accounting a Toyota Camry passenger car for 600,000 rubles, VAT 18%.

We fill out the document Acceptance for accounting of fixed assets in the same way as the first example considered:

On the Tax Accounting tab, in the line Order of inclusion in expenses, select Accrual of depreciation. We check the Accrue depreciation checkbox and indicate the useful life of the OS - 84 months:

We post the document and analyze its movement using the Dt/Kt button. In accounting and tax accounting, the entries will have the following form: accounting for fixed assets - Dt 01.01/Kt 08.04 for the amount net of VAT - 508,474.58 rubles:

Acceptance of fixed assets for accounting under the simplified tax system

For the simplified taxation system (STS), a special accounting of fixed assets (FA) and a document are used Acceptance of fixed assets for accounting filled in differently.

When applying the simplified tax system, depreciation of fixed assets for tax purposes is not charged, and expenses for twelve months are accepted in a special manner. For expenses to be accepted, the debt to the supplier must be repaid.

Expenses can begin to be written off from the last day of the quarter (March 31, June 30, September 30, December 31) in which the OS was put into operation. At the end of the year, the purchased OS must be completely written off.

- In the first quarter, expenses are recognized at a quarterly rate;

- If in the second, then one third for three quarters;

- If in the third quarter, then half the amount for two quarters;

- If in the fourth quarter, then the entire amount is recognized at a time.

If the fixed asset has not been paid in full, then the paid share will be taken into account in proportional shares during the remaining reporting periods of the year after the payment date.

Let's consider the third case.

Let’s say that the organization Garant-Service LLC uses the simplified tax system (income minus expenses) to take into account a Lenovo laptop worth 95,000 rubles.

We fill out Acceptance for accounting of fixed assets in the same way as the first example considered:

After filling out the sections Fixed Assets and Accounting, we move on to Tax Accounting (STS). We indicate the cost of the fixed asset, the date of its acquisition and useful life. The procedure for including costs in expenses – Include in expenses. In the Payment subsection we enter the amount and date of payment accepted for accounting of the fixed assets:

We navigate the document and analyze its movement by button Dt/Kt. In accounting, the entries will be generated: acceptance of fixed assets accounting – Dt 01.01/Kt 08.04:

It is worth remembering that only those individual entrepreneurs or organizations whose residual value of depreciable fixed assets does not exceed one hundred million rubles can apply the simplified tax system.

For more information on how to avoid mistakes when determining the costs of purchasing an operating system for tax accounting when applying the simplified tax system, the object “income minus expenses” in 1C 8.2 (8.3) can be seen in our video:

Entering fixed asset balances in 1C using the example of a car

Let's consider one more case. Often, the commissioning of an OS object occurs before the enterprise begins to use any software products for accounting.

Let’s say Garant-Service LLC 01/01/2015. purchased and put into operation a ŠKODA Rapid car worth RUB 622,000. To start working with the 1C Enterprise Accounting 8.3 database as of December 31, 2015. the enterprise needs to enter the initial balances of the operating system.

We use the Balance Entry Assistant:

Install balance entry date: 12/31/2015 and press the button Enter account balances, by selecting account 01 Fixed assets:

Press the button Add. We create an OS object - a ŠKODA Rapid car. Fill in the name and asset accounting group – Vehicle. We select the code, and the depreciation group in 1C 8.3 is filled in automatically.

On the Initial balances tab, indicate the initial cost of the car - 622,000 rubles. and Accumulated depreciation - the amount of accrued depreciation from the moment the vehicle was put into operation - RUB 124,400.

For this enterprise, fixed assets depreciation expenses are charged to account 26 General business expenses:

On the bookmark Accounting fill out the MOL, the useful life of the OS is 60 months and check the box - Calculate depreciation:

Next bookmark Tax accounting. We fill in: the initial cost of the car, the date of its purchase is 01/01/2015. and useful life - 60 months:

On the bookmark Events fill in the date of registration of the ŠKODA Rapid car with commissioning, as well as the name and number of the document confirming the operation:

Click on the button Record and close. Now the balance appears in the assistant for entering initial balances:

- Dt on account 01.01– 622,000 rubles;

- CT on account 02.01 – 124,400 rubles:

Let's calculate the amount of depreciation for January 2016. for the ŠKODA Rapid car, through the Closing of the month. To do this, in 1C 8.3, in the Operations menu, open the Month Closing section:

In field Period indicate the month of depreciation calculation - January. We forward the documents a month in advance and carry out the operation

Fixed assets are those assets that are used as labor tools for more than 12 months and cost more than 100,000 rubles.

Accounting for fixed assets in 1C 8.3 is 100% automated. First, in 1C Accounting for the operating system, it is drawn up. Next, they are accepted for accounting and assigned an inventory number.

The developers of 1C:Accounting 3.0 have reduced this operation to the execution of one document - “Receipts (acts, invoices)” with the type of operation “Fixed Assets”. In this case, there is no need to create . All transactions, both on receipt and on acceptance for accounting, are created by one document - receipt.

Let's look at step-by-step instructions for accounting for OS in 1C 8.3.

In the “Fixed assets and intangible assets” menu, select “Receipt of fixed assets” and create a new document.

In the header you must indicate the organization, counterparty and agreement. Set up the way to reflect depreciation and VAT expenses. If you are going to rent out the property in the future, check the appropriate box.

In the tabular part of the document, list the required fixed assets. Remember that if you buy several identical objects (for example, 3 machines), then in the “Fixed” assets directory and in this tabular section you should have 3 different positions with different inventory numbers.

The tabular part also indicates VAT, accounts (accounting, depreciation, VAT) and service life in months.

Or watch the video:

OS depreciation in 1C 8.3

Let's look at depreciation using the example of month-end closing. In the "Operations" menu, go to the "Month Closing" item.

Please note that setting up depreciation rules and methods is configured in . Depreciation is calculated every month, starting from the month following the acceptance of the asset for accounting.

When performing a routine operation on depreciation and wear and tear of the operating system, a posting was generated in the amount of 2950 rubles. The settings indicate the linear method of calculating depreciation. The lathe in our example has a service life of 60 months. Depreciation is calculated by the cost of the asset divided by its service life. Everything was calculated correctly.

An example of depreciation is discussed in this video:

Other accounting documents

The “Fixed Assets and Intangible Assets” menu also contains other documents on the receipt and accounting of fixed assets. For example, modernization, lease, transfer for installation and others. There is nothing difficult about filling them out.

Introduction

The main regulatory documents regulating the accounting of fixed assets are the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by the Order of the Ministry of Finance of the Russian Federation dated March 30, 2001. No. 26n (hereinafter referred to as PBU 6/01) and Federal Law of December 16, 2011. No. 402-F3 “On accounting.”

To accept assets for accounting as fixed assets, the following conditions must be simultaneously met:

1) use in the production of products, when performing work or providing services, or for the management needs of organizations;

2) use for a long time, i.e. useful life exceeding 12 months or normal operating cycle if it exceeds 12 months;

3) the organization does not intend to subsequently resell these assets;

4) the ability to bring economic benefits (income) to the organization in the future (clause 4 of PBU 6/01).

Fixed assets include: buildings, structures, transmission devices, working and power machines and equipment, measuring and control instruments and devices, computer technology, vehicles, tools, production and household equipment and accessories; working, productive and breeding livestock, perennial plantings, on-farm roads and other relevant facilities.

The following are also taken into account as part of fixed assets: land plots; environmental management objects (water, subsoil and other natural resources); capital investments for radical improvement of land (drainage, irrigation and other reclamation works); capital investments in leased fixed assets, if, in accordance with the concluded lease agreement, these capital investments are the property of the lessee.

Fixed assets do not include: machinery, equipment and other items listed as finished products in the warehouses of manufacturing organizations, as goods - in the warehouses of organizations engaged in trading activities; items handed over for installation or to be installed that are in transit; capital and financial investments.

Accounting for fixed assets is carried out for the purposes of:

1) formation of actual costs associated with the acceptance of assets as fixed assets for accounting;

2) correct execution of documents and timely reflection of the receipt of fixed assets, their internal movement and disposal;

3) reliable determination of the results from the sale and other disposal of fixed assets;

4) determining the actual costs associated with the maintenance of fixed assets (technical inspection, maintenance, etc.);

5) ensuring control over the safety of fixed assets accepted for accounting;

6) conducting an analysis of the use of fixed assets;

7) obtaining information about fixed assets necessary for disclosure in the financial statements.

Accounting for fixed assets in the program "1C: Enterprise 8.2"

1.1. Arrival of wasps

To perform the “Receipt of fixed assets” operations, you need to create a document “Receipt of goods and services”. As a result of this document, the corresponding transactions will be generated.

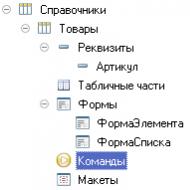

Creation of the document “Receipt of goods and services” (Slide No. 1):

Call from the menu: Purchases and Sales – Receipt of goods and services.

Document transaction type Equipment, then button OK.

Button Add.

Filling out the document “Receipt of goods and services” (Slide No. 2):

In field From indicate the date of capitalization of the fixed asset item.

In field Organization indicate the organization that receives the equipment.

In field Stock indicate the warehouse to which the equipment will be posted.

In field Counterparty indicate the equipment supplier.

In field Agreement indicate the equipment supply agreement.

On the bookmark Equipment add a new line (button Add).

In field Nomenclature indicate the type of equipment to be received, select it from the directory "Nomenclature". If such equipment is not in the directory, add it to the group "Equipment (fixed assets)"

In field Quantity put 1 if there is one object.

In field Price indicate the price of the equipment.

Check the automatically calculated amount in the field Sum and adjust it if necessary.

In field % VAT indicate the VAT rate.

Check the automatically calculated VAT amount in the field Sum VAT and adjust it if necessary.

Check the automatically calculated amount Total.

Indicate the equipment account in the field Account(account 08.04).

Indicate the VAT account to which the VAT presented by the supplier will be charged (invoice 19.01).

Check the automatically specified equipment tax account in the field Account and correct it if necessary.

On the bookmark Accounts check the automatically specified settlement accounts with counterparties.

On the bookmark Additionally Enter the details of the document from the supplier through which the fixed asset was received: incoming number and date of the receipt document.

If the presented invoice is on the tab Invoice set the flag Invoice presented and fill out the document details.

Record and post the document – button OK.

Result of conducting the document “Receipt of goods and services” (Slide No. 3):

1) To view transactions, click the button The result of the document.

1.2 Acceptance of fixed assets for accounting

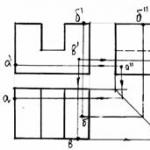

To perform the operation “Acceptance for accounting of fixed assets”, you need to create a document “Acceptance for accounting of fixed assets”. This document registers the fact of completion of the formation of the initial cost of a fixed asset item and (or) its commissioning. As a result of this document, the corresponding transactions will be generated.

The initial cost of the object, which is planned to be taken into account as fixed assets, is formed on account 08 “Investments in non-current assets”.

Before accepting an object for accounting as fixed assets, an accountant may have a question: what is the current established value of the object (taking into account all acquisition costs)? To obtain such information, you can use the report Balance sheet for account 08 (for this example - according to subaccount 08.03)

It is worth noting that subaccount 08.03 supports quantitative accounting (unlike account 01 “Fixed Assets”).

The unit of measurement of fixed assets is an inventory object, therefore, when purchasing several objects of the same type that are accounted for on account 08.03 in quantitative terms (for example: 3 computers were received), it is necessary to put into operation (accept for accounting) each object separately and assign it has a unique inventory number (for example: computer No. 1: inventory No. 000001; computer No. 2: inventory No. 000002; computer No. 3: inventory No. 000003).

In the example under consideration, the main product (ironing system) is supplied in the amount of 1 piece.

Creation of the document “Acceptance for accounting of fixed assets” (Slide No. 4):

Call from the menu: OS - Acceptance of fixed assets for accounting.

Click the button Add.

Select document transaction type Equipment, then the button OK.

Filling out the document “Acceptance for accounting of fixed assets” (Slide No. 5):

In field From indicate the date of commissioning (acceptance for accounting) of the fixed asset.

In field OS event leave the default value Acceptance for accounting with commissioning.

In field OS location select the department in which the fixed asset will be used.

Equipment. This opens the directory "Nomenclature".

Open the folder Equipment (fixed assets). Select object "Premium Furniture Set" double click.

Fields Stock And Check filled with default values, leave them unchanged.

Click the button Add In chapter Basic facilities. In this case, a line is added in the tabular section for entering information about the fixed asset.

Click the selection button in the field The main thing. This opens the directory "Fixed assets".

Click the button Add. A window appears for entering data about the new fixed asset.

In field Full name enter the full name (used on printed forms).

Fill in the fields Manufacturer, Serial number, Passport number, Date of issue (construction).

Click the selection button in the field OKOF. The directory appears All-Russian classifier of fixed assets, you must select the appropriate group for the fixed asset.

Click the selection button in the field OS accounting group and select the fixed asset category.

Click the selection button in the field Depreciation group and select the group corresponding to this fixed asset.

Click the button OK to save the entered data. Data on the tab Accounting And Tax accounting filled in automatically when posting a document “Acceptance for accounting of OS.”

Filling out a bookmarkAccountingdocument “Acceptance for accounting of fixed assets” (Slide No. 6):

Click the selection button in the field Accounting procedure Accrual depreciation.

Click the selection button in the field MOL. The directory opens Physical faces, in which it is necessary to select a financially responsible person.

Click the selection button in the field Method of admission and select the appropriate element, in our example we select Purchase for a fee.

In field Account indicate the account in which the fixed asset will be accounted for.

In field Depreciation account indicate the account in which depreciation will be accumulated. Attention! If depreciation is supposed to be charged, then the checkbox Calculate depreciation you need to install.

Click the selection button in the field Accrual method depreciation and select the method of calculating depreciation for accounting purposes.

Click the selection button in the field Methods of reflecting depreciation expenses. This opens the directory , in which you need to select the desired element or create a new one. In accordance with this method, depreciation entries will be generated in the future. To create a new way of reflecting depreciation expenses in the directory "Methods of reflecting expenses" you need to press the button Add and in the dialogue form that opens, indicate the cost account and analytics to which the costs of depreciation of fixed assets will be attributed (Slide No. 7).

In field indicate the period in months for accounting purposes.

In field Depreciation schedule by year an annual depreciation schedule for fixed assets is indicated (filled out only in organizations with a seasonal nature of production).

Filling out a bookmarkTax accountingdocument “Acceptance for accounting of fixed assets” (Slide No. 7):

Click the selection button in the field The procedure for including costs in expenses and select the appropriate element for tax accounting purposes, in our example we select Depreciation calculation.

Check the box Calculate depreciation. If tax accounting does not require depreciation to be calculated, the checkbox must be unchecked.

In field Useful life (in months) indicate the period in months for tax accounting purposes.

In field Special coefficient indicate the coefficient (increasing or decreasing) if it is not equal to 1.00.

In field Include bonus depreciation as expenses The checkbox is checked if the accounting policy provides for the use of the right to bonus depreciation. For the example under consideration it is not installed.

To call a printed form for the act of acceptance and transfer of fixed assets OS-1, use the button Form OS-1.

The result of the document “Acceptance for accounting of fixed assets” (Slide No. 8):

In addition to accounting and tax accounting entries in the window Result of the document(Slide No. 8) you can check the data entered into various program registers when accepting a fixed asset for accounting. To do this, you need to go to the appropriate bookmarks.

Fixed assets are inventory assets worth more than a certain amount (constantly increasing) and whose useful life is more than a year.

Fixed assets include buildings, structures and other real estate, construction projects, equipment, power lines, pipelines, and so on.

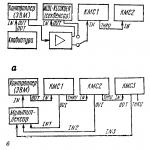

In the 1C 8.3 system, several separate sections are allocated for accounting of fixed assets, which contain all the necessary operations for full-fledged work on this topic:

- Chapter " Receipt of fixed assets". In this section, documents are created that are included in the cost of fixed assets. Also in this section 1C is drawn up.

- In chapter " Fixed Asset Accounting» You can create documents reflecting the movement and inventory of fixed assets.

- Chapter " Disposal of fixed assets» contains documents on the write-off and transfer of fixed assets.

- Chapter " Depreciation of fixed assets» is responsible for depreciation calculations and accruals.

In this article, using a step-by-step example as a step-by-step instruction, we will look at the main operations related to accounting for fixed assets in 1C 8.3.

Receipt can be in the organization () and in leasing. In this article, we will consider accounting for acquired fixed assets.

So, let's create a document for capitalization of the OS. I will not dwell in detail on the creation of the admission document, since there is information on this topic. I will give just an example of a completed document to make it easier to move on:

Receipt of additional expenses for the operating system

The initial cost of equipment and other fixed assets is formed at the acquisition stage not only from the purchase price, but also from installation costs and other expenses associated with the acquisition.

Therefore, it is worth considering two documents:

- Transfer of equipment for installation.

You can create them in the section “Fixed assets and intangible assets” - Receipt of fixed assets. As usual, documents are created by clicking on the “Create” button. In the header of the document, fill in the standard details - Organization and Counterparty.

In the tabular section, in the “Main” tab, the amount of additional costs is indicated:

On the “Products” tab, the fixed asset item is indicated, the cost of which includes these expenses:

Our video about the receipt of additional expenses in 1C Accounting:

Get 267 video lessons on 1C for free:

Transfer to installation

In this document we will fill in the following details:

- Organization.

- Stock.

- Construction object.

- Cost item.

Let's add equipment to the table part:

The above documents must be created before the fixed asset is accepted for accounting.

How to register and put into operation an OS

This procedure has also already been described by me earlier. I will not describe it again, I will only show how the document is filled out and say that as a result of posting the document, the equipment is transferred from account 08.04 to account 01.01.

Non-current asset tab:

OS tab:

Depreciation in transactions will be charged to account 02.01:

Our video about the receipt and acceptance of fixed assets for accounting in 1C 8.3:

Moving the OS to 1C

The movement of a fixed asset is very similar to the movement of goods, only the goods are moved between warehouses, and the fixed asset is moved between departments (after all, we have already taken it into account).

When preparing a document, only the details “Accrual of depreciation” and “Method of recording depreciation expenses” may raise questions.

These details should be indicated if depreciation needs to be calculated after the move. We will leave them empty and charge depreciation at the end of the month:

Inventory of fixed assets

Inventory of fixed assets in 1C is practically no different from inventory of goods, only, again, instead of a warehouse we indicate a division (more details about goods in the article). In the tabular section, instead of quantity, we indicate the presence of a fixed asset:

If a fixed asset is not listed in accounting, but in fact it is, a document of acceptance for accounting is made based on the inventory, and vice versa, if it is actually missing, we write off.

Here, in addition to the standard fields, we indicate the reason why the fixed asset is written off:

We will not post the document, since we will still need the fixed asset to consider the depreciation operation.

Depreciation of fixed assets

Calculation and recording in accounting is done using the month closing assistant. The operation is performed once a month and, as a rule, at the end:

To open the assistant, you need to go to the “Operations” menu, then follow the link “ “. The assistant window will open immediately. In it you need to select a period and organization. Then the assistant will do everything himself. All calculations in the assistant are made sequentially, and depreciation deductions are calculated first. If the operation went through without errors, a document for the routine operation “Depreciation and depreciation of fixed assets” will be created: