1 with calculation of average earnings. Calculation of average earnings for vacations, business trips, severance pay and in other cases of maintaining average earnings

As usual, the reason for writing this article was a problem that we had to solve: a document behaved strangely in the 1C: Salary and Personnel Management 2.5 database Accrual of vacation to employees of organizations. Namely, for some employees the average salary was calculated normally, but for others it was zero, although these employees definitely received wages for the entire year. But first things first.

What is average earnings and when does it apply?

Average earnings are the average salary of an employee for a certain period of time. It is used when paying:

- sick leave;

- maternity benefits, child care benefits up to 1.5 years;

- vacation pay and compensation for unused vacation;

- for days of blood donation, days off to care for a disabled child, etc.

We will leave the detailed methodology for calculating average earnings outside the scope of this article, but note that average earnings are calculated differently, depending on the purpose for which it is calculated. Next you will see how this is implemented in 1C: Salary and HR Management

Mechanism for calculating average earnings in 1C: Salaries and personnel management

To calculate average earnings in 1C: Salaries and personnel management, the following objects exist:

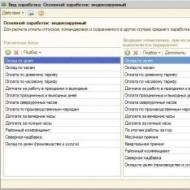

- plan of calculation types Average earnings(available via menu ).

- calculation register Calculation of average earnings.

The calculation register stores information about the calculated average earnings for each period by employee and type of calculation (average earnings can take into account not only salary, but also bonuses, vacation pay, travel allowances, etc.). In terms of calculation types, information is stored about what types of calculation are used when calculating average earnings in various situations (see figure).

Why is average earnings not calculated in 1C: Salaries and personnel management

In our case, the average earnings were calculated, but were equal to zero. After examining the database, it turned out that users had added a calculation type Salary by day (production and services), which was used to calculate wages for individual employees. However, this calculation type was not added to the calculation types plan Average earnings, which means these payments were not taken into account when calculating average earnings.

In our case, the employee had no other payments, so the error was obvious - zero average earnings. However, situations often arise when the calculation does not include earnings that are not the only one. In this case, the average earnings will be calculated, the employee will receive vacation pay or sick leave, but the amount will be underestimated, because Not all payments were taken into account.

For example, an employee receives his basic salary according to a predefined type of calculation Salary by day, and an additional bonus - according to the type of calculation created by the user. There is a predefined type of calculation in terms of calculation types (if it has not been removed), but the bonus will have to be added manually, otherwise the calculation of average earnings will be erroneous.

How to add an accrual to the calculation of average earnings

- Open plan of calculation types Average earnings(available via menu Payroll calculation by organization - Payroll settings - Average earnings).

- Select the required section and open it.

- Add a calculation type to 2 columns at once: Calculation base And Leading accruals. The first column shows that the amounts for this type of calculation will be taken into account when calculating average earnings, and the second column shows that it is necessary to recalculate the average earnings when the accrued amounts change.

If you encounter other errors when calculating average earnings in 1C: Salary and HR Management, we will be grateful for this information in the comments. The article will be updated.

The ZUP configuration version 3.1, developed by 1C, has comprehensive tools for the effective operation of the personnel department of a company of any size. In this article, we will take a closer look at how to use ZUP to carry out such a common operation as calculating business trips for employees. According to the law, we are dealing with an employee working in a non-permanent position, which is a non-standard situation that requires a special payment system.

Travel allowances in 1C ZUP 8.3

To fill out a business trip order and calculate the corresponding accrual in ZUP 3.1, the document “Business trip” is used, which we will open through the menu “Human Resources / All employee absences”.*

Figure 1. Personnel records and calculation of business trips in ZUP

*Also, a “Business trip” can be created from the log of relevant documents in the “Personnel/Salary” section.

In the expanded list, select “Create” and the document type “Business trip”:

Figure 2.Creation of travel allowances in 1C ZUP 8.3

The standard document we are considering is designed for registration, calculation and subsequent payment of travel allowances. Using it, you can print the corresponding printed forms:

- Direction order (T-9);

- Certificate (T-10);

- Service assignment (T-10a);

- Calculation of average earnings;

- Detailed calculation of charges.

Figure 3. Printable forms of the “Business trip” document

To create business trips for several employees at once, use the corresponding document. To create it, in the same section “Personnel/All absences of employees”, by clicking “Create”, select “Group trips”. After filling out the header and tabular part of the document with employees for whom business trips are issued, based on it, you can automatically create a “Business Trip” directly for each employee. To do this, you need to use the “Register absences” link, which is located at the bottom of the document.

Filling out the “Business trip” document

The accrual will be reflected in the month indicated in the header of the document. For output to printed forms, the date and document number are used. The number is generated automatically when recording a document. The organization prefix is added to the beginning, then the base prefix and the actual next sequential number. Prefixes are set for the convenience of distinguishing documents entered in different organizations or databases.

If prefixes are not specified, then when generating the number, zeros are set instead. To calculate, you must indicate the start and end of the trip. This period includes the days the employee is on the road. Travel allowances in 1C ZUP 8.3 are paid for days or hours that are working hours, according to the schedule established by the employee.

When maintaining the staffing table in the ZUP, by checking the appropriate box, you can release the rate for the period of absence of the employee. In this case, in staffing reports, the rate will be shown as free, and it will also be possible to hire another employee at this rate.

If a business trip is issued to an employee who is employed in the organization at the main place of work, as well as part-time, it is required to register the absence of all the employee’s jobs. To do this, the document form contains a link “Absences from other places of work.”

Figure 4. Rate exemption when calculating travel allowances in ZUP 3.1

In case of a long business trip, you can choose different types of payment:

- Pay immediately and in full – payment will be fully charged in the current document;

- Pay for your stay on a business trip monthly.

Figure 5.Payment for long-term travel allowances in ZUP 8.3

The document is calculated automatically. If automatic recalculation of documents when editing them is disabled, then to calculate the document you must manually click the arrow button. The yellow color of this button indicates that the document has not been recalculated in accordance with the changes made to it. The calculation results area shows a summary of the calculations for this document. This data is provided for viewing purposes only.

If you need to view or edit detailed records of accruals or recalculation, use the “Accrued (detailed)” tab:

Figure 6. Result of accrual of travel allowances in 1C ZUP 8.3

According to the conditions specified on the “Main” tab, the accrual for payment of a business trip is calculated: the number of paid days or hours of a business trip is multiplied by the average daily or average hourly earnings.

Business trips are paid by the hour for employees with a schedule of summarized working hours or by day from the average daily earnings.

Work with the calculation results is carried out in the same way as with “Calculation of salaries and contributions”.

Calculation of business trips in ZUP 3.1 based on average earnings

To calculate the average earnings, we take the last 12 months. When it becomes necessary to view or adjust the average earnings calculation, you can use the “Change average earnings calculation data” button:

Figure 7.Checking the calculation of average earnings

To display the average salary for the period manually, enter the required dates, click “Set manually” and “Recalculate”.

How to reflect a business trip on a day off in 1C ZUP

An employee may be and work on a business trip on a weekend or holiday, which, according to the law, leads to the need for additional payment. In 1C ZUP, you can reflect a business trip on a weekend, that is, the fact of working on such a day and the need to pay for it, in a separate document “Work on weekends and holidays”:

Figure 8. Calculation of business trips when working on a day off

After posting the document, employees are automatically calculated double pay for work on holidays and weekends by day or hour, depending on the parameters of the main payroll document.

Payment of travel allowances

To pay travel allowances, you must create a pay slip. You can create a statement directly from the “Business Trip” document using the “Pay” button:

Figure 9. Payment for business trips to ZUP

In the event that travel allowances will be paid during the interpayment period, this must initially be indicated in the “Business Trip” document. In the transfer statement, select “Pay/Trips”, and then select the basis document from the list of available trips.

We talk about the nuances of calculating average earnings and give examples of setting up the base for calculating average earnings in “1C: Salary and Personnel Management 8” edition 3.

In cases determined by the legislation of the Russian Federation, the employee must be paid in the form of average earnings, and not wages. The procedure for calculating the average salary for sick leave and, for example, business trips and vacations, differs. 1C experts clarify what you need to know about calculating average earnings in accordance with Decree of the Government of the Russian Federation of December 24, 2007 No. 922 for cases provided for by the Labor Code of the Russian Federation, and also provide examples of setting up the base for calculating average earnings in “1C: Salary and Personnel Management 8” edition 3 and the impact of deviations from the employee’s work schedule on the calculation.

In what cases is average earnings calculated?

The term “average earnings” is used in regulatory documents to describe calculation rules in different cases. Sick days, vacations, business trips and others are paid based on average earnings. At the same time, average earnings are calculated in different ways. Thus, Federal Law No. 255-FZ dated December 29, 2006 and Government Decree No. 375 dated June 15, 2007 determine the procedure for calculating benefits for temporary disability, pregnancy and childbirth, and child care until the child reaches 1.5 years of age.

The general rules for calculating average earnings for cases where an employee was not at work, but according to the Labor Code such earnings were retained, are established in Article 139 of the Labor Code of the Russian Federation.

The calculation procedure is defined in Decree of the Government of the Russian Federation dated December 27, 2007 No. 922 (hereinafter referred to as Decree No. 922).

This article discusses the calculation of average earnings in accordance with Article 139 of the Labor Code of the Russian Federation and Resolution No. 922.

This resolution defines a different procedure for calculating average earnings for two cases:

1. Vacation and compensation for unused vacation.

2. Other cases provided for by the Labor Code of the Russian Federation (except for cases of determining the average earnings of workers for whom a summarized recording of working time is established).

Cases named in the Labor Code of the Russian Federation when average earnings are maintained:

- business trip (Article 167 of the Labor Code of the Russian Federation);

- passing a medical examination (Article 185 of the Labor Code of the Russian Federation);

- transfer of an employee to another job (Articles 72.2 and 182 of the Labor Code of the Russian Federation);

- donation of blood and its components (Article 186 of the Labor Code of the Russian Federation);

- employee participation in collective bargaining (Article 39 of the Labor Code of the Russian Federation);

- failure to comply with labor standards, failure to fulfill labor (official) duties through the fault of the employer (Article 155 of the Labor Code of the Russian Federation);

- etc.

The Labor Code of the Russian Federation establishes a non-closed list of cases of maintaining average earnings.

The formulas for calculating average earnings are different for the first and second cases, but in each of them you need to know the billing period, the number of days worked in the billing period, and the actual earnings of the employee received in the billing period.

Billing period

In general, the billing period consists of 12 months preceding the month in which average earnings were maintained (clause 4 of Resolution No. 922).

In accordance with Article 139 of the Labor Code of the Russian Federation, the employer may establish a different pay period if this does not worsen the situation of employees.

In the program "1C: Salary and Personnel Management 8" edition 3 in documents registering days of payment based on average earnings (for example, Vacation, Business trip), there is a pencil icon - Change data for calculating average earnings(Fig. 1).

Rice. 1. Changing the billing period

When you click on it, a window opens Entering data to calculate average earnings. Switch Calculation period of average earnings provides the ability to select a period: Standard, determined automatically And Set manually.

If local regulatory documents provide for a billing period other than 12 months, then when working with such documents in the program, the user should independently control that Average earnings, calculated according to the manually set billing period, was no less than according to the standard one. It is convenient to carry out control in the form , moving the switch.

The billing period includes the time of actual work. If, for example, an employment contract with an employee was concluded less than 12 months before calculating average earnings, then in the standard calculation period (12 previous months) the time before hiring will be excluded.

That is, the billing period does not change, but unworked time is allocated in it. The list of excluded periods is defined in paragraph 5 of Resolution No. 922.

Thus, the time when the employee:

- received average earnings (excluding breaks to feed the child);

- was on maternity leave and sick leave;

- did not work due to downtime due to the fault of the employer or due to circumstances beyond the control of the parties;

- could not work due to a strike in which he did not participate;

- used additional paid days to care for a disabled child;

- in other cases, he was released from work with full or partial retention of earnings or without it.

The 1C: Salary and Personnel Management 8 program, edition 3, provides for the exclusion of such periods.

Setting up excluded periods is carried out in the calculation type card (menu Settings - Accruals) on the tab Average earnings.

If the flag is not established, then the period and earnings for this period are excluded from the calculation of the average.

When there are no days worked in the billing period, the calculation is made based on the current month.

For example, a business trip or vacation occurs in the month when an employment contract was concluded with the employee. In the shape of Entering data to calculate average earnings button Add according to payroll data fills in the data for calculating average earnings with information from the current month.

Actual earnings

When calculating average earnings, the employee’s actual earnings include all types of payments provided for by the remuneration system and accrued to the employee in the billing period, regardless of the source of funds. In other words, the calculation of the average includes all payments established by the employer in the remuneration system as wages.

In addition, the following are included in the calculation:

- allowances and additional payments to tariff rates and salaries for professional skills, experience, knowledge of a foreign language, combining professions, increasing the volume of work, etc.;

- payments related to working conditions (regional coefficients, additional payments for work in harmful, dangerous and difficult conditions, for working overtime at night, on days off);

- bonuses and remunerations provided for by the remuneration system, fixed in local regulations;

- other types of wage payments from the employer.

note, one-time bonuses that are not included in the remuneration system do not participate in the calculation of average earnings. In the program "1C: Salaries and Personnel Management 8" edition 3, all types of calculations that have Purpose of accrual - Bonus, are necessarily included in the calculation of average earnings.

Flag Include in the accrual base when calculating average earnings in the calculation type card on the tab Average earnings for such accruals is set by default and is not available for switching. For bonuses that are not included in average earnings, new types of calculation should be created with Purpose of accrual - Other accruals and payments.

Calculation of average earnings for...

...all cases except holidays

The calculation of average earnings for all cases, except vacation, is made using the same formula, but depends on the remuneration system, more precisely, on the method of time recording.

If an employee is set to a summed working time regime, then the calculation is carried out by the hour, and the average hourly earnings of the SCHZ are calculated using the formula:

SchZ = ZP / FHF,

Where:

HPF- actual time worked in hours;

Salary- earnings accrued to the employee for the pay period.

If an employee does not have a summed working time regime, then the calculation is carried out by day and the average daily earnings SDZ is calculated using the formula:

SDZ = ZP / FVd,

Where FVd- actual time worked in days.

To calculate the average earnings for the period, in this case, the average daily earnings are multiplied by the payable time on the employee’s schedule in days.

However, not in all cases the time subject to payment is calculated according to the schedule. The exception is payment for donor days. In letters dated 03/01/2017 No. 14-2/ОOG-1727 and dated 10/31/2016 No. 14-2/B-1087, the Russian Ministry of Labor explained that payment for days of donating blood and its components should be made based on an eight-hour working day, regardless of the schedule employee.

...vacations

When calculating average earnings for the purpose of calculating vacation, regardless of the method of recording working time, accounting is carried out by day.

The average daily earnings of SDZ is calculated according to the formula:

SDZ = Salary / 29.3 x Month + Dnep,

Where:

Months- number of complete calendar months worked;

Dnep- the number of days in incomplete calendar months, calculated by the formula:

Dnep = 29.3 / CD x OD,

Where:

KD- number of calendar days in a month;

OD- number of days worked.

Examples of the impact of deviations from the work schedule on the calculation of average earnings

Let’s consider how the calculation of an employee’s average earnings is affected by deviations from his work schedule, for example, due to being on vacation, a business trip, etc.

Example 1

When calculating vacation (Fig. 2), the average daily earnings amounted to 1,022.68 rubles. (RUB 358,571.43/350.62 days). In November, one day was not worked, and earnings amounted to 28,571.43 rubles. The month of November is not fully taken into account - 28.32. In total, 358,571.43 rubles were accrued for the billing period. and 350.62 days are taken into account.

Rice. 2. Calculation of average earnings for vacation, Example 1

When calculating a business trip (Fig. 3), the average daily earnings amounted to 1,451.71 rubles. (RUB 358,571.43 / 247 days). In total, 358,571.43 rubles were accrued for the billing period. and 247 days worked were taken into account.

Rice. 3. Calculation of average earnings for a business trip, Example 1

Example 2

When calculating vacation (Fig. 4), the average daily earnings amounted to 1,019.83 rubles. (358,571.43 rubles / 351.6 days), which is less than in Example 1. The fact is that the time off affected the employee’s earnings - in November 28,571.43 rubles were accrued, as with any other absence . But time off does not reduce the number of days worked, and the month is considered fully worked. In total, 358,571.43 rubles were accrued for the billing period. and 351.6 days were taken into account.

Rice. 4. Calculation of average earnings for vacation, Example 2

However, when calculating a business trip, time off is not included in the number of days actually worked, and the average earnings are 1,451.71 rubles, as in Example 1 (see Fig. 3).

Example 3

When calculating vacation (Fig. 5), the average daily earnings amounted to 1,032.18 rubles. (362,914.98 rubles / 351.6 days), which is more than in Example 1. The fact is that working on a day off affected the employee’s earnings - 32,914.98 rubles were accrued in November. But working on a day off does not change the fact of a fully worked month, and a coefficient of 29.3 is used for calculation. In total, 362,914.98 rubles were accrued for the billing period. and 351.6 days were taken into account.

Rice. 5. Calculation of average earnings for vacation, Example 3

When calculating a business trip, working on a weekend increases the days actually worked, and the average earnings are 1,457.49 rubles. (RUB 362,914.98 / 249 days). In total, 362,914.98 rubles were accrued for the billing period. and 249 days worked were taken into account (Fig. 6).

Rice. 6. Calculation of average earnings for a business trip, Example 3

From the editor. Get even more information about the rules for calculating average earnings, about accounting for bonuses, about the indexation of average earnings when salaries increase, about the provisions on calculating average earnings in local documents, and also get acquainted with other examples of calculating average earnings in the 1C: Salary and Personnel Management program 8" edition 3 can be found from

ATTENTION: similar article on 1C ZUP 2.5 -

Hello, dear visitors. Today we continue to analyze the features of accounting in ZUP 8.3 and in the next publication in a series of articles with step-by-step description of working in ZUP 3.1 (3.0) for beginners(the entire series of articles is available) we will talk about the basics of calculating salaries in the program and preparing data for this calculation. Let's look at specific examples of how in the document " Calculation of salaries and contributions" Salaries will be automatically calculated taking into account established planned accruals, work schedules, deductions and absences of employees. We will also analyze the features of calculating time worked and calculating wages based on the formulas specified in the types of calculation.

✅

✅

From 10/01/2016 we will hire an employee – Sidorov S.A. In the document Recruitment the employee must indicate the work schedule according to which he will work and assign planned accruals. They will be automatically calculated monthly (or at other intervals) when calculating salaries in the document “Calculation of salaries and contributions”. In ZUP 2.5, planned accruals were accrued exclusively on a monthly basis, and in the ZUP program version 3, it became possible to assign planned accruals that would be paid, for example, once a year or once a quarter. This frequency is determined in the settings of a specific accrual. I wrote in more detail about the differences between ZUP 2.5 and ZUP 3.1 (3.0) in a series of articles:

So, in our example, on the “Main” tab, we will set the employee’s work schedule - Five days. It is on the basis of the schedule when calculating wages that the standard time will be determined and the time actually worked will be determined by the displacement method. The standard time in October according to the Five-day schedule is 21 days / 168 hours.

On the “Payment” tab, we will assign a planned accrual to the employee - Payment at an hourly rate, and set the hourly rate to 300 rubles. In the settings of this type of accrual ( Payment at an hourly rate) it is indicated that this accrual is being carried out Monthly and the calculation will be made according to the following formula: TariffRateHourly*TimeInHours. We have already indicated the hourly rate for the employee, and the time in hours is actually the number of hours worked by the employee per month. The program will determine them automatically using the displacement method in the document during the final calculation, i.e. Hours of absence (sick leave, business trip, vacation, etc.) are excluded from the standard time according to the employee’s schedule.

In order for the accrual type to be available in the program Payment at an hourly rate it is necessary in the Settings section - Payroll calculation - link Setting up the composition of accruals and deductions, check the box - Application of hourly wages. I talked in more detail about all the settings in this section in the article.

At the same time, on October 10, 2016, two more employees are being hired by our organization. We will register their acceptance with one document Hiring by list(Section Personnel - document log Admissions, transfers, dismissals). Now let’s look at each employee individually and see what settings we set for them when they were hired.

Employee Ivanov A.M. assigned the same work schedule as in the previous example - Five days, but the planned accrual is Payment according to salary in the amount of 30,000 rubles per month.

In the settings of the accrual type “Payment by salary” it is established that this type of accrual is carried out Monthly and will be calculated according to the formula. We indicated the salary, this is the amount of 30,000 rubles, the share of part-time work (the number of rates for which an employee is hired) is equal to 1, because our employee is hired full time. Time in days is the actual number of days worked per month (in the same way, it is determined automatically by the program using the displacement method, as in the previous example, only in days), the norm of days is determined from the employee’s work schedule.

To the second employee - N.S. Petrov. set a work schedule Five days, type of planned accrual – Payment by salary (hourly).

Open the accrual type settings Payment by salary (hourly)— this accrual will be carried out Monthly and calculated using the formula Salary*TimeInHours/NormalHours. The only difference between this type of accrual and the previous one is that the proportion is calculated not in days, but in hours.

We will look at a more detailed calculation in the program using formulas for each employee a little later using a specific example when filling out the document. Calculation of salaries and contributions for the month, but for now we will continue to enter the necessary information for calculating salaries.

What documents in ZUP 3.1 (3.0) introduce planned accruals for employees?

✅

✅ CHECKLIST for checking payroll calculations in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll calculation in 1C ZUP 3.1

Step-by-step instructions for beginners:

According to the example, employee Sidorov S.A. from October 17, 2016, another type of planned accrual is assigned - Bonus percentage from his salary. What document in the ZUP3.1(3.0) program should reflect this fact? There are several options, let’s look at each of them and decide which one is best to use in our case. All these documents in the program are available in the section Salary - document log Changes in employee pay.

- Document Personnel transfer.

So, let's open the magazine Changes in employee pay and create a document Personnel transfer. Let's select an employee from the proposed list and indicate the date 10/17/2016 from which a new accrual is assigned. On the “Payment” tab, check the box Change charges, click the “Add” button and enter a new type of accrual, in this example it is Bonus percentage(10 %).

This document also provides for other possibilities, such as transferring an employee to another department or position/staffing unit, transferring to another work schedule, changing the right to leave, changing the method of calculating the advance payment. That is, it provides quite a lot of functionality and it is not advisable to use it only to enter a new type of planned accrual. You can use this document if we need a printed form of Transfer Order (T-5). In our example, the document Personnel transfer will not be used.

- Document Changes in wages.

Let's consider another option. Let's choose from a magazine Changes in employee pay document Changes in wages. In the same way, we will indicate the change date of 10/17/2016, select our employee from the proposed list, then check the box Change charges and by clicking on the “Add” button, enter a new accrual Bonus percentage. Accrual Payment at an hourly rate, assigned by the Hiring document, is loaded here automatically after selecting an employee. Using the “Cancel” button, you can cancel any of the assigned charges. (specifically in our example this is not required). Feature of the document Changes in wages is that it is intended to add or cancel planned accruals only for one employee.

- Document Changing planned accruals.

The document is also available in the ZUP 3.1 (3.0) program Changing planned accruals to enter or cancel random dialing planned accruals for any quantity employees.

- Document.

This document is for entry only one planned accrual, but for arbitrary number of employees. In the “Accrual” field, indicate the type of accrual that needs to be assigned, Bonus percentage, Appointment date – 10/17/2016, then click the “Selection” button and select S.A. Sidorova. Feature of the document Assignment of planned accrual is that we can assign an Accounting Account (a way to reflect wages in accounting) for a given planned accrual (Bonus percentage) for a given employee. In our example, we will not use this feature.

So, we reviewed several documents in the program with which you can add a new type of planned accrual to an employee. In our example, it is most logical to use the document Changes in wages, because We have only one employee, one new planned accrual and we do not change other working conditions for this employee (work schedule, position, department, etc.).

Let's review the document Changes in wages.

Assigning scheduled deductions

✅ Seminar “Lifehacks for 1C ZUP 3.1”

Analysis of 15 life hacks for accounting in 1C ZUP 3.1:

✅ CHECKLIST for checking payroll calculations in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll calculation in 1C ZUP 3.1

Step-by-step instructions for beginners:

Now let's look at what documents in 1C ZUP 3.1 (3.0) employees are assigned planned deductions. From the “Salary” section - in the journal Alimony and other deductions let's create a document Performance list. We will assign deduction according to the writ of execution to N.S. Petrov. from October 10, 2016, by selecting him from the proposed list of employees. We indicate that the calculation will be made as a percentage (15%) of the employee’s earnings, “Recipient” - Petrova M.S. In the settings of this document, you can also specify the method of calculation as a fixed amount or share of earnings, indicate whether or not to take sick leave into account for calculating the base, and indicate through which payment agent to transfer alimony.

Document Performance list does not charge anything, but only registers the conditions for calculating the withholding. The calculation of the assigned deduction will be made monthly when calculating the salary in the document Calculation of salaries and contributions(on the “Holds” tab), and a little later we will look at it with you.

For operational work, our organization uses cellular communications, but there is a certain limit on expenses for it. For employees who exceed this limit, a certain amount must be withheld from their salaries. In order for us to register this hold in the program, we will open the “Settings” section and create a new type of hold in the “Deductions” log: Cell phone withholding (over limit). In the settings, specify “Hold Destination” – Deduction against settlements for other transactions, “Hold in progress” – Monthly, “Type of salary transaction” - Deduction for other transactions with employees, retention rate – The result is entered as a fixed amount.

It is worth noting that the view that we assigned in the previous example is installed by default in the program, so we did not have to create it .

After we record (the “Record and close” button) a new type of deduction, in the journal Alimony and other permanent deductions it will be possible to create a document. So, let's create a document, select an employee, for example, A.M. Ivanov, who from 10/10/2016 to 10/31/2016 needs to withhold 200 rubles for using cellular communications in excess of the established norm. Document Deduction for other transactions does not calculate anything, but only registers the fact of this deduction. The deduction itself will be made in the document Calculation of salaries and contributions when calculating wages for October.

In our examples, we indicated to employees the following types of retention: Withholding under a writ of execution And Deduction for other transactions. In the 1C ZUP 3.1 (3.0) program it is also possible to assign:

- Deductions for loan repayment,

- Withholding of union dues,

- Withholding voluntary pension contributions to state and non-state pension funds,

- Retentions in favor of third parties.

Now we will not consider all these documents, I think this is the topic of a separate article (follow the publications, we will try to consider this issue)

Registration of interpayment documents in ZUP 3.1 (3.0)

According to the example, employee Ivanov A.M. got sick. The employee provided us with sick leave on October 28, 2016. Let’s fill out the interpayment document Sick leave(section “Personnel” or “Salary” - Sick Leave magazine), indicate the month of accrual October 2016, the reason for incapacity for work - (01,02,10,11) Illness or injury (except for injuries at work) and the period of release from work from 20.10. to 27.10.

To determine the percentage of payment, it is also necessary to enter the employee’s insurance record. I described in detail how and in what documents to enter this data in

The Sick Leave document is a personnel payroll document; it immediately calculates personal income tax and the amount to be accrued at the expense of the employer and the Social Insurance Fund. Let's review the document.

Let's fill out one more document - (Salary section). Employee Petrov N.S. worked on October 15 for 4 hours. On schedule Five days assigned to the employee upon hiring, this is a day off, i.e. employee worked beyond the monthly norm. Document Work on weekends and holidays the fact of working on a day off is recorded, and calculations for days/hours worked on a day off will be made in the document Calculation of salaries and contributions for October.

Final salary calculation in the document “Calculation of salaries and contributions”

So, we have entered all the necessary data for calculating salaries. Let's open the document Calculation of salaries and contributions(Salary section), indicate the accrual month October, click the “Fill” button. The program will automatically add all hired employees who have time worked. Now let's see how in the program 1C ZUP 3.1 (3.0) accruals, deductions, contributions and personal income tax will be calculated taking into account the personnel records information we entered and interpayment documents.

Let's analyze the accrued wages of each employee separately. In order for us to see the calculation in detail, click the “Show calculation details” button.

- Sidorov S.A. was accepted into the organization on 10/01/2016, he was assigned a planned accrual Payment at an hourly rate, hourly tariff rate – 300 rubles. The employee had no absences during the month, i.e. He worked a full 168 hours (in October the standard time according to the Five-day schedule is 21 days/168 hours). As a result, the payment at the hourly rate in October amounted to 50,400 rubles (300 * 168 - according to the formula TariffRateHourly*TimeInHours). Bonus percentage assigned to the employee not from the beginning of the month, but from October 17, 2016, i.e. Not the entire amount of 50,400 rubles is taken into the calculation base, but only for the 88 hours worked in the period from 10/17 to 10/31. Calculation: 88*300 = 26,400 rubles. We set the bonus percentage to 10%, which means 26400*10/100 = 2640 rubles. The calculation is correct.

- Ivanov A.M. hired on October 10, 2016, he was assigned a five-day work schedule and planned accrual Payment according to salary in the amount of 30,000 rubles . In October he worked only 10 days, because... was on sick leave in the period from 20.10 to 27.10. Calculation was made according to the formula Salary*Share of Part-Time Worker*TimeInDays/NormalDays— 30000*1*10/21 = 14285.71 rubles. Also, this employee was assigned a deduction for cellular communications (above the limit); on the “Deductions” tab we see the amount of 200 rubles, which was indicated in the Deduction for other transactions document.

In order to make sure how much time the employee actually worked, we will generate a report Report card. In the Personnel section - Salary reports - open Time sheet (T-13), indicate the required period from 01.10 to 31.10, select Ivanov A.M. and click the “Generate” button. Indeed, we see in the report card the sick time - 8 days and the turnout time - 10 days. It was during these 10 days that the calculation was completed.

- Petrov N.S. scheduled accrual assigned Payment by salary (hourly) in the amount of 30,000 rubles. The employee worked only 128 hours in October on a five-day schedule, because... hired from 10.10. The calculation is made according to the formula Salary*TimeInHours/NormalHours – 30000*128/168 = 22857.14 rubles.

Also Petrov N.S. worked 4 hours on his day off, which are paid double. In order to pay for these hours, the program automatically determines the cost per hour. In this example, the cost of an hour is calculated as follows: 30,000 (Salary)/168 (standard time according to the employee’s schedule) = 178.57143 rubles.

Accordingly, payment for work on a day off is 178.57143 (cost of an hour) * 4 (hours of work) * 2 (double payment) = 1428.57 rubles.

It is worth noting that the method of converting an employee’s tariff rate into the cost of an hour (day) is determined by the program settings in the Settings - Payroll section. Except “Time standards according to the employee’s schedule” can also be used “Average monthly number of hours (days) in a month” or “Time standard according to the production calendar”.

Also on the “Retentions” tab, the program calculated for this employee Deduction by writ of execution. The calculation base was determined as follows - 22857.14 (payment based on salary (hourly)) + 1428.57 (payment for work on holidays and weekends) - 3157.1423 (personal income tax) = 21128.71 rubles. The amount of deduction from wages is calculated from the amount remaining after taxes are withheld (Federal Law dated October 2, 2007 No. 229-FZ “On Enforcement Proceedings”). In our example, the calculation method in the document Performance list we indicated a percentage (15%) of earnings. So, 21128.71*15/100 = 3169.31 rubles. The calculation is correct.

In the document Calculation of salaries and contributions On the “Personal Income Tax” tab, personal income tax is immediately calculated. For employee Ivanov A.M. part of the personal income tax was calculated, as we remember in the document Sick Leave. Also, in the ZUP 3.1 (3.0) program, contributions are immediately calculated, which we can see on the “Contributions” tab, which is a distinctive feature from the ZUP 2.5 program, where it was necessary to enter a separate document for calculating contributions. I talked in detail about the differences between the ZUP 3.1 (3.0) program and ZUP 2.5 in.

So the document Calculation of salaries and contributions is resultant, it collects all personnel changes, changes in planned accruals/deductions and planned indicators, all deviations from work schedules, absenteeism, all interaccount accruals and takes them into account in the final calculation. Therefore, this document must be entered last in the chain of settlement documents in 1C ZUP 3.1 (3.0).

- Reason 1. Reduction of premiums if there was a checkbox in ZUP 2.5

- Reason 2. Reduced bonuses for newly hired employees

Reason #1. Reduction of bonuses, if in 2.5 the checkbox “When calculating the average, do not reduce bonuses accrued in proportion to the time worked” was used

In the settings of ZUP 2.5 there was a checkbox When calculating the average, do not reduce bonuses accrued in proportion to time worked :

This setting was valid for bonuses accrued in proportion to time worked. In the general case, they were taken into account to calculate average earnings in full amounts, but there were cases when the period for which the bonus was accrued went beyond the calculated period of average earnings. In this case, according to Letter of the Ministry of Health and Social Development of the Russian Federation dated June 26, 2008 N 2337-17 “On the calculation of average earnings,” such a bonus must be recalculated in proportion to the time worked. If we read verbatim the Decree of the Government of the Russian Federation of December 24, 2007 N 922 “On the peculiarities of the procedure for calculating the average wage” (hereinafter Resolution N 922), then such an unambiguous conclusion can no longer be drawn.

Therefore, the ZUP 2.5 program provided a setting that allows the user to independently determine whether such bonuses should be fully or partially taken into account in average earnings.

There is no such setting in ZUP 3. Therefore, in the program, such bonuses are always recalculated in proportion to the time worked, i.e. they always decrease.

For example, employee Romashkin R.R. goes on vacation from May 15 to May 28, 2017. In May 2016, he was awarded a bonus based on time worked in the amount of 30,000 rubles. The period for which this bonus was accrued (i.e. the base period of the bonus) is the first quarter of 2016:

In this case, when completing the document Vacation The calculation period for average earnings is taken from May 2016 to April 2017:

It turns out that the base period of the bonus, accrued in proportion to the time worked, goes beyond the boundaries of the calculated period of average earnings. Although this bonus in the decoding of the calculation of average earnings falls into the line Premium fully taken into account , but in this case in ZUP 3 it will automatically be recalculated in proportion to the time worked:

In our example, the time worked ratio is:

245/247 = 0,99190283

Therefore, the bonus on average earnings will be taken into account in the amount of:

30,000 (bonus) * 0.99190283 (time worked coefficient) = 29,757.08 rubles.

Solution No. 1: manual adjustment in deciphering average earnings

If we still need to take such a bonus into account in full, then we need to right-click on the bonus amount in the breakdown of the calculation of average earnings and select the item More details :

In the form that opens, edit in the column Base period start date value in such a way that the base period of the bonus begins to be included in the calculation period of average earnings. In our example, we will correct the date to 05/01/2016:

Then the bonus will be taken into account in full when calculating average earnings, that is, in our example, in the amount of 30,000 rubles:

Solution #2: Program Changes

Another option for solving this problem is software. Changes will need to be made to the common module Accounting Average EarningsClientServer by replacing the string in the function Reduce Premiums by Percentage Accrued for Time Not Included in the Calculation Period :

This can be done by enabling it for this module. Then there will be no need to modify the configuration.

Reason #2: Reduced bonuses for newly hired employees

In ZUP 3, compared to ZUP 2.5, a new opportunity has appeared to take into account bonuses of recently hired employees when calculating average earnings, starting with version 3.1.3. It is connected in the section Setup – Payroll by checking the box:

If you do not enable this option, then for bonuses that are partially taken into account when calculating the time worked coefficient, the standard time is taken for the year as a whole, and not from the date the employee was hired.

For example, an employee worked for 1 month and received a bonus. Next month the employee is sent on a business trip. In this case, when calculating average earnings, the bonus amount will be recalculated by multiplying by a coefficient of 1/12.

Resolution No. 922 does not have a clear algorithm for accounting for bonuses in this case. Therefore, the developers provided the user with the opportunity to independently determine whether the billing period should be limited to the date of reception of recently hired employees and thus take into account bonuses in full when calculating average earnings.

For example, an employee was hired on July 1, 2017. In August, he was awarded a one-time bonus in the amount of 10,000 rubles. The employee worked in full for July and August. In September, the employee is granted vacation from September 27 to October 10.

To issue an award, a document is created in the program Prize :

Limit the beginning of the average earnings calculation period to the date of admission is not established, then when calculating average earnings in the document Vacation The bonus amount is recalculated in proportion to the time worked. In this case, the norm when calculating hours worked is taken as a whole for the year:

44 (number of days worked in July and August) / 248 (norm days per year) = 0.17741935

The bonus amount taken into account when calculating average earnings will be:

10,000 (bonus amount) * 0.17741935 (time worked coefficient) = 1,774.19 rubles.

If in the salary calculation settings the checkbox Limit the beginning of the average earnings calculation period to the date of admission established, then when calculating the average earnings in the document Vacation The premium amount will be taken into account in full, because the employee worked fully for two months and in this case the number of days worked will coincide with the norm:

44 (number of days worked in July and August) / 44 (norm days from the date of admission) = 1

The premium amount will be taken into account in full in the amount of 10,000 rubles, because the coefficient of hours worked is equal to one.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge